Stripe IPO美股支付股票PayPal(PYPL)對Adyen分析

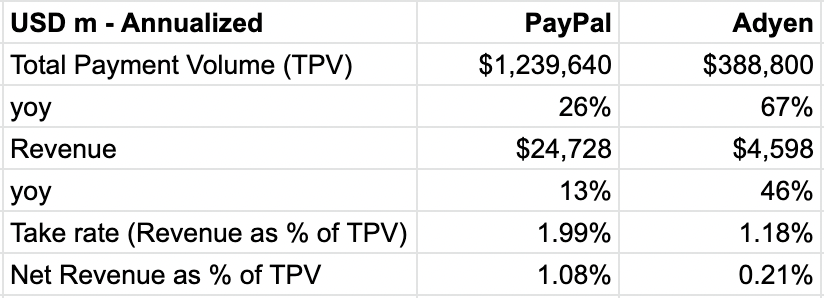

Adyen的交易價格高於PayPal,因為它的增長速度更快,而且是一家企業業務。 PayPal的利潤率更高。

該階段的投資者和財務信息披露有限,即將到來的IPO。

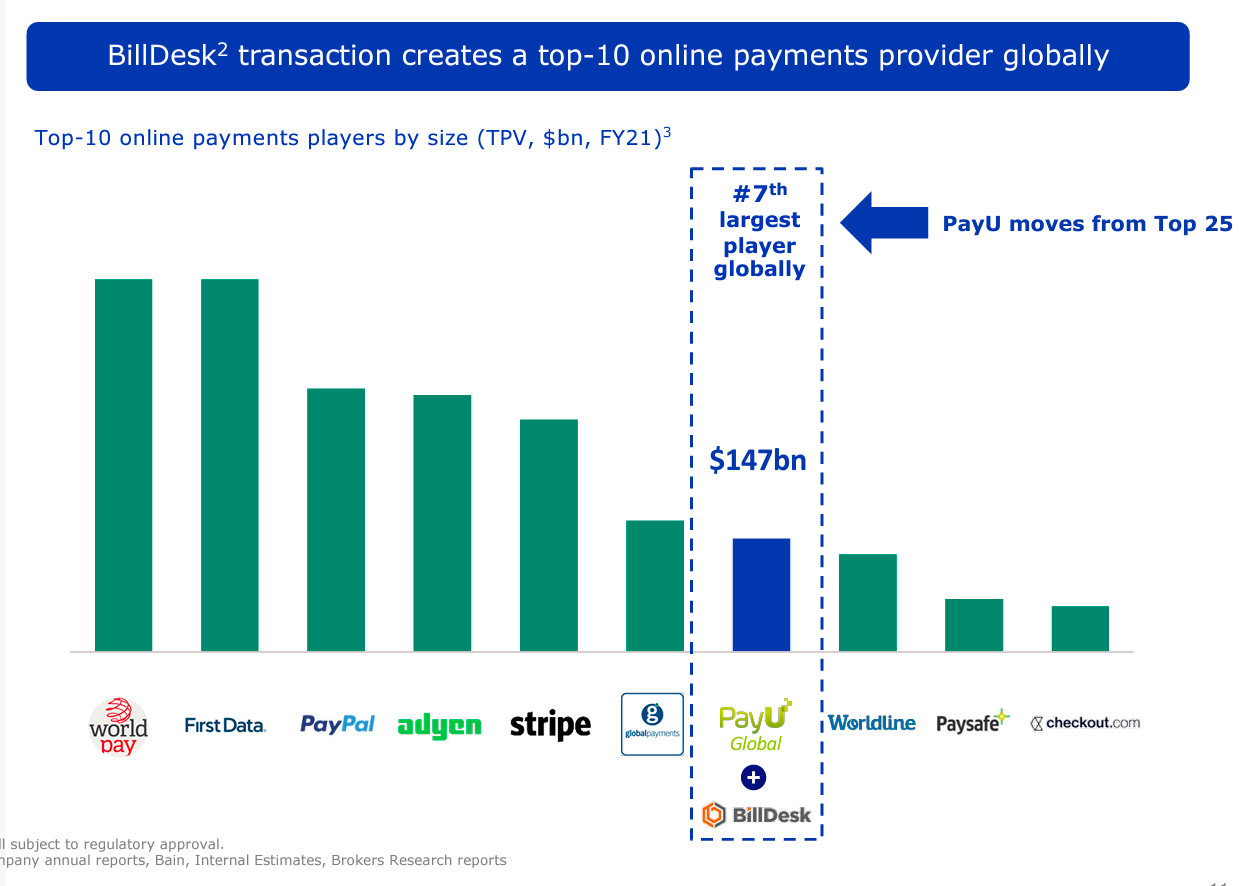

我們將發布一個系列,根據 Prosus 的 2022 年 HY 業績電話展示表,看看它的一些在線支付競爭對手。

這篇文章中,將Stripe(成立於200年)的較新的對手(2)- PayPal成立10年和Adyen(成立於200年)

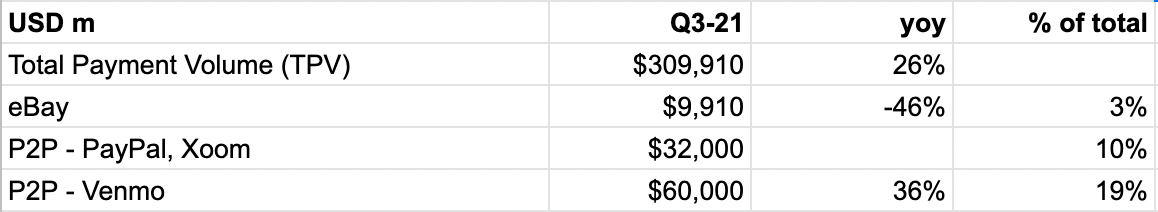

貝寶 21 年第三季度投資者更新和 2021 年 2021 年即將到來的一些投資者的信用指標,我們計算。

從FCF這兩個指標來看,PayPal的比Adyen的價格要低。然而,PayPal的FCF與收入之比更高,意味著交易能力。

21)高收入佔冠捷的收入比例(5)比較,收入佔冠捷的唯一比例,這是因為與PayPal產生的差異,Adyen從金融機構的淨報價增加。這可能是因為Adyen的冠捷中的8%是企業,而 PayPal 的賬戶來自中 8% 是公司。另一個原因可能是地域組合,PayPal 的 62% 來自美國,而 Adyen 的 60% 來自歐洲,23% 來自美國。

艾迪恩的估值可能是因為它在冠捷和收入方面的增長得快。

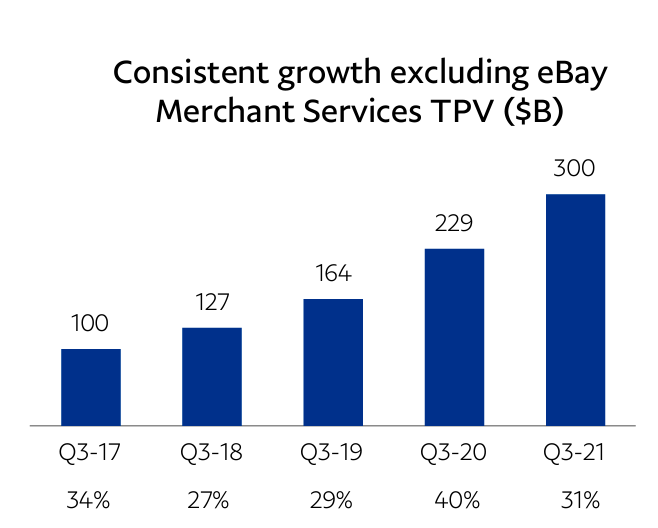

PayPal增長的原因是eBay,它現在佔了3%的原因。

PayPal 不包括 eBay 的 TPV 增長。