BMW Stock analysis - selling at distressed, could it be acquired?

BMW is trading at below book with potentially 9% dividend yield and its financial services division alone worth >40% of its market cap.

BMW's market cap is EUR47b while its shareholders equity is EUR72b so it is selling below book value.

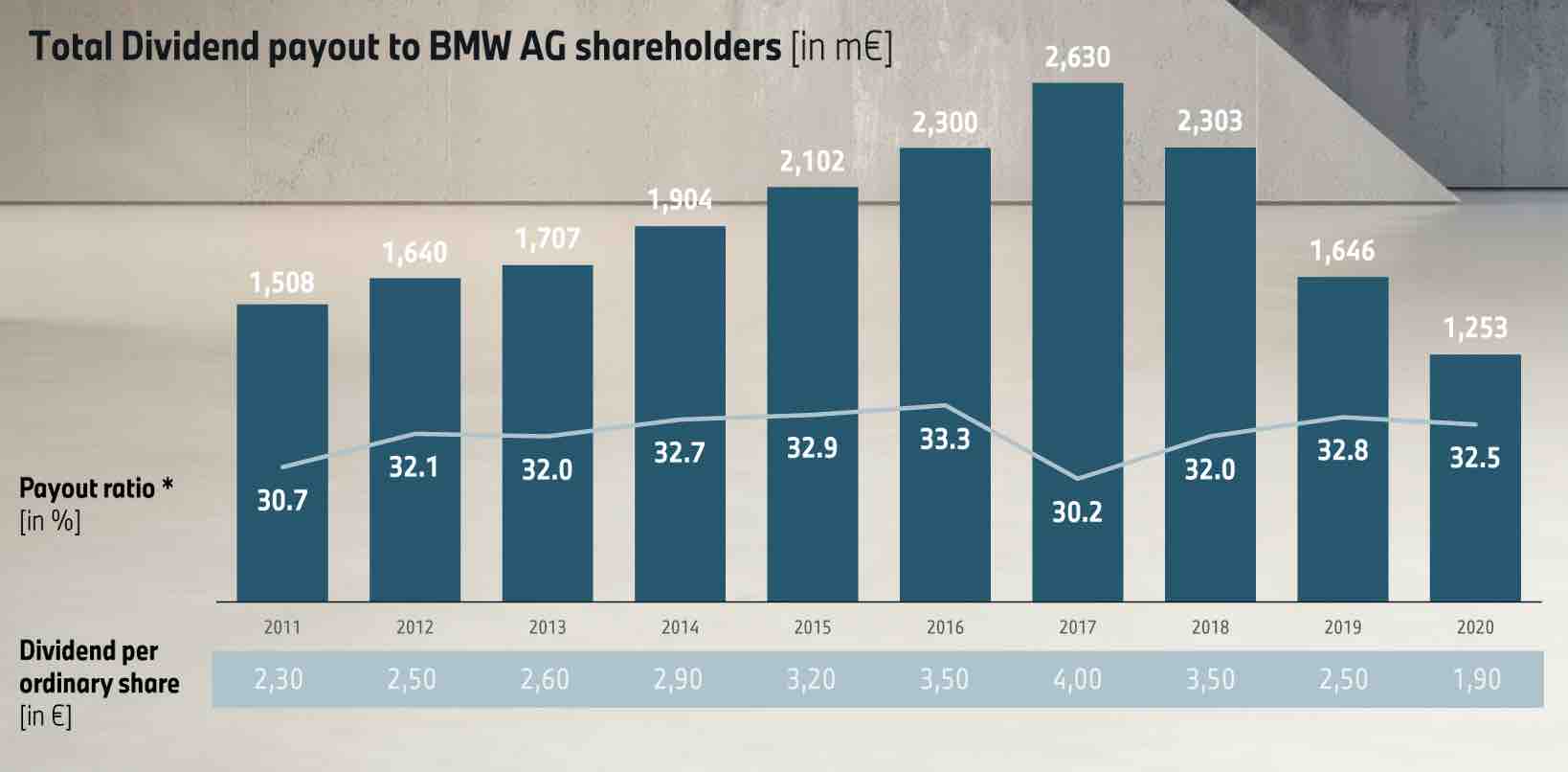

BMW is trading at 4x PE and on track to make EUR13b in FY2021. Assuming it follows its historical payout ratio at 32%, it could pay out EUR4b in dividends equal to a 9% yield.

We think one of the key reasons for the distressed valuation is because of BMW's declining EBIT margin...

...which has shown signs of improvement in 2021.

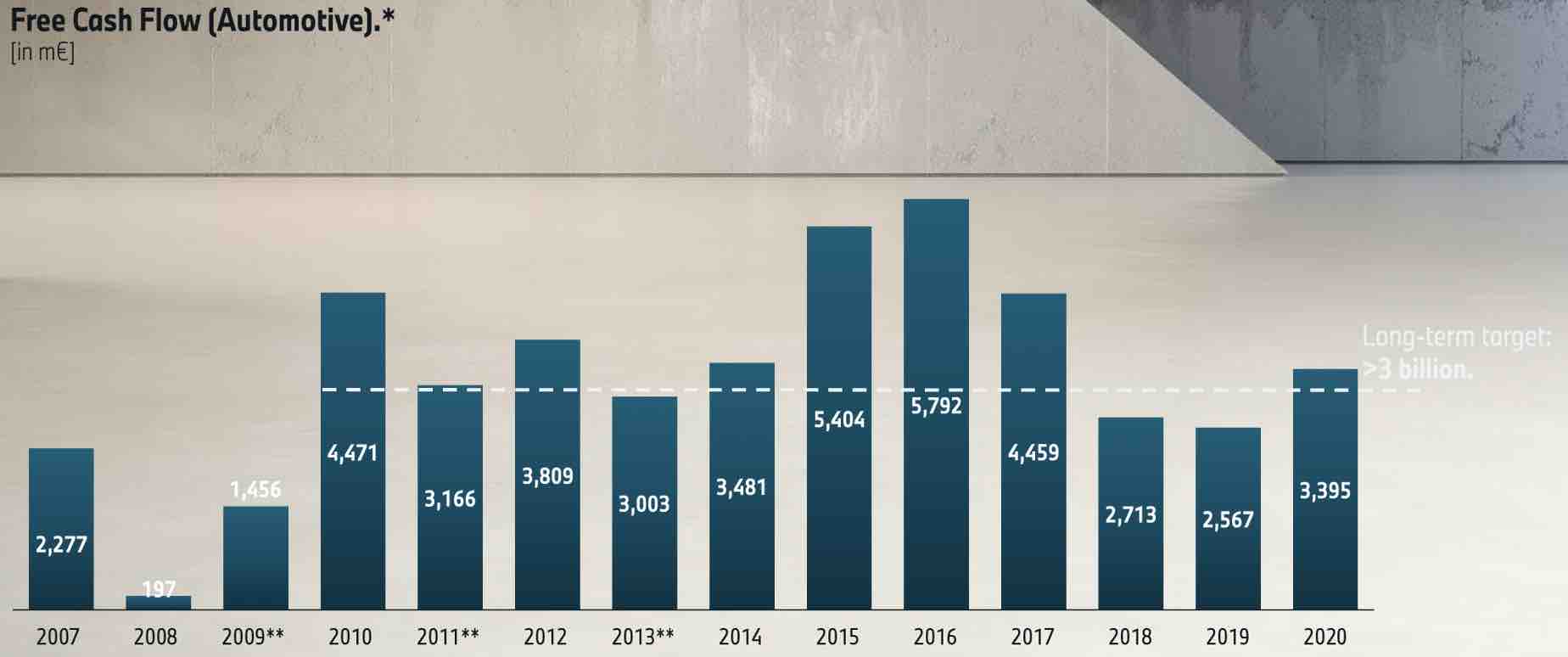

Even in distressed times, BMW has been able to produce about EUR3b in free cash flow. The current market cap implies 15x free cash flow.

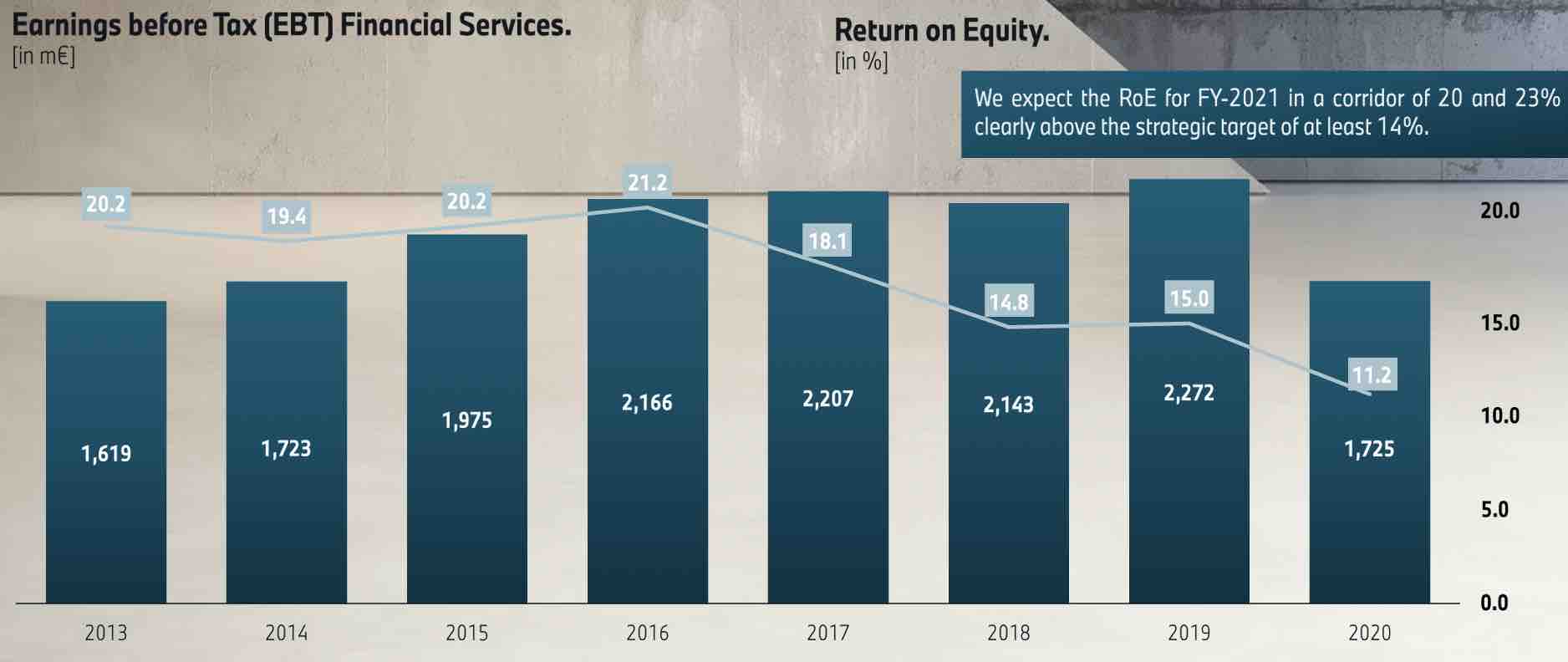

In addition, BMW Financial Services makes about EUR2b in Earnings before Tax (EBT) or a ROE of mid teens.

Deutsche Bank is currently trading at 10x PE with a ROE of 4%. Assuming similar 10x PE valuation then BMW Financial Services alone would be worth about EUR20b.

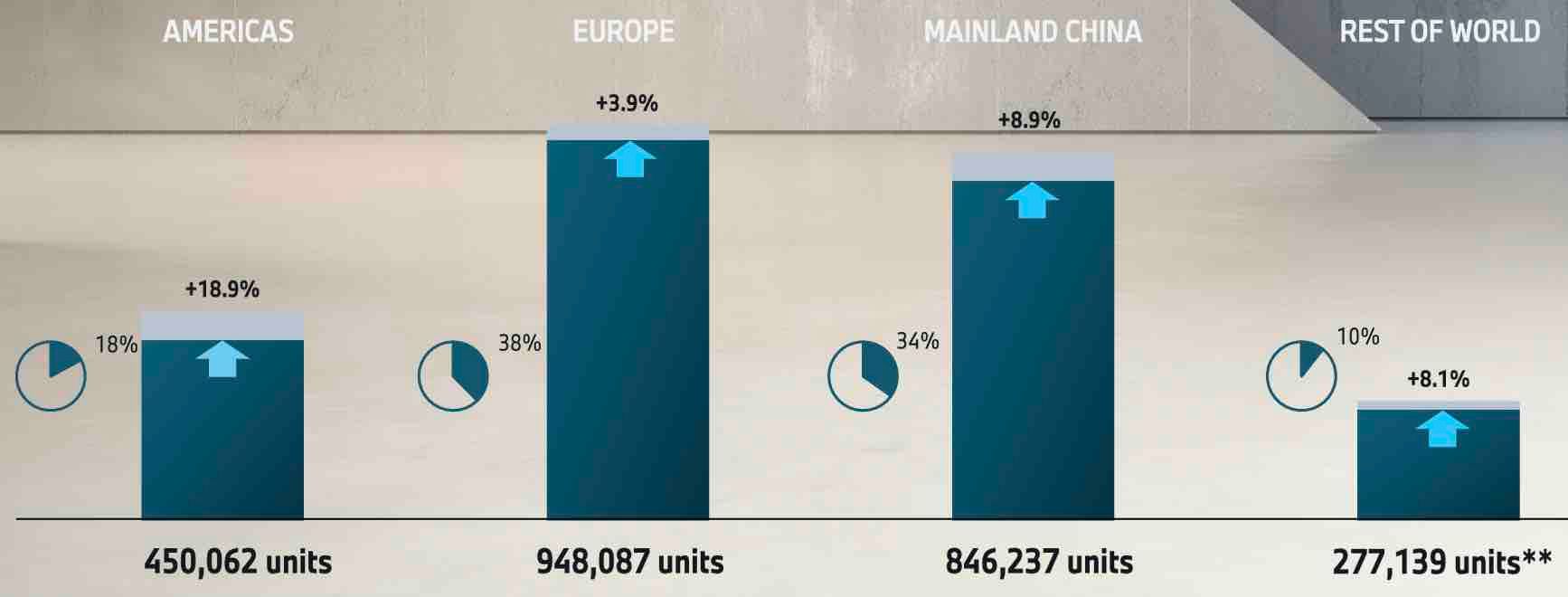

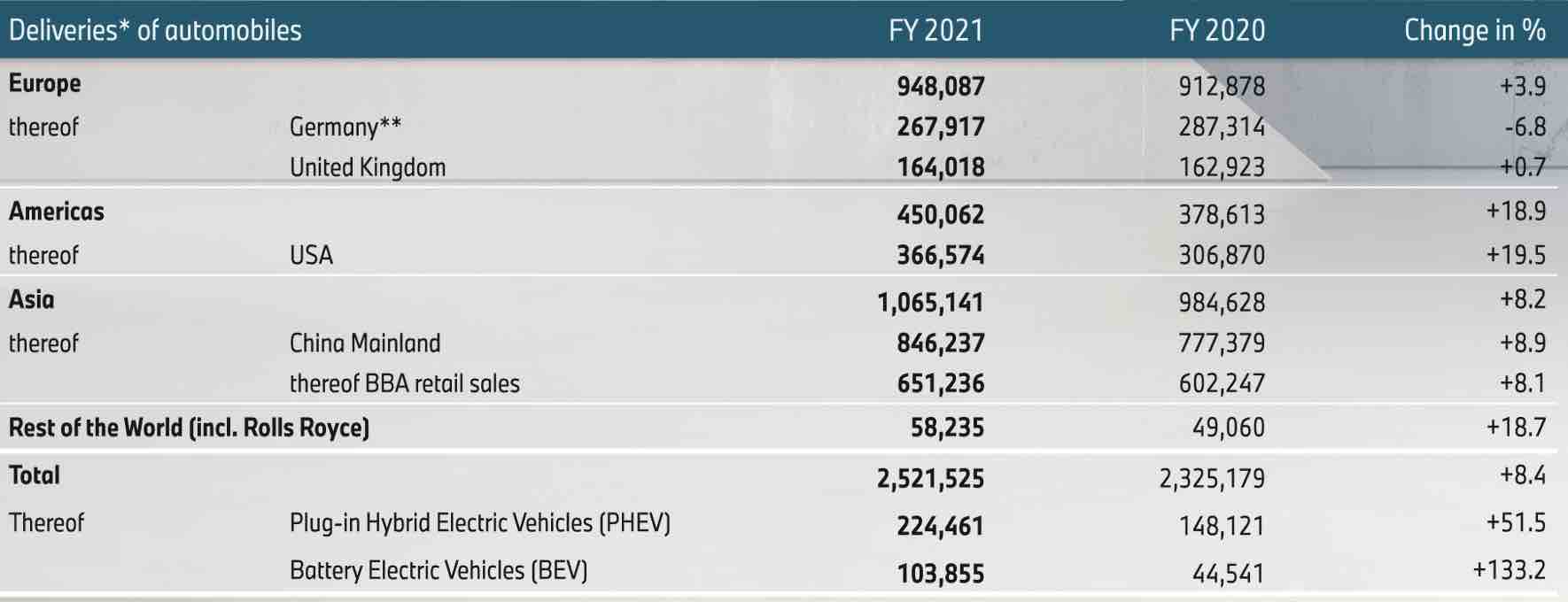

In terms of geography, while Europe and China are key regions, most growth are coming from Americas.

In Europe, growth are coming from outside BMW's traditional markets in Germany and UK. China accounts for the majority of Asia sales while BBA or BMW Brilliance Automotive retail sales is the majority of China.

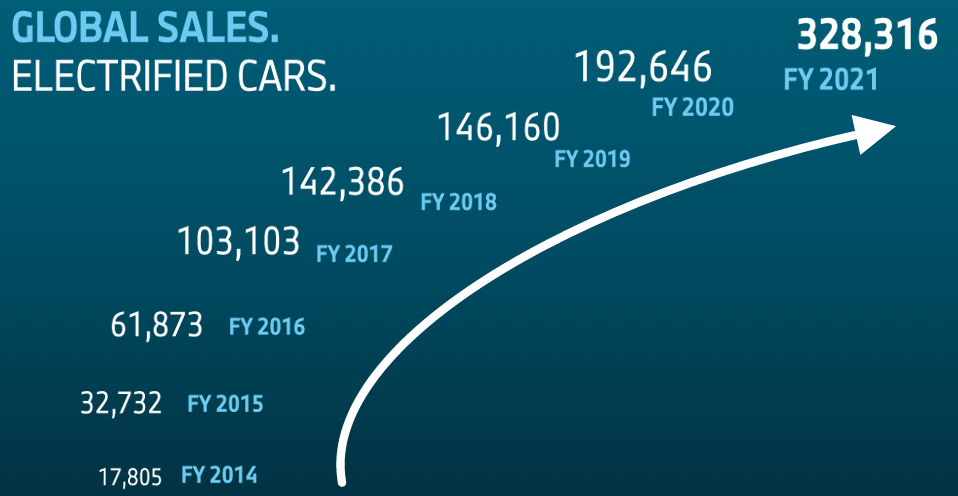

Finally, strong growth can be seen in the EV segments...

...which has seen faster growth in FY2021.

Specifically, 13% of global sales are now electrified.

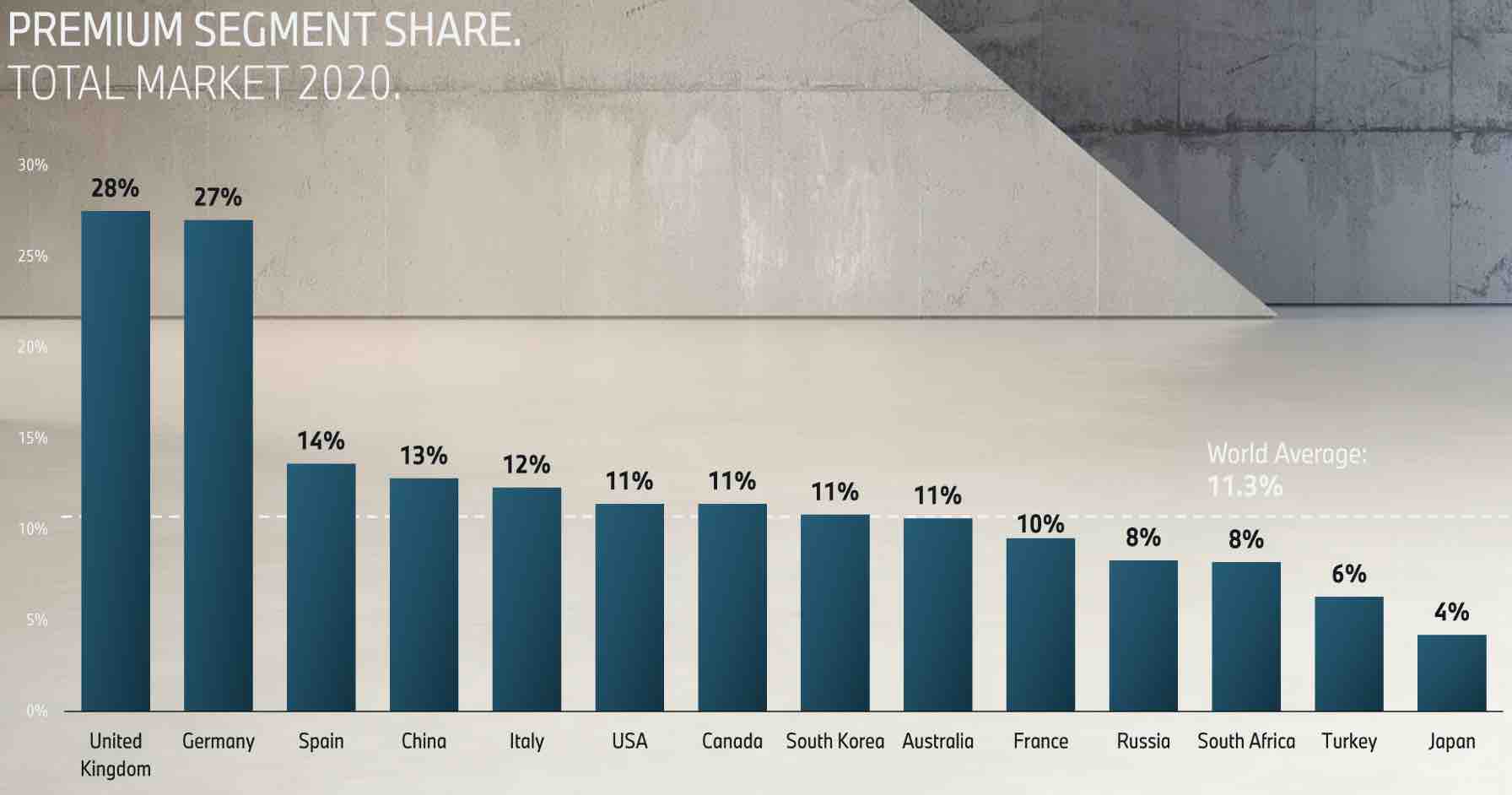

UK and Germany are dominant markets for BMW. The market is more competitive in China and USA as well as other regions.

China has matured and is growing about high single digit annually.

BMW is the dominant brand in the group in terms of sales.

Unfortunately, like most other cases, as investors, we do not have access to cross sectional or by model breakdown data such as specific BMW model sales in Europe, Americas, Asia to better understand which model sells better where.

BMW has a very diversified production network.

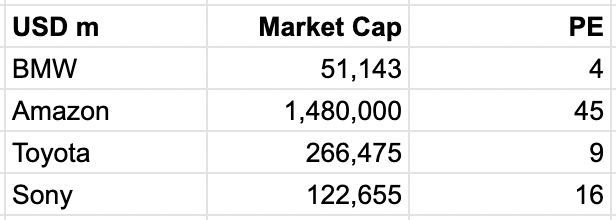

Could BMW be acquired by one of Sony, Amazon, Toyota, any company looking to push into EV or an activist investor?

A final thought - while it is clearly a changing landscape in the automobile industry with the shift towards EV, how much of a premium should new EV makers who have barely sold products have over the traditional players.