Evergrande (3333) Stock Analysis - How much do they owe? A look at their Balance Sheet (January 2022 Update)

(January 2022 Update) Evergrande's land reserves are valuable. The liquidity crisis will likely dilute the existing shareholders.

Back in April 2021, Evergrande was introducing their new set of EVs.

Evergrande New Energy Vehicle Group (0708.HK) has since corrected by more than 90% from ~HKD60 to HKD3-4. While the property developer, Evergrande Group's bond has corrected to distressed level.

In this memo, we will look into the reports from Evergrande's Investor Relations website to try to understand more details.

Banks Exposed

Evergrande discloses its Principal Bankers.

We are not sure if this is ranked by the amount of borrowings but Bloomberg did just run a story on Minsheng and Evergrande.

Other than that, this list entails some of the biggest banks in China including Agricultural Bank of China, Industrial and Commercial Bank of China (ICBC), China Construction Bank Corporation (CCB).

A couple of notable exceptions are Bank of China (BOC) and China Merchants Bank (despite CMB is also headquartered in Shenzhen, same as Evergrande).

To put into perspective, Evergrande has total liabilities of about Rmb 2 trillion (USD300b) on its balance sheet. ICBC has Rmb35t in assets. There is no disclosures on the exact amount owed but assuming say, 10% of Evergrande's liabilities are due to ICBC then that would account for 0.56% of ICBC's total assets. In reality, it is likely to be less as from a risk management perspective, 0.56% exposure to a single entity is fairly high. China has total banking assets of about Rmb330t so Evergrande accounts for about 0.59% as a whole.

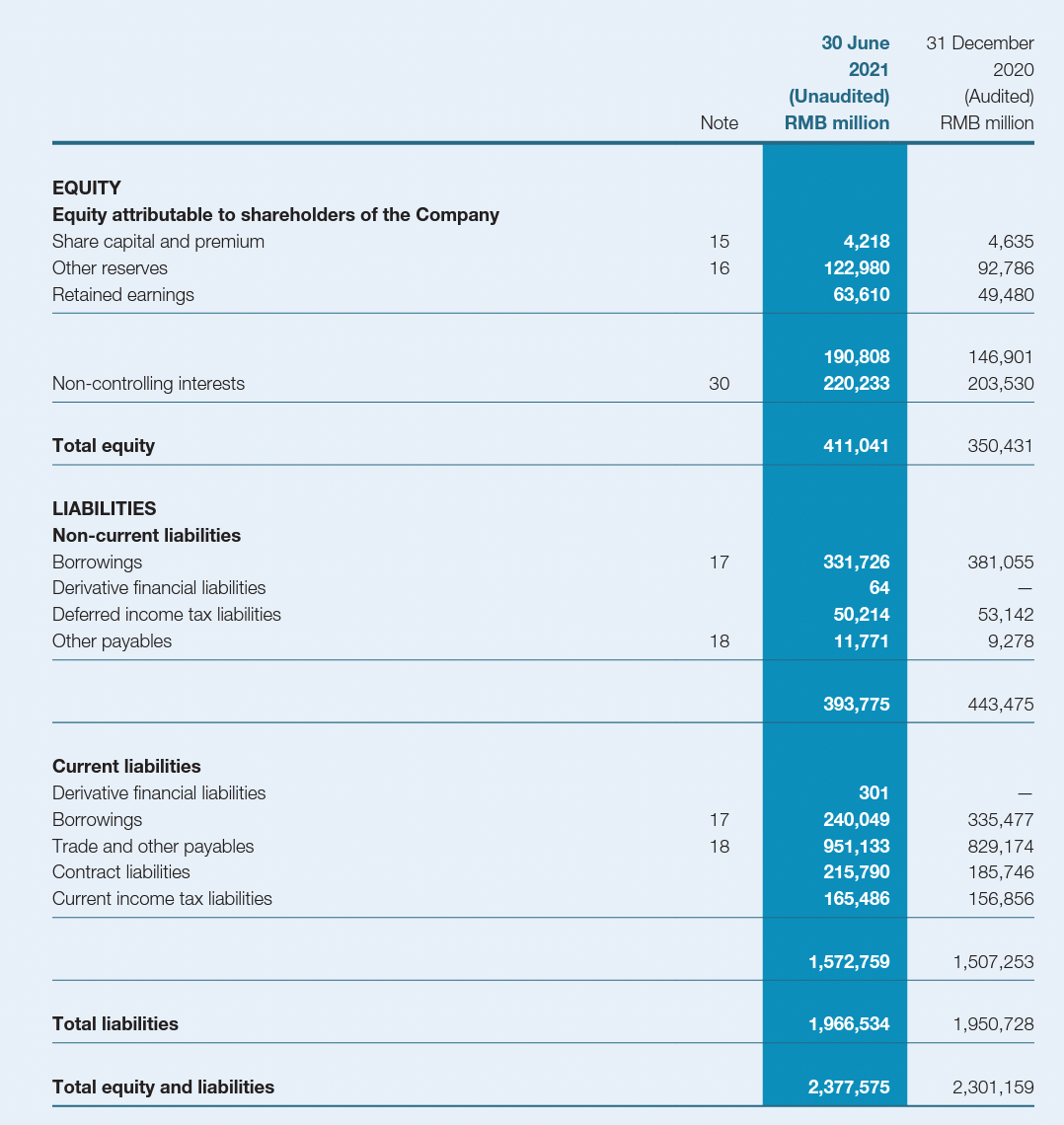

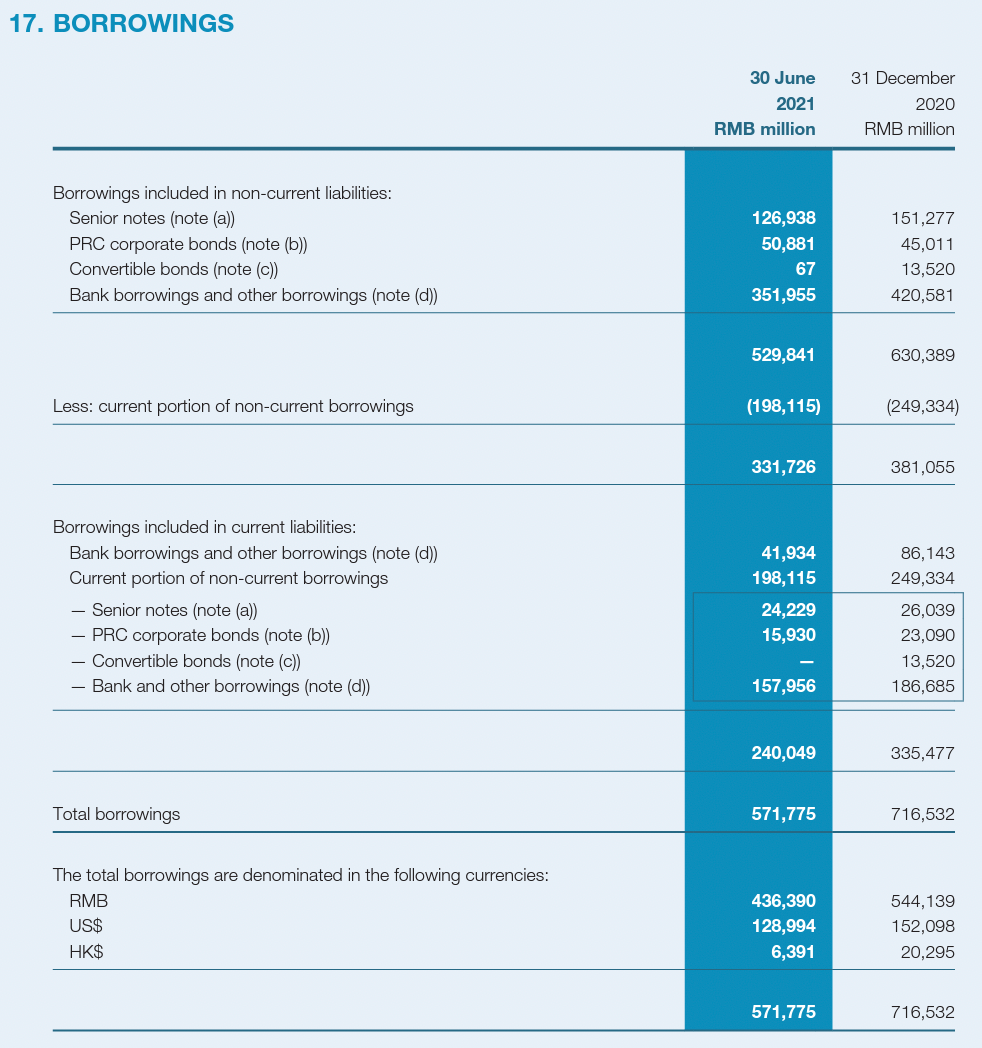

Trade and other payables, Borrowings are the key liabilities

Evergrande's balance sheet is actually quite simple, just that the balances are very large (there is no disclosures on off balance sheet commitments).

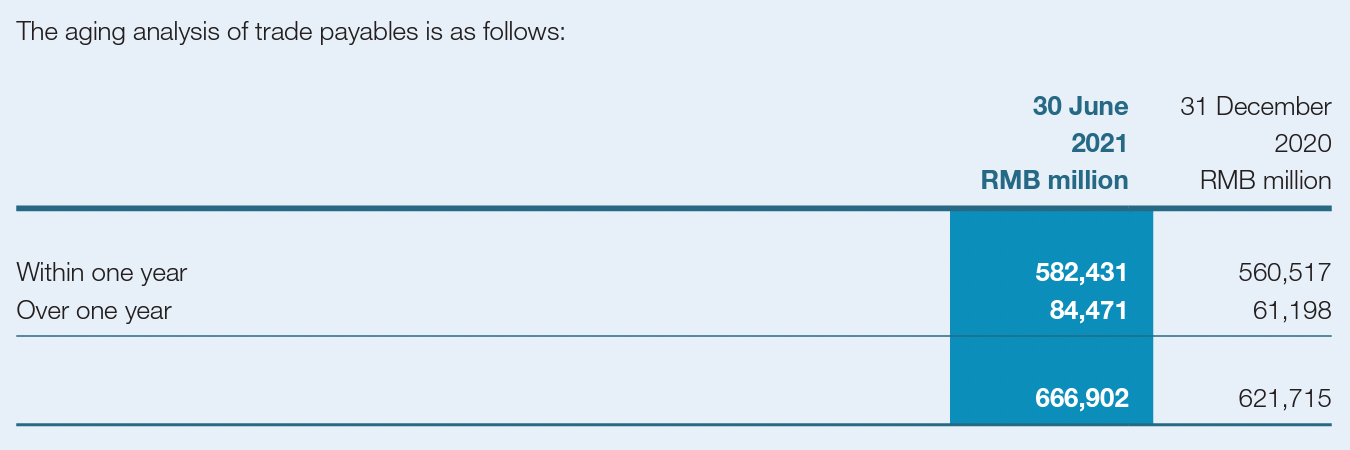

Trade and other payables are mostly liabilities to third parties, which are payments to suppliers and construction contractors.

Note that back in December 2020, Evergrande had similar levels of borrowings and trade and other payables so why has this suddenly became a problem?

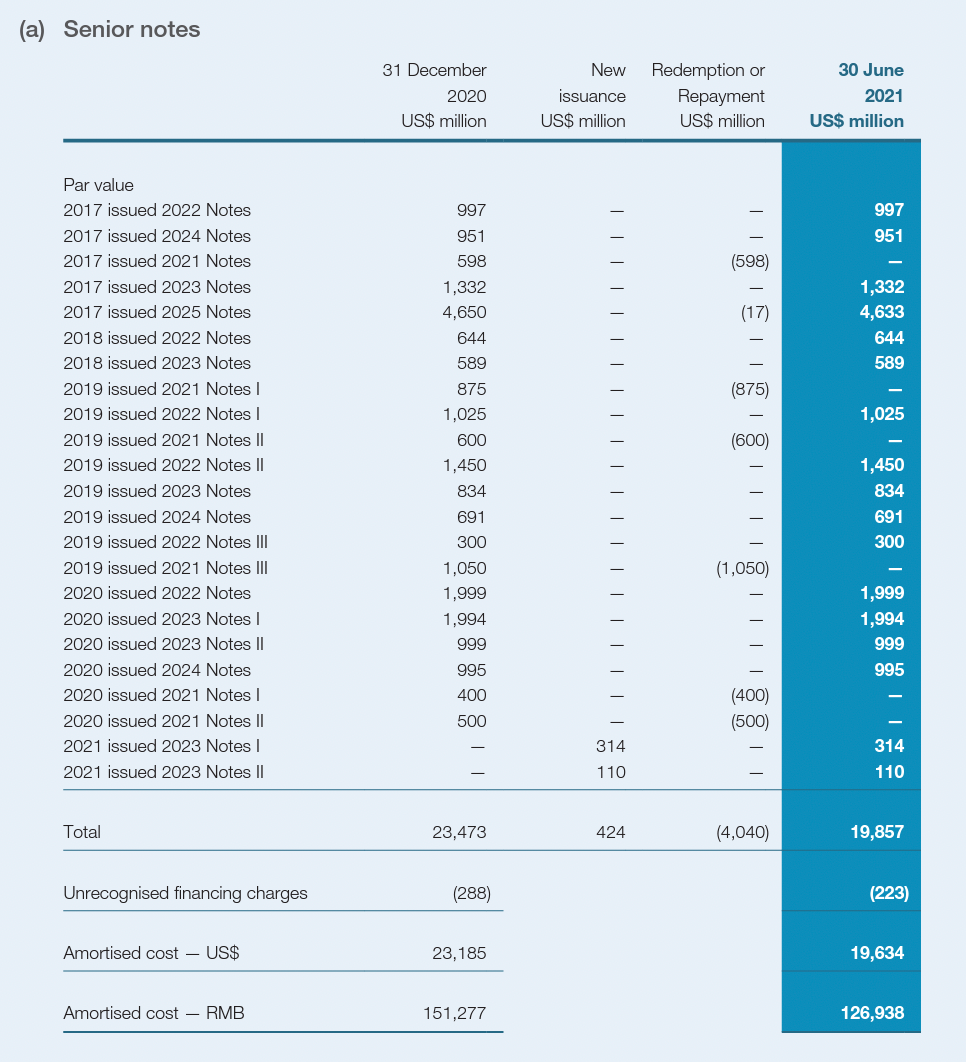

In fact, Evergrande had been repaying or redeeming some of its Senior notes back in January to June 2021.

Trade payables has always had short duration of within a year.

Most of the borrowings in current liabilities are bank and other borrowings.

Evergrande explains other borrowings as follows:

Other borrowings mainly represent certain subsidiaries of the Group in the PRC which are engaged in development of real estate projects have entered into fund arrangements with certain financial institutions (the “Trustees”), pursuant to which the Trustees raised trust funds and injected the funds to the group companies. All the funds bear fixed interest rates and have fixed repayment terms.

How to resolve?

1. Equity investors

As per Evergrande,

"...introducing new investors to increase the equity of the Group and its subsidiaries, with the objective to further improve liquidity, relieve financial pressure and reduce debt."

2. Capital injection

As per Evergrande,

"During the six months ended 30 June 2021, the Group has established certain new subsidiaries engaging in property development and property sales agency businesses and received capital injections from minority interests totaling RMB30,530 million. The carrying amount of net assets attributed to certain minority interests amounting to RMB23,039 million was recognised as an increase in non-controlling interests. The difference between the capital injections and the carrying amount of net assets attributed to certain minority interests amounting to RMB7,491 million was recognised as an increase in reserves."

3. Asset sale

As per Evergrande,

"The Group will continue to actively explore with potential investors on the sale of certain interests in China Evergrande New Energy Vehicle Group Limited (708.HK) and Evergrande Property Services Group Limited (6666.HK)...

...disposing of equity interests and assets (including but not limited to investment properties, hotels and other properties)...

Disposal of interests in assets: • sale of an aggregate of 11% interest in Hengten Networks Group Limited. to two buyers at a price of HK$3.20 per share for a total consideration of approximately HK$3.25 billion; after deducting the shareholder’s loan provided by the Group to Hengten Networks Group Limited, the net amount of cash generated from such sale was approximately HK$1.18 billion; • sale of a 1.9% interest in Shengjing Bank Co., Ltd. at a price of RMB6.0 per share for a total consideration of RMB1.0 billion; • sale of a 7.08% interest in Shenzhen High and New Technology Investment Group Company Limited (深圳市高新投集團有限公司) for a total consideration of approximately RMB1.04 billion; • sale of a 49% interest in Evergrande Spring Group Limited for a total consideration of approximately RMB2.0 billion; and • sale of interests in 5 property projects and other non-core assets for a total consideration of approximately RMB9.27 billion."

4. Property (apartment) sales

Evergrande made property development sales of Rmb211b in 1H21 though this will likely be affected as a result of delayed payments to suppliers and construction contractors as per below.

"The adverse effects on the liquidity of the Group led to delays in payments to suppliers and of construction fees in the Group’s property development business, which resulted in the suspension of work on certain projects of the Group. Currently, with the coordination and support of the government, the Group is actively negotiating with suppliers and construction contractors to strive for the resumption of construction work of these projects. If the relevant projects do not resume work, there may be risks of impairment on the projects and impact on the Group’s liquidity. In order to improve the current cash flow situation and deal with the liquidity issue, subsequent to the Reporting Period and as of 27 August 2021, the Group has taken the following measures: — Actively resolve payments to suppliers and contractors: • the Group sold property units to suppliers and contractors to set off some of the outstanding payments, with a total amount of approximately RMB25.17 billion;"

"At the same time, the Group will adopt the following measures to mitigate the liquidity issues that we are currently facing, which mainly includes adjusting project development timetable, strictly controlling costs, vigorously promoting sales and payment collection"

5. Renewal and extension of borrowings

Due to the significant decline in its equity value and the resulting increase in leverage (ie, equity value decline but borrowings remain the same), Evergrande is unlikely to be able to roll over most of its borrowings until they boost equity value. This can be achieved through either or a combination of the above - new equity investors (which will create dilution), capital injection and asset sale.

As per Evergrande,

"As at 30 June 2021, the Group’s total land reserves covered 778 projects located in 233 cities across China. The land reserves of the Group had a total planned GFA of 214 million square meters with an original value of RMB456.8 billion."

The assets of the business is still highly valuable so it is a matter of negotiation between Evergrande and the new investors.

Once equity is boosted, Evergrande's ability to issue debt hence ability to solve the liquidity crisis should also be boosted.