Warren Buffett portfolio - Why did Berkshire Hathaway issue Yen bonds? (January 2022 Update)

(January 2022 Update) Berkshire Hathaway earns >4% from the spread between its funding rate and the dividend yields. At current prices, to acquire up to 9.9% would require another JPY1t or so.

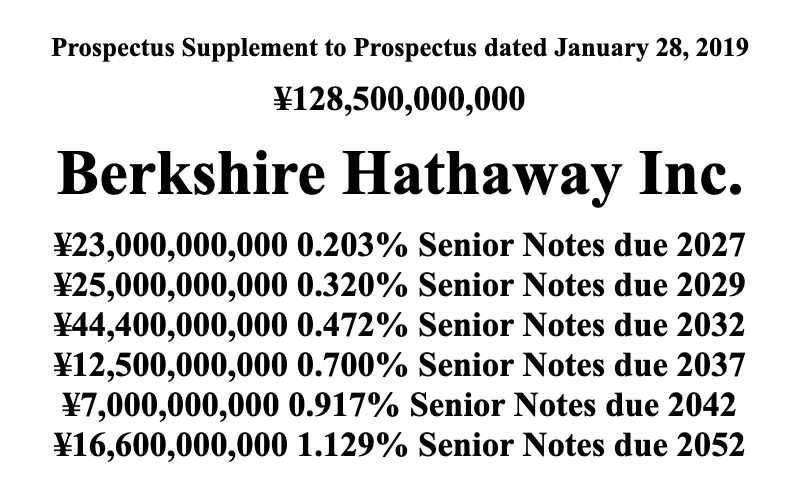

According to a 2022-01-14 SEC filing, Berkshire Hathaway (the largest company in the US as measured by shareholders’ equity) is offering a total of JPY128.5b (USD1.1b) in bonds.

In an earlier release back in August 2020, Berkshire Hathaway has announced that it has, through its wholly-owned subsidiary, National Indemnity Company, acquired slightly more than 5% of the outstanding shares in five of the leading Japanese trading companies - Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo.

According to Berkshire,

"These holdings were acquired over a period of approximately twelve months through regular purchases on the Tokyo Stock Exchange."

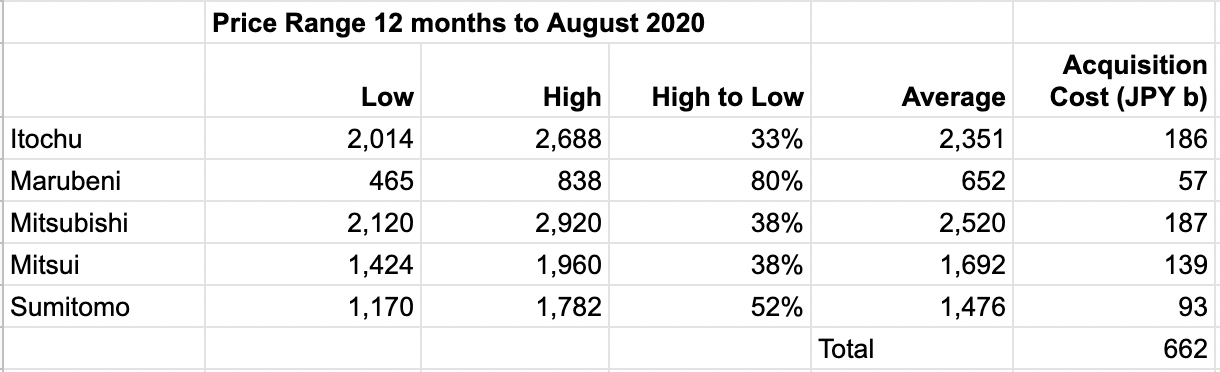

The below table highlights the low to high end price ranges of the five names during this period.

Taking the average prices from low to high, the total acquisition cost would have been JPY662b, consistent with Berkshire's statement below,

"Berkshire Hathaway has 625.5 billion of yen-denominated bonds outstanding, maturing at various dates beginning in 2023 and ending in 2060. Consequently, the company has only minor exposure to yen/dollar movements."

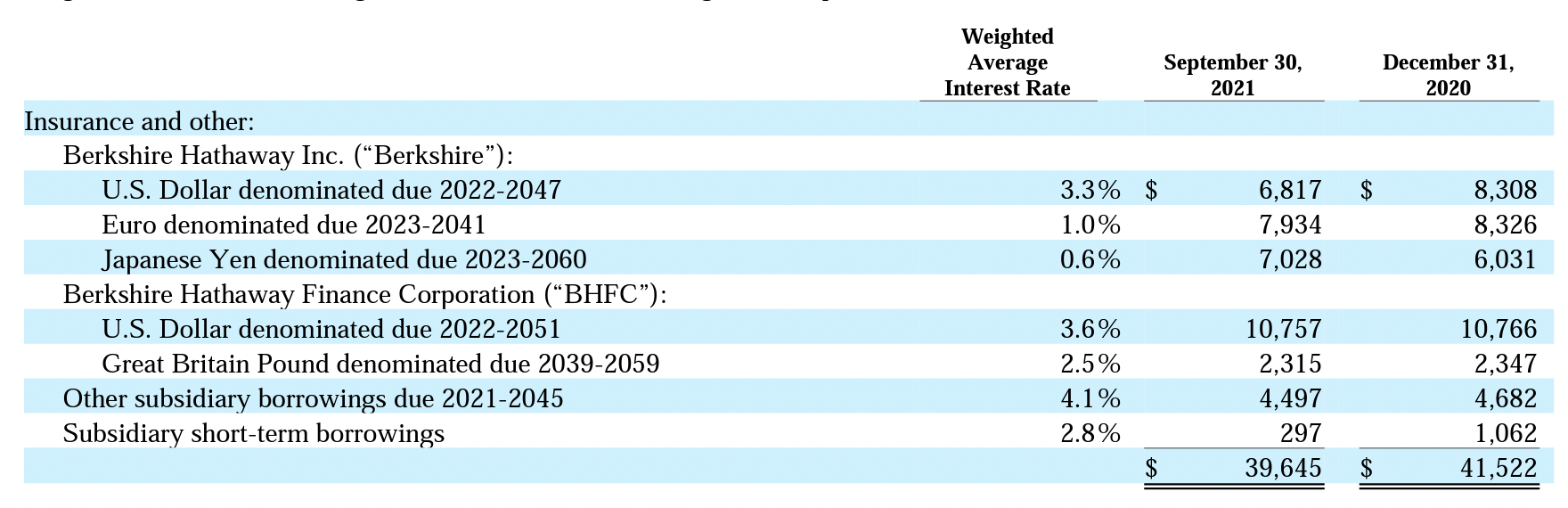

As per the below from Berkshire's Q3'21 report, Berkshire is paying 0.6% yield on these existing yen bonds, the lowest of all the bonds issued.

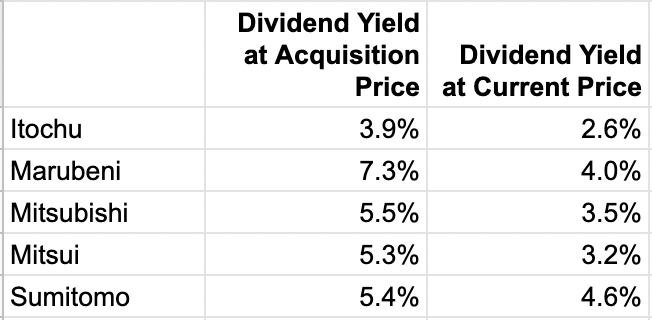

Berkshire's dividend yields on the above five names based on our calculations below.

This implies Berkshire is able to earn a carry or spread between its funding rate (the bond yield it pays) against the dividend yield it receives.

According to Berkshire,

"Berkshire Hathaway’s intention is to hold its Japanese investments for the long term. Depending on price, Berkshire Hathaway may increase its holdings up to a maximum of 9.9% in any of the five investments.

However, Warren E. Buffett, CEO of Berkshire Hathaway, has pledged that the company will make purchases only up to an ownership of 9.9% in any of the five investments.

The company will make no purchases beyond that point unless given specific approval by the investee’s board of directors.

Berkshire Hathaway has a long history of substantial, passive holdings in successful businesses. For instance, Berkshire Hathaway has held major stakes in Coca-Cola for 32 years, American Express for 29 years and Moody’s for 20 years."

At current prices, to acquire up to 9.9% would require another JPY1t or so.

While issuing yen-denominated bonds matches the assets and liabilities, the dividends that Berkshire receives is in JPY, which has been declining against the USD, the reporting currency of Berkshire. If Berkshire didn't issue yen bonds but invested with its USD, it would have lost money on the FX.

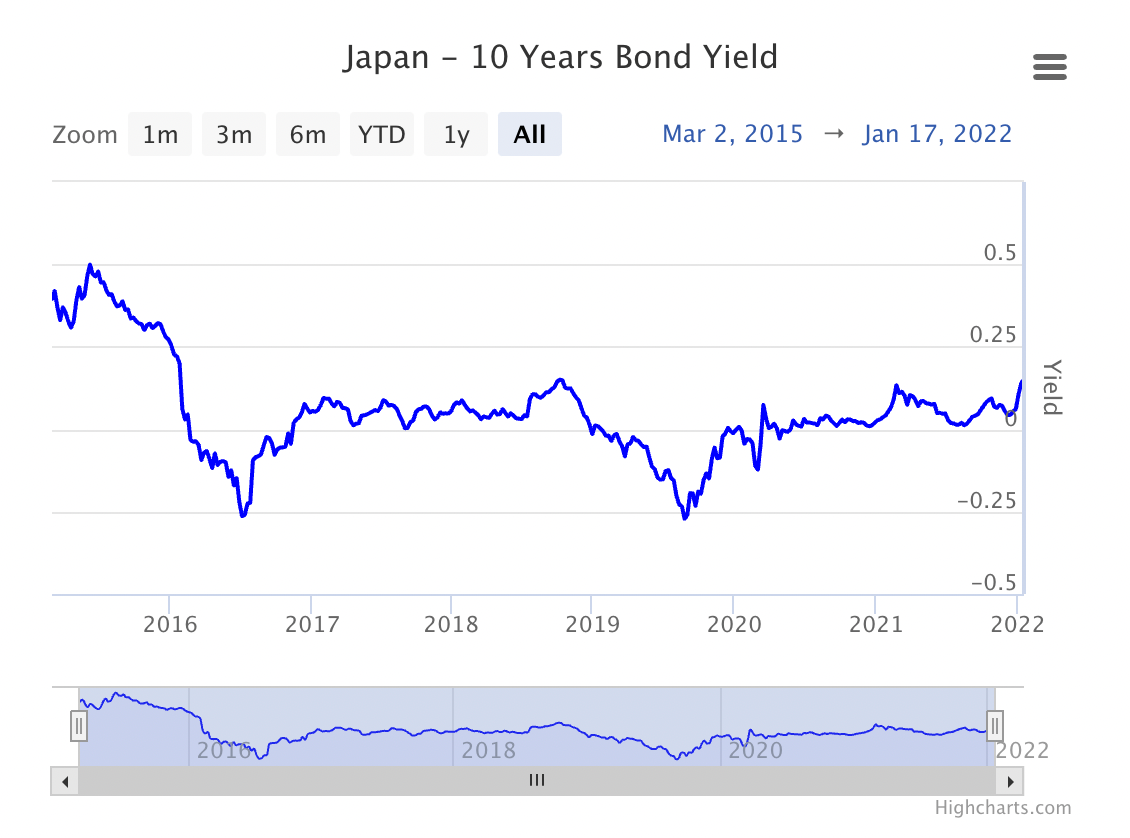

JPY bond yields have been trending up. Assuming Berkshire will continue to issue yen bonds to fund subsequent purchases, its funding rates may change though there is still quite a wide margin against the dividend yields.