What Microsoft-Activision Blizzard could mean to PS5 and Sony's financials? (January 2022 Update)

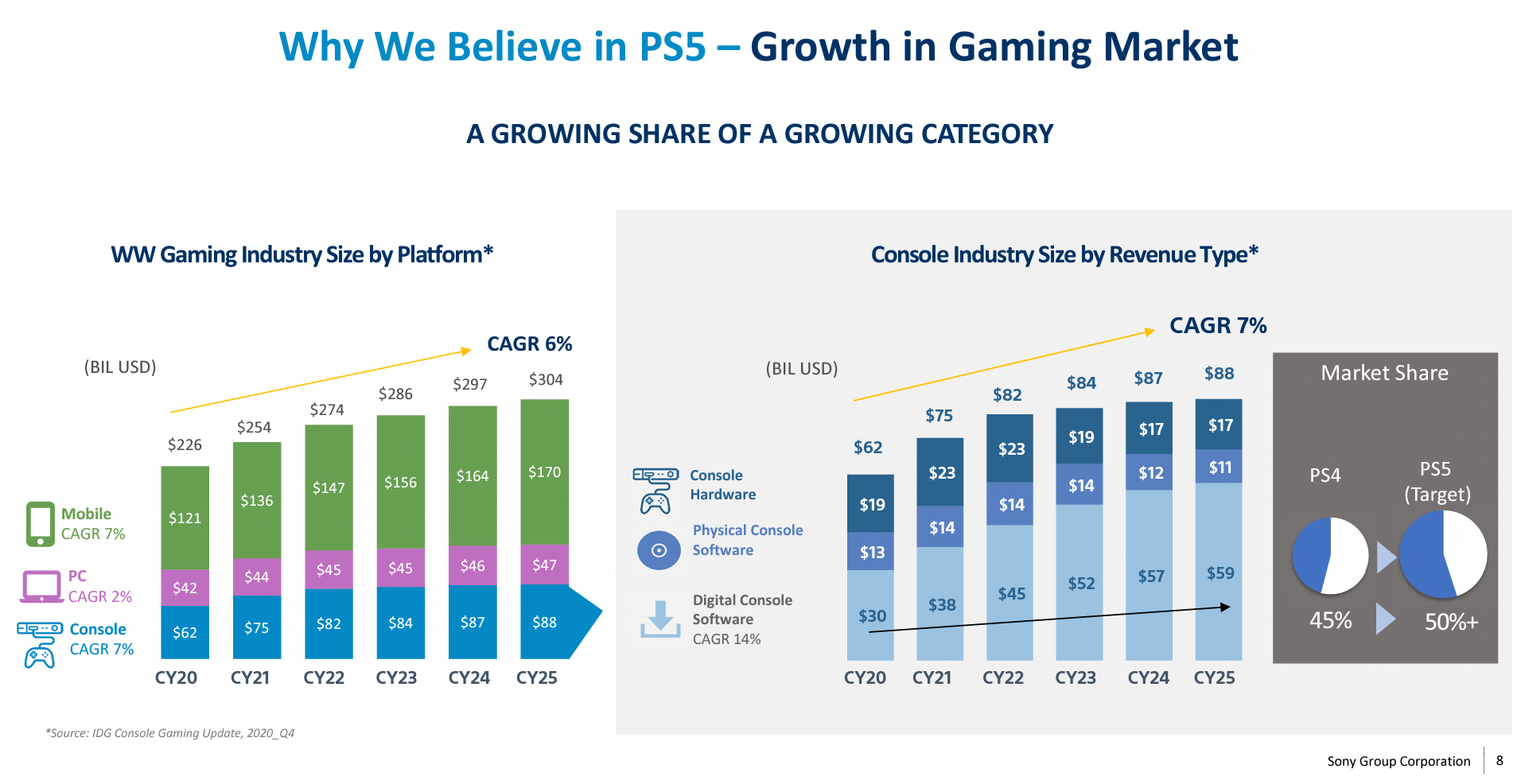

(January 2022 Update) PS5 targets to have higher market share than PS4 at 50%+. Will Microsoft-Activision Blizzard change this game plan? First party titles account for only 10-20% of total software unit sales, implying working with non-first party developers is key.

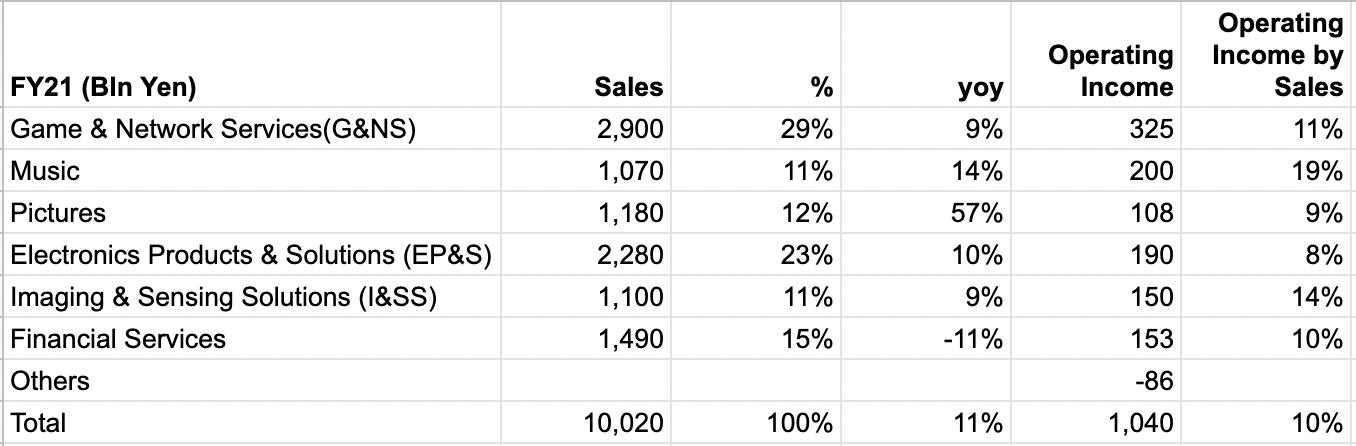

PS5 is part of the Game & Network Services (G&NS) segment, which accounts for 29% of Sony's total sales. G&NS is growing at ~9% on a year on year basis with an operating income margin of 11%. Both metrics are similar to the group level.

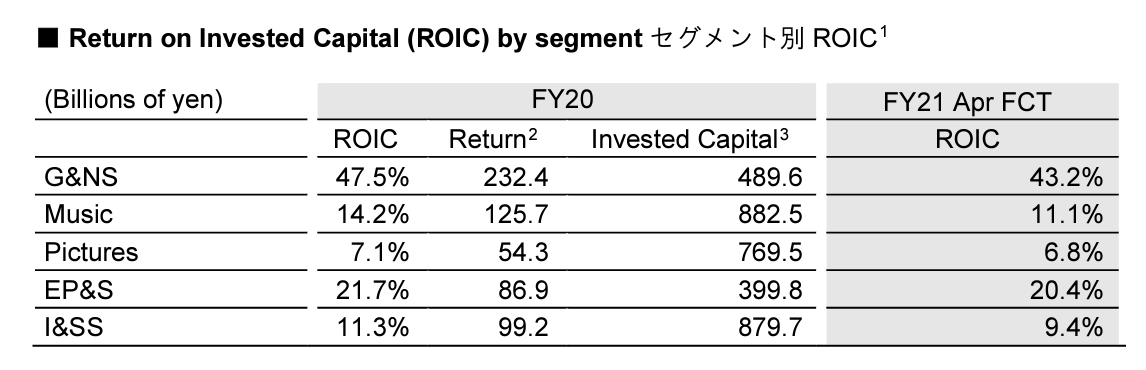

However, Game & Network Services (G&NS) do have the best return on capital of all the segments.

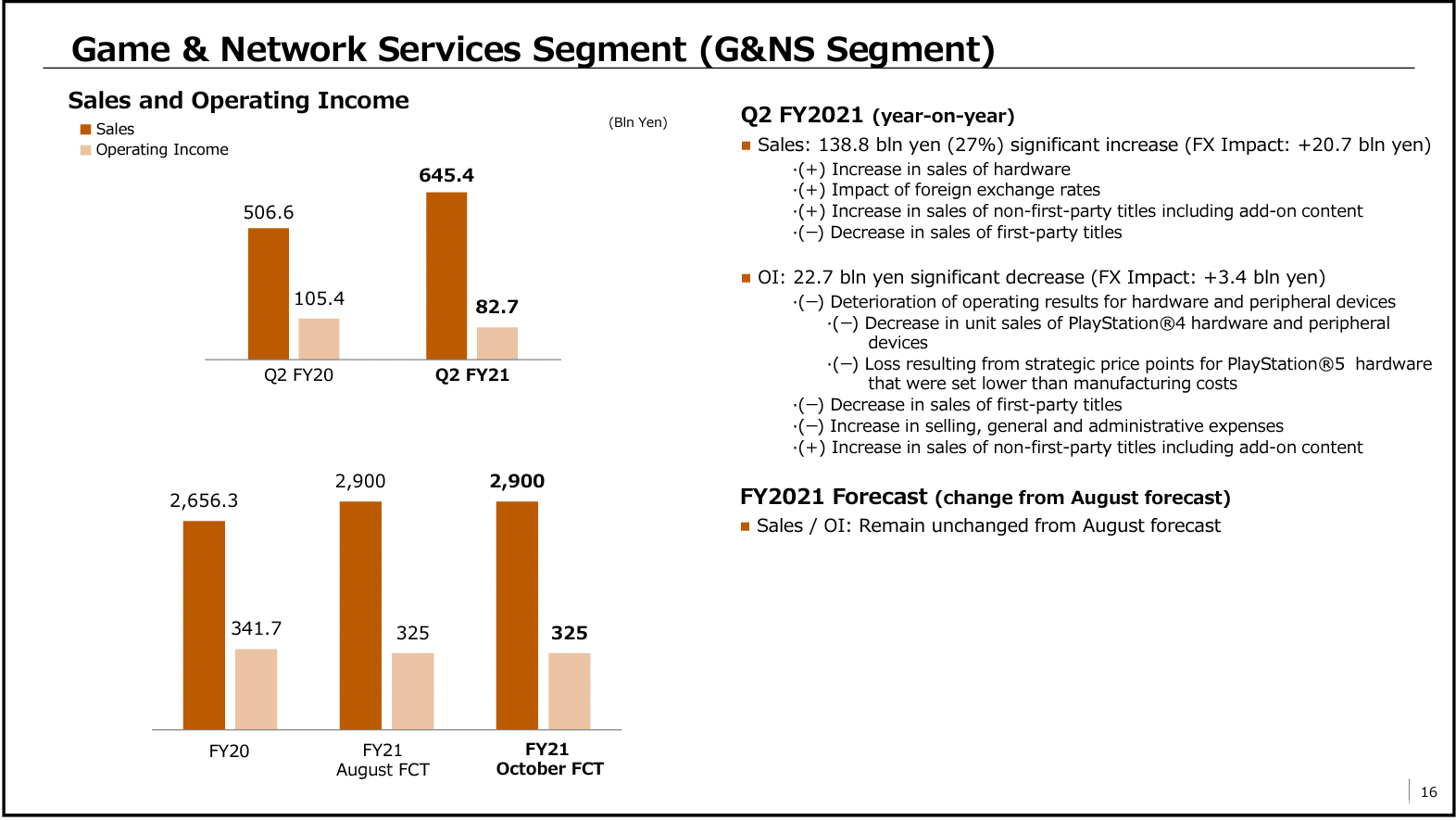

As per Sony's FY2021 Q2 presentation,

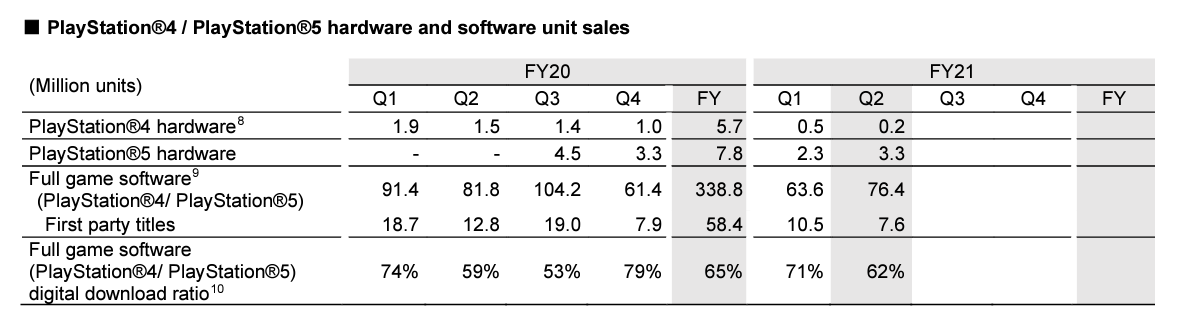

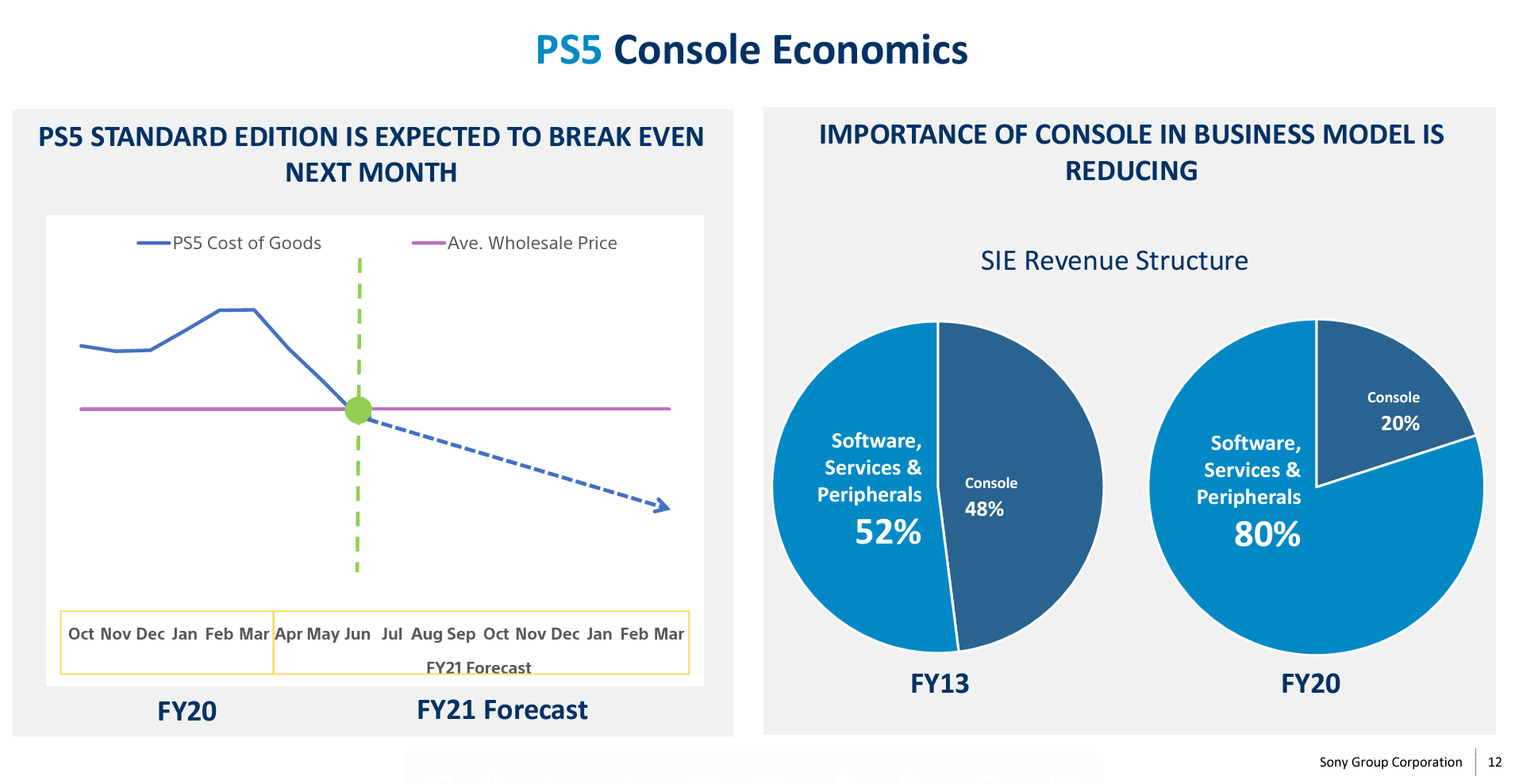

PS4 unit sales have slowed, which is expected given the rollout of PS5. However, PS5 is strategically priced to sell at below manufacturing costs, which has resulted in losses.

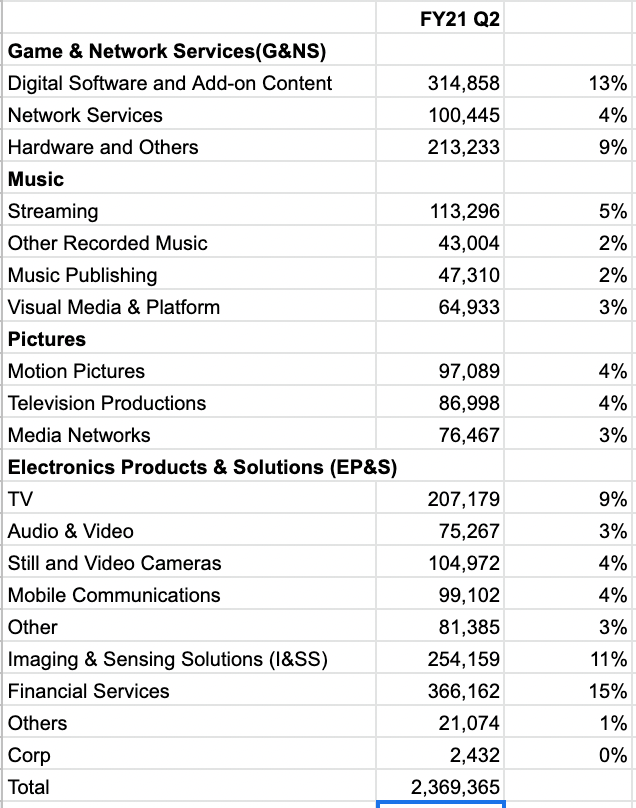

More detailed breakdowns of the segments can be obtained from the FY2021 Q2 Supplemental Information.

Specifically, hardware sales accounted for ~9% of the total with the majority coming from Digital Software and Add-on Content (13%) and Network Services (4%).

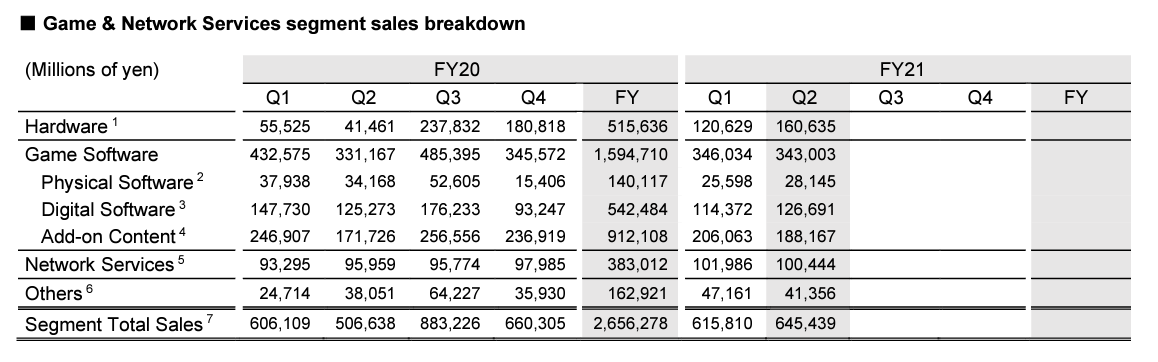

The historical quarterly trends indicate hardware sales were boosted from FY20 Q3 from the launch of PS5. Given PS5s are sold at losses, it would likely be expected to compensate by boosting Digital Software, Add-on Content and Network Services sales over time.

PS5 is now selling substantially more than PS4.

Notice first party titles account for only 10-20% of total software unit sales. This implies working with non-first party titles developers remain the key to developing the gaming ecosystem.

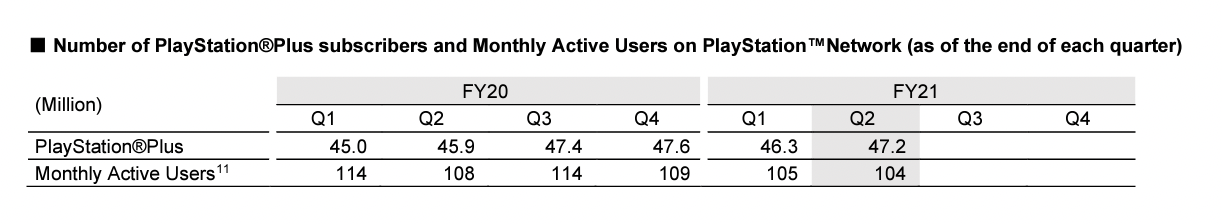

Subscribers and Monthly Active Users remain flattish though.

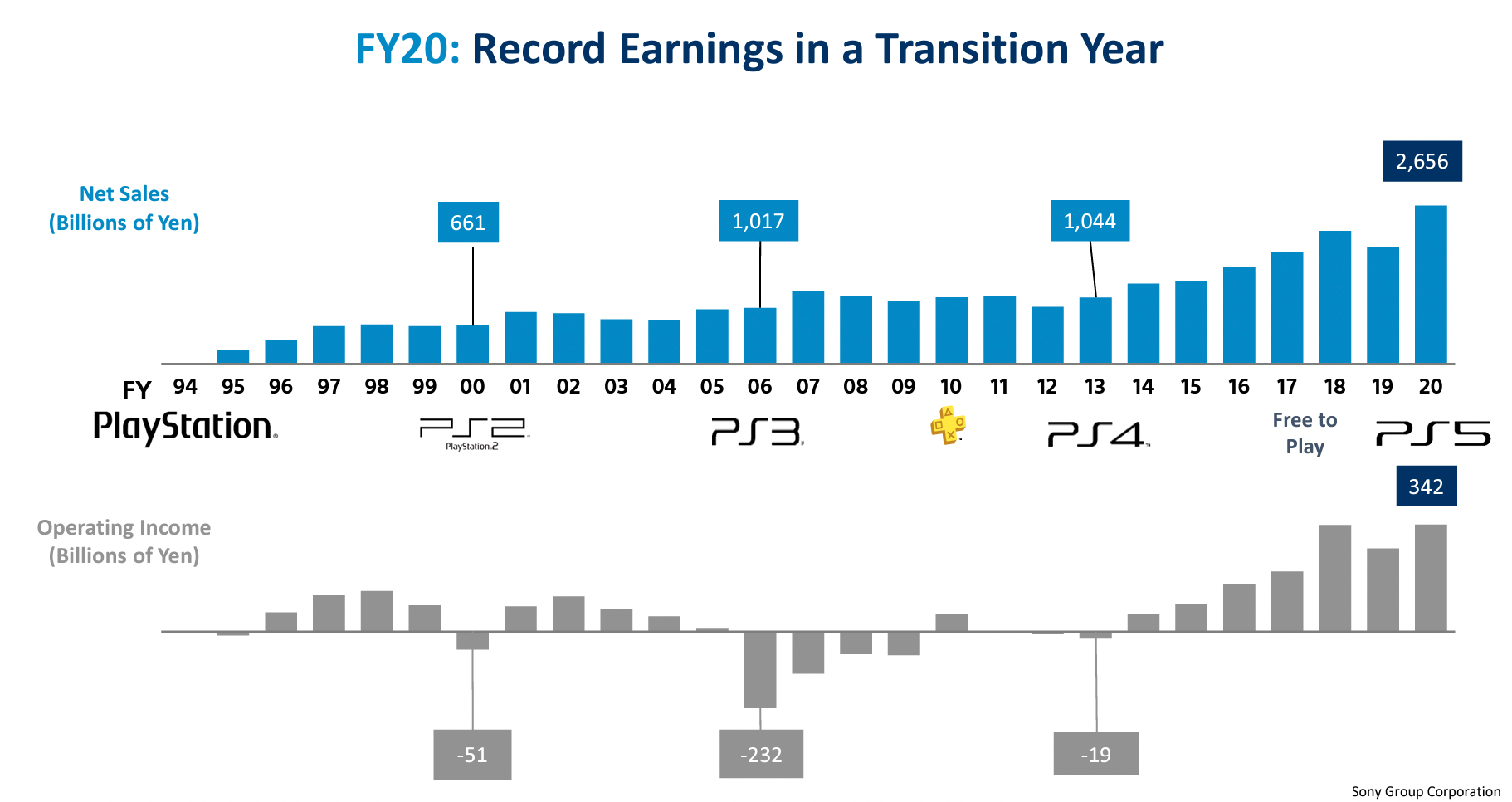

As per Sony's IR Day 2021 presentation, on an yearly basis, operating income has been rising since PS4 launch.

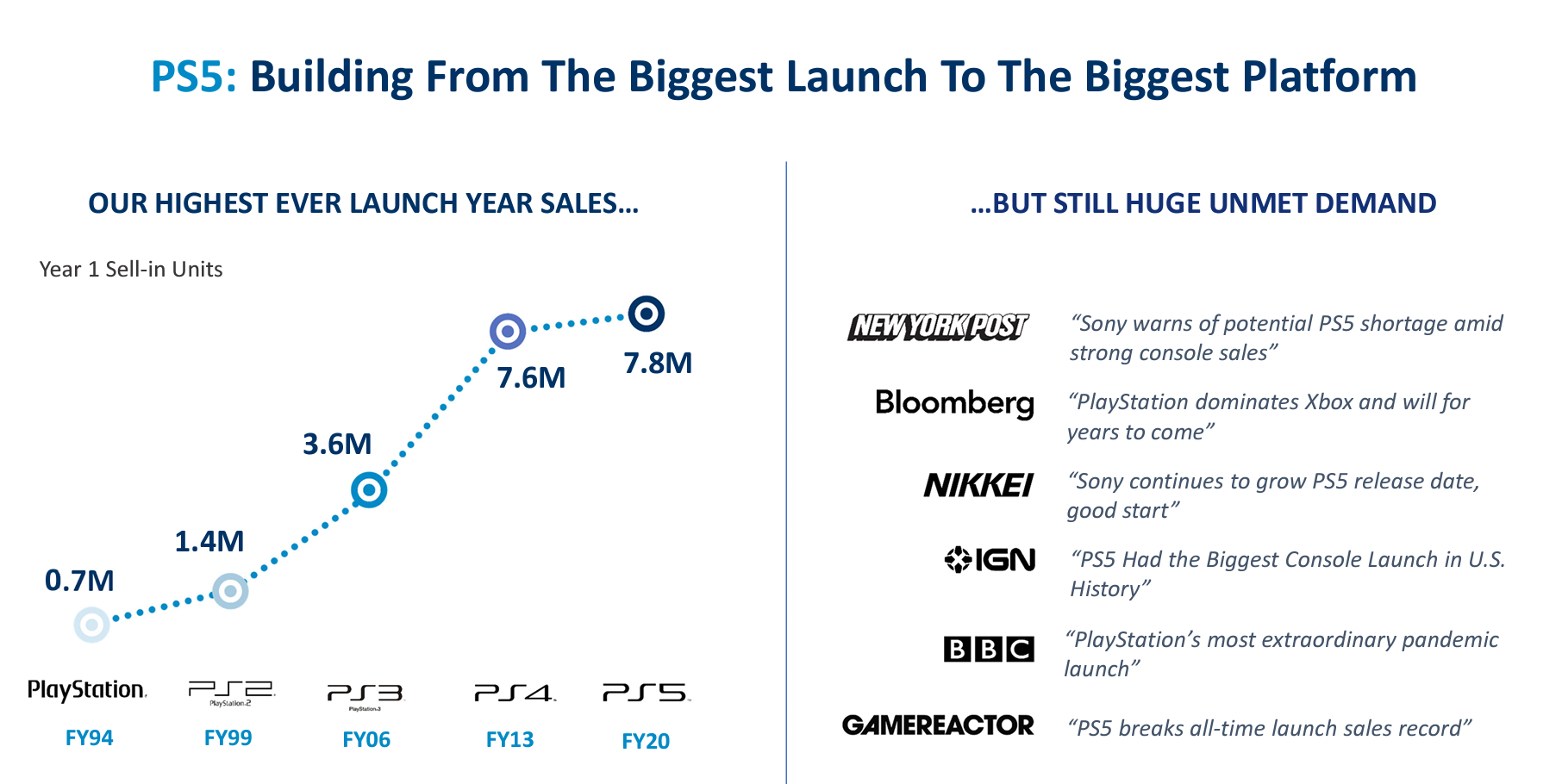

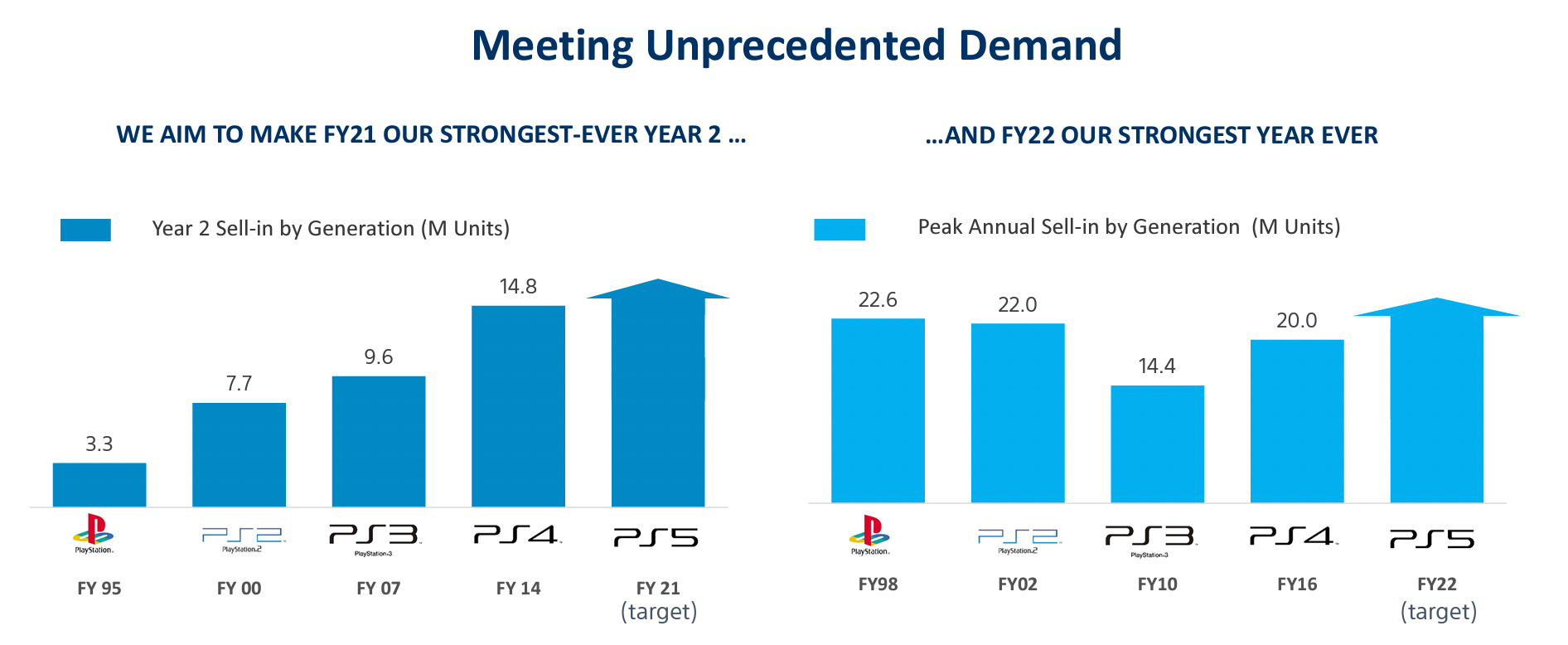

PS5 is a bigger launch than PS4.

While mobile remains dominate, digital console software is expected to have higher CAGR at 14% in the coming years.

PS5 also targets to have higher market share than PS4 at 50%+. Will Microsoft-Activision Blizzard change this game plan?

Sony believes in the potential of PS5 driven by:

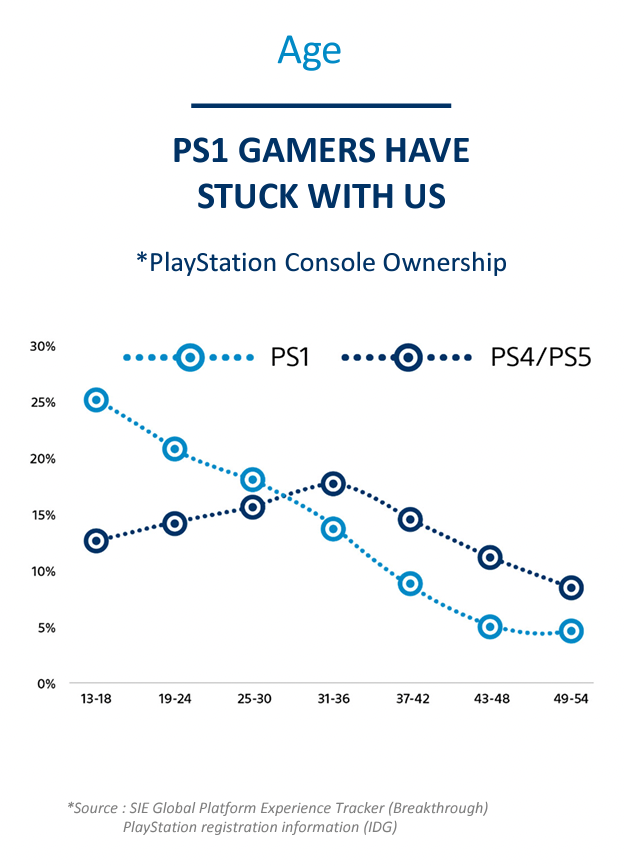

- Age

Some of the generations that bought PS1 has continued to buy PS5.

2. Gender

There are higher female ownerships of PS4/PS5 compared to PS1.

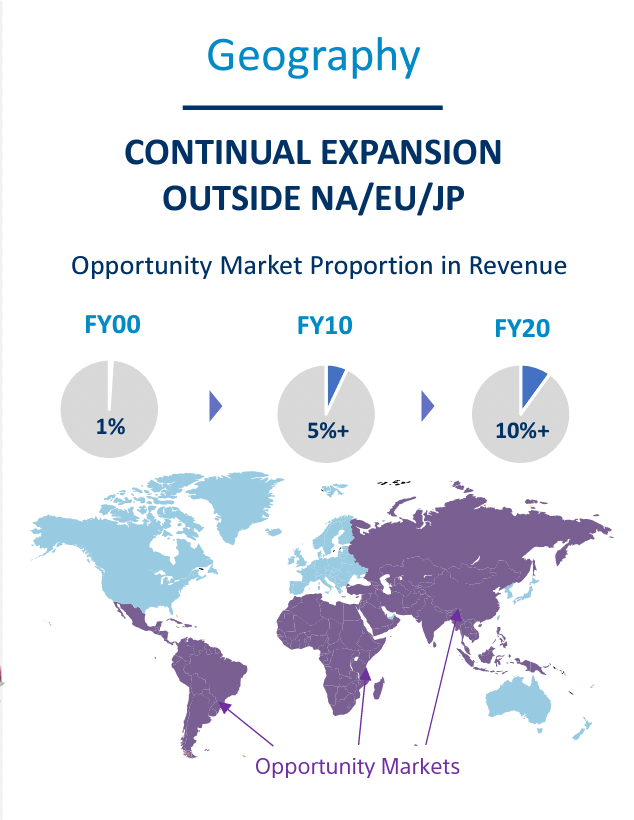

3. Geography

Expanding into new markets.

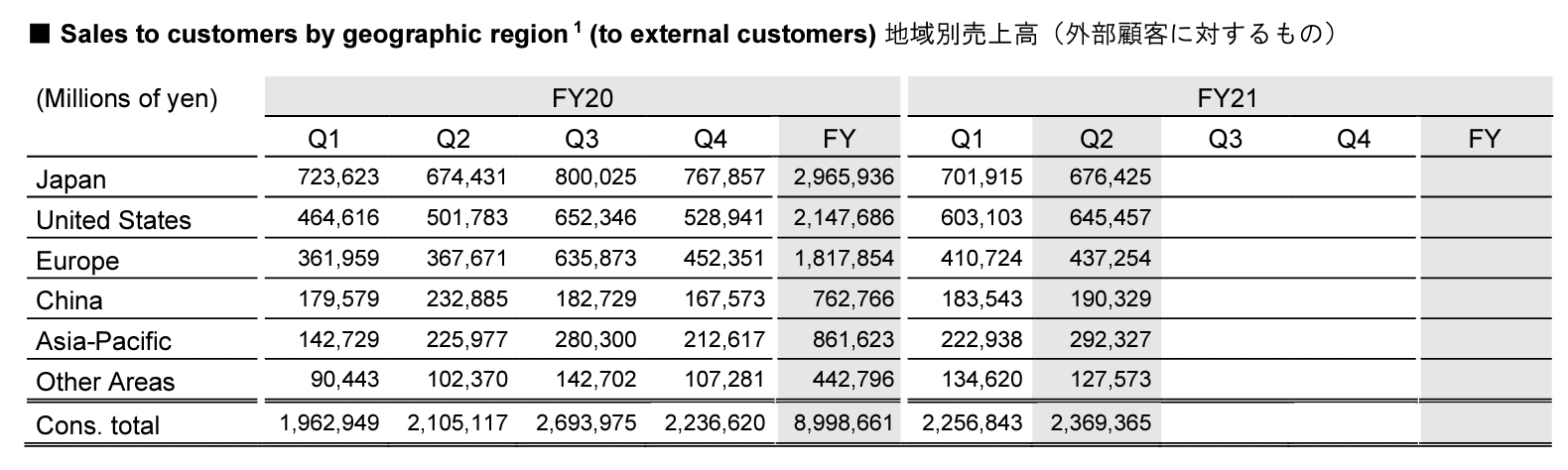

At the group level, Japan, US and Europe remain the largest markets by sales.

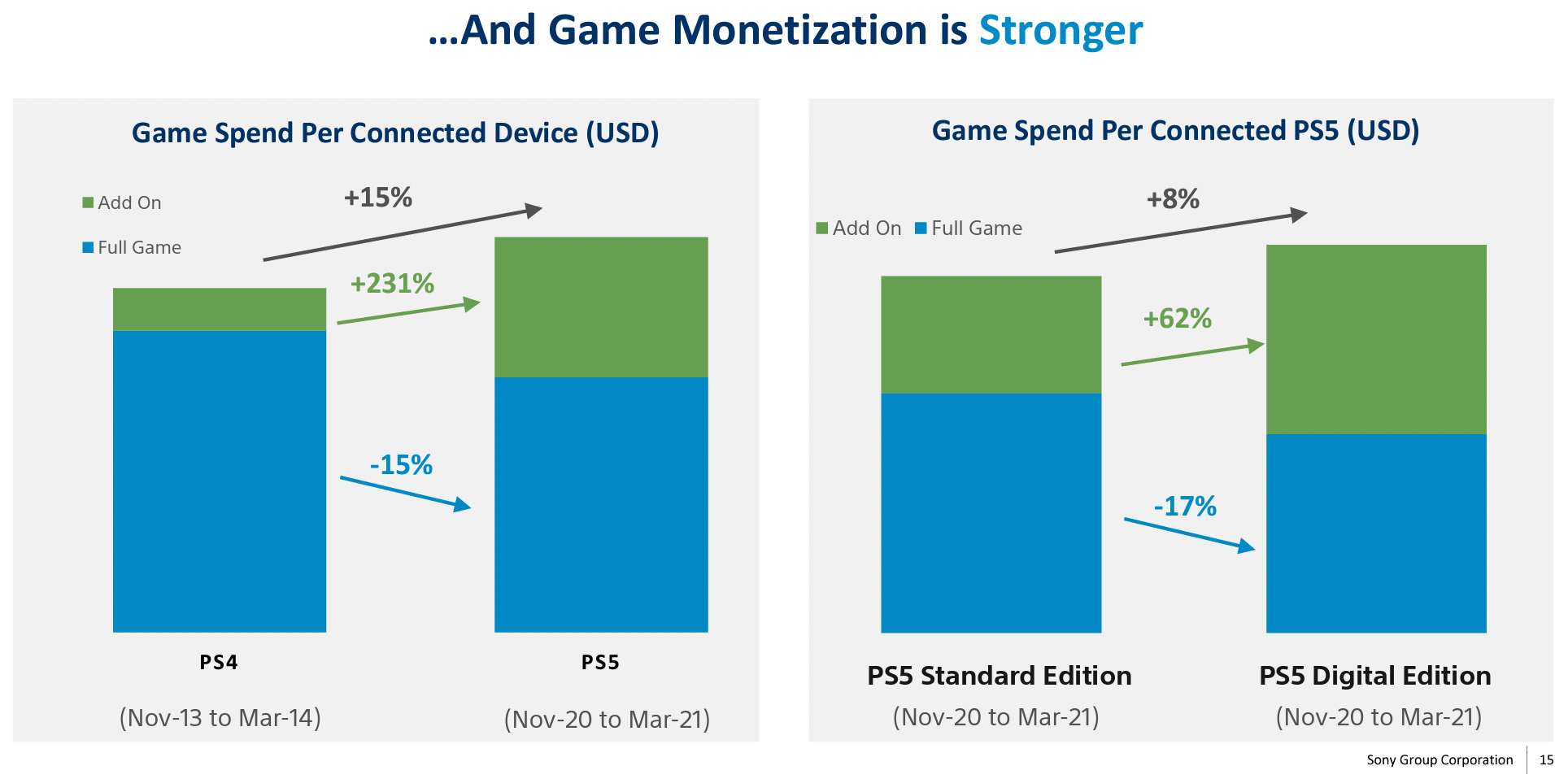

80% of revenue is driven by software compared to 52% before and PS5 console is expected to have a short breakeven. These imply high profitability potential.

Year 2 sell-in is higher with each new version of PS but peak annual sell-in for PS3/PS4 have not matched PS1/PS2.

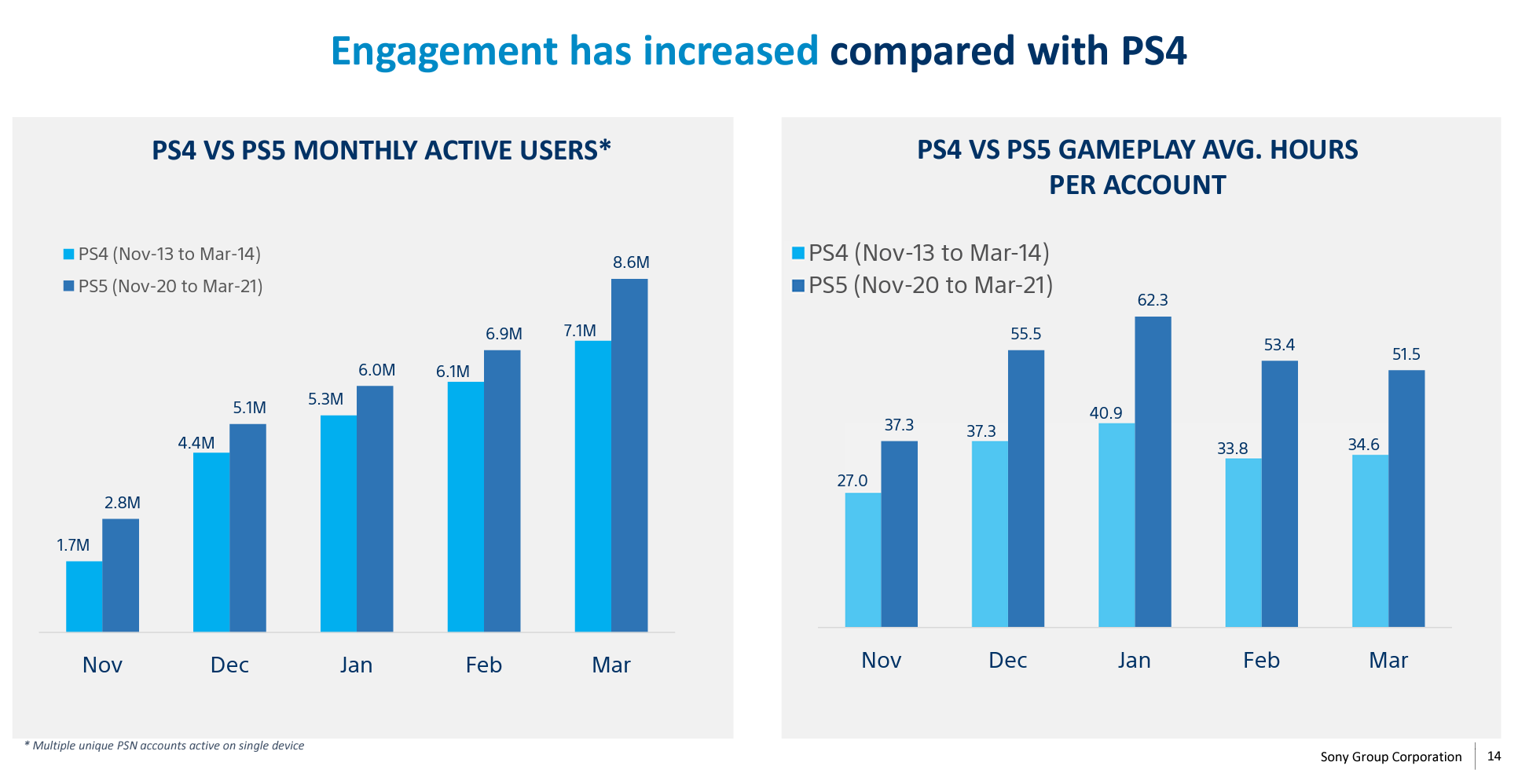

There are more Monthly Active Users for PS5 than PS4 and users are spending more time playing.

Users are also purchasing more add-ons compared to full games.

Notice Call of Duty (an Activision game) is present, will Microsoft acquiring Activision mean Call of Duty be exclusive to Xbox going forward? The impact though is unlikely to be material as it is only 1 of 5 Free to Play games.

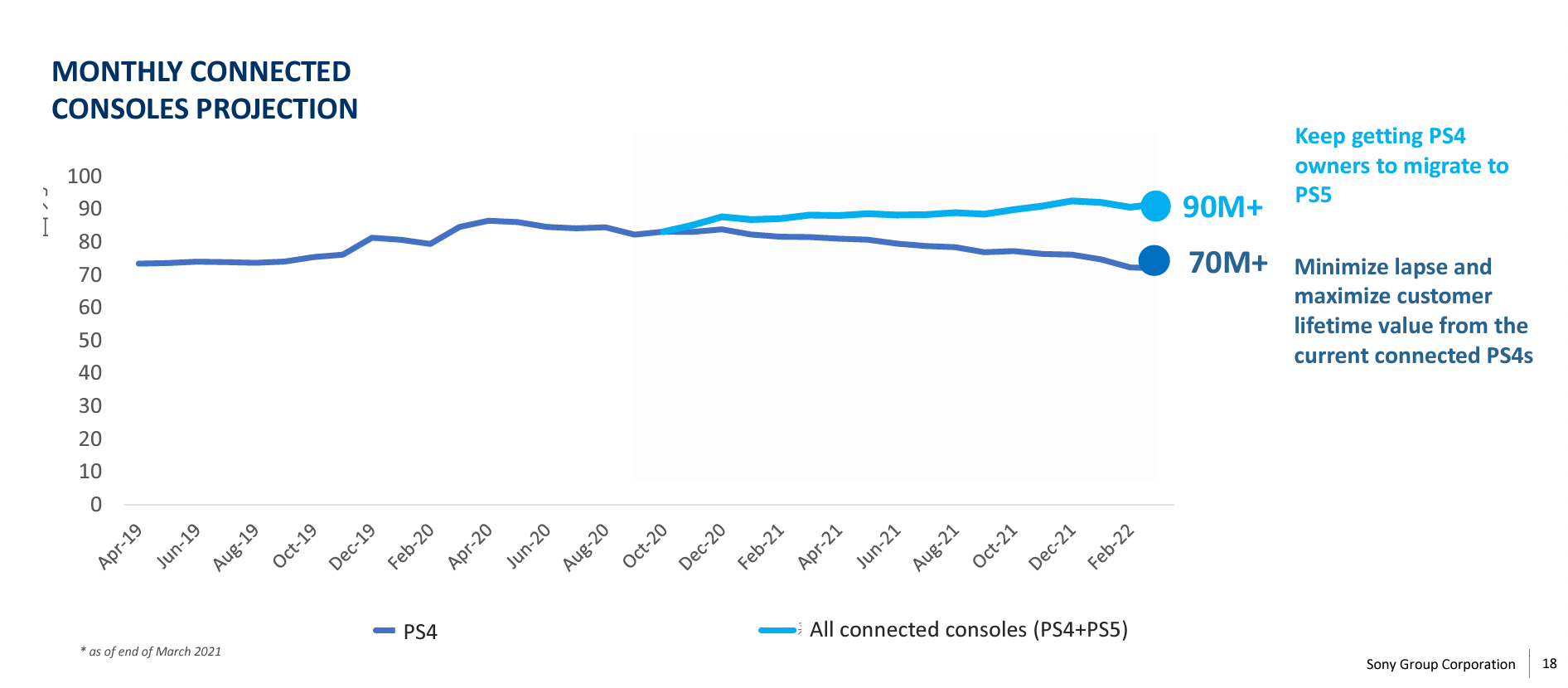

The migration from PS4 to PS5 appears well as monthly connected consoles have been rising slightly.