ATVI Stock Analysis (Activision Blizzard) - What is Microsoft (MSFT Stock) acquiring for $69b? (January 2022 Update)

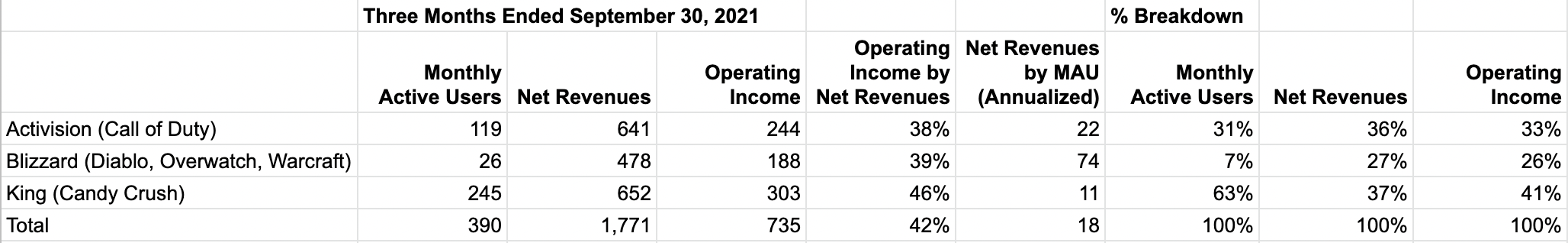

(January 2022 Update) Blizzard has 7% of MAUs but accounts for 27% of revenue because its MAU contributes ~$74 yearly, >3x of Activision or Call of Duty and almost 7x of King or Candy Crush.

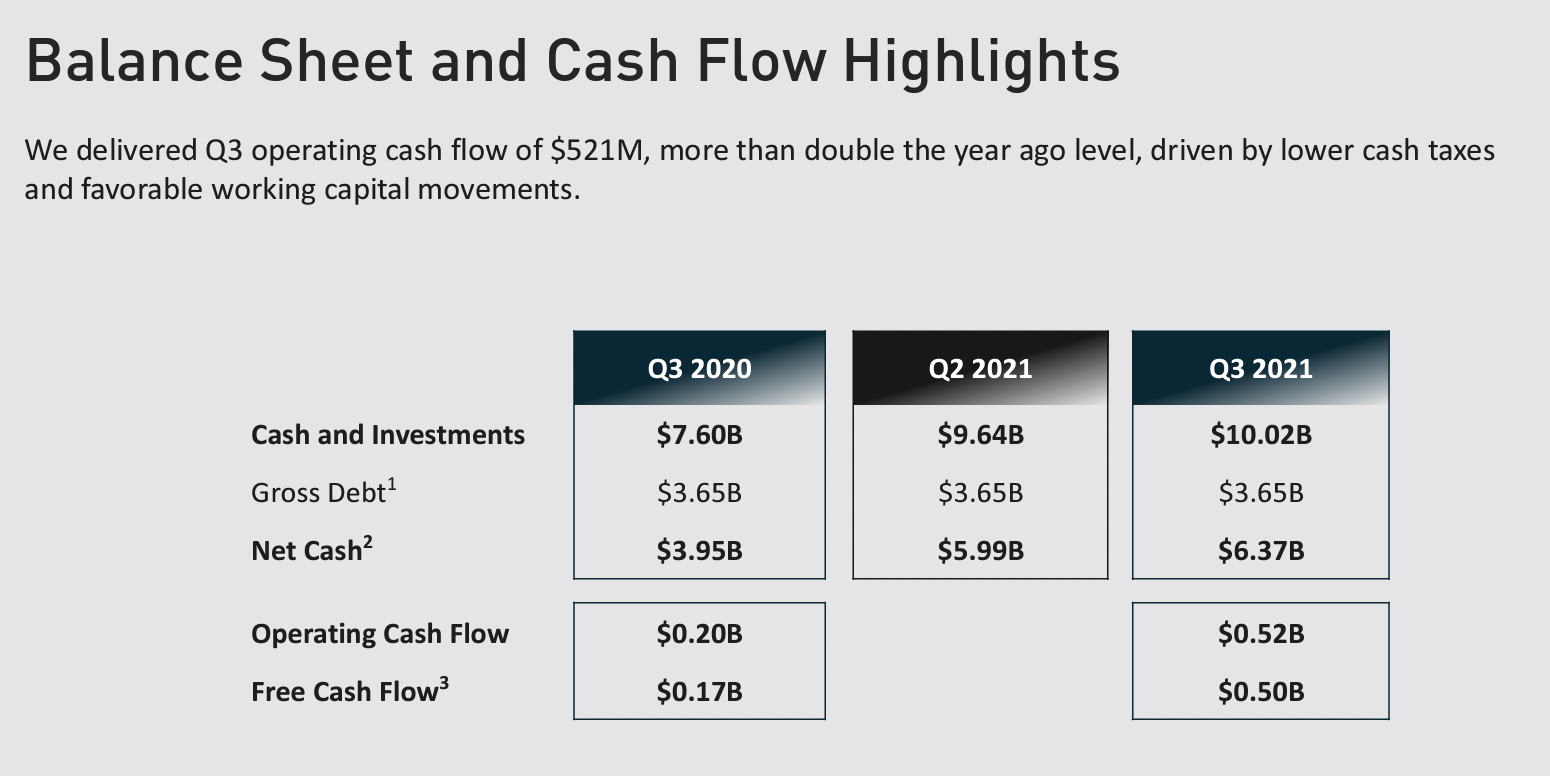

Activision Blizzard has an earnings outlook of about $2.6b for 2021, implying the business is acquired at a 27x earning multiple.

In addition, the business has net cash of about $6.4b.

We calculated a number of metrics using information from Activision Blizzard's IR website.

Blizzard (with titles including Diablo, Overwatch, Warcraft) has the least Monthly Active Users or MAUs of the three segments, 7% of the total. However, its contribution to net revenues and operating income account for 27% and 26% respectively. This is because its MAU contributes ~$74 yearly, >3x of Activision or Call of Duty and almost 7x of King or Candy Crush.

That said, the most profitable segment in terms of Operating Income by Net Revenues is King.

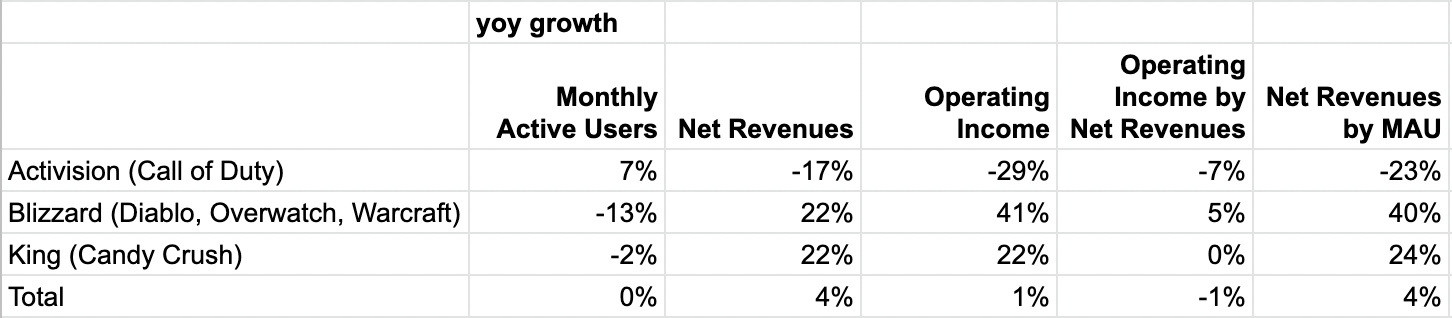

Breaking down the revenue growth, Activision has been growing MAUs but its Net Revenues by MAU has fallen. On the other hand, Blizzard and King had fallen MAUs but growing Net Revenues by MAU.

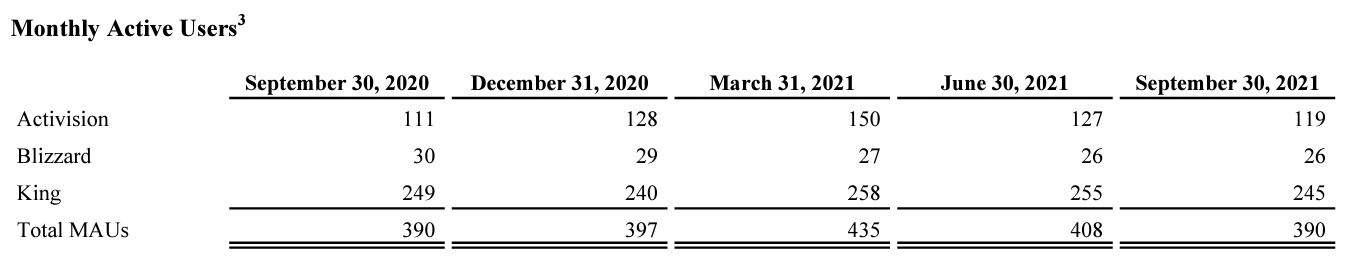

On a quarterly basis, Monthly Active Users or MAUs have not been growing.

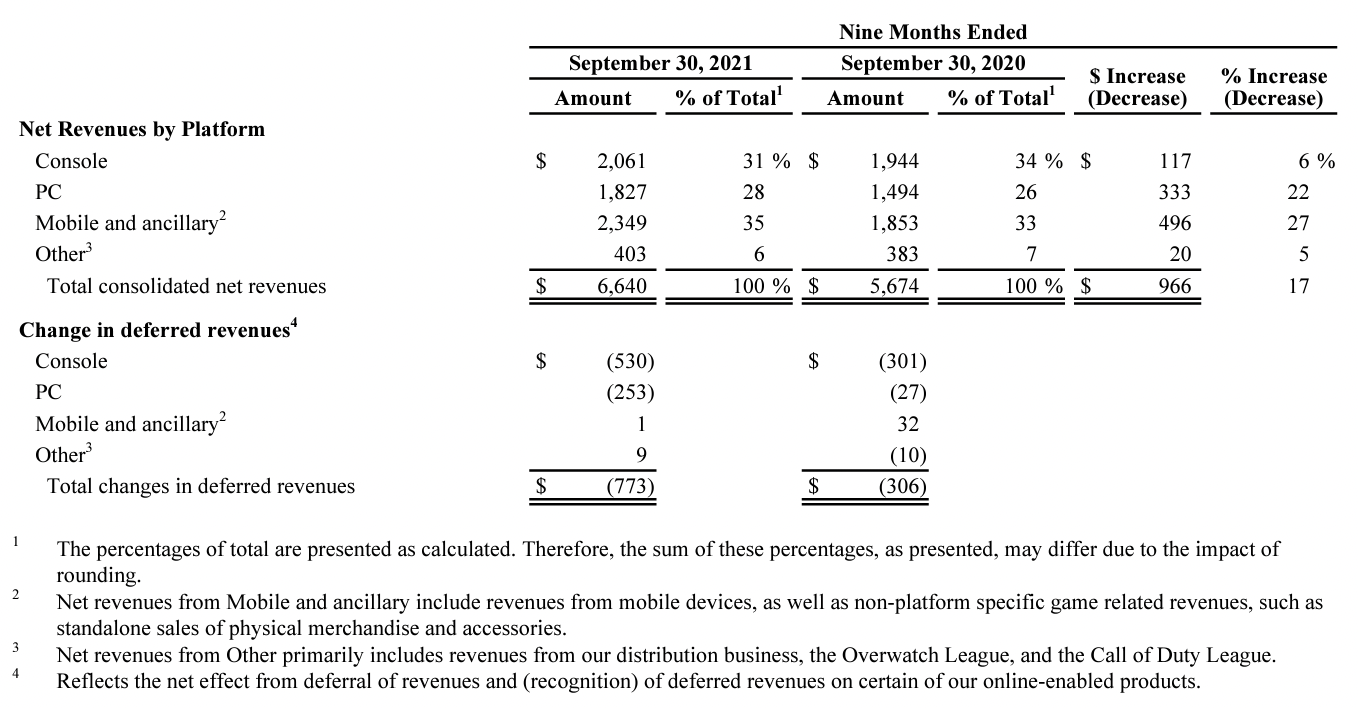

The business is fairly evenly split between the platforms.

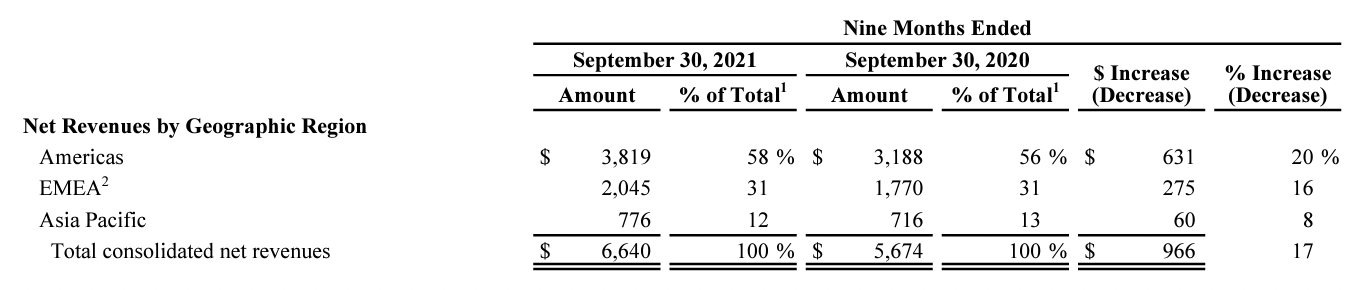

The business has a global reach though the majority of the revenue is derived in the US.

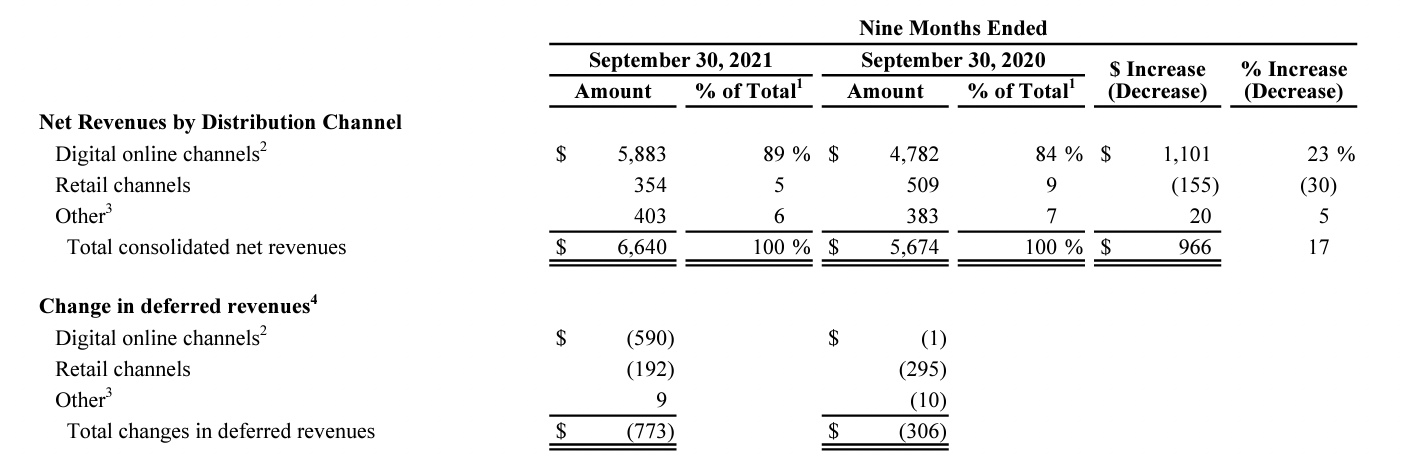

Majority of the revenue is derived from digital online channels.