Stocks to Buy Now from Peter Thiel's portfolio - Affirm (AFRM stock) analysis (November 2021 Update)

(November 2021 Update) Affirm has attracted traditional interest bearing assets to its platform through using technology.

Market Cap

Affirm's market cap can be broken down into a number of metrics.

A) In a report from Worldpay, "global e-commerce transactions totaled $4.6 trillion in 2020, up 19% from 2019".

Most of Affirm's business is still in the US, which according to U.S. Department of Commerce figures, "Consumers spent $791.70 billion online with U.S. merchants in 2020".

B) Affirm's market share

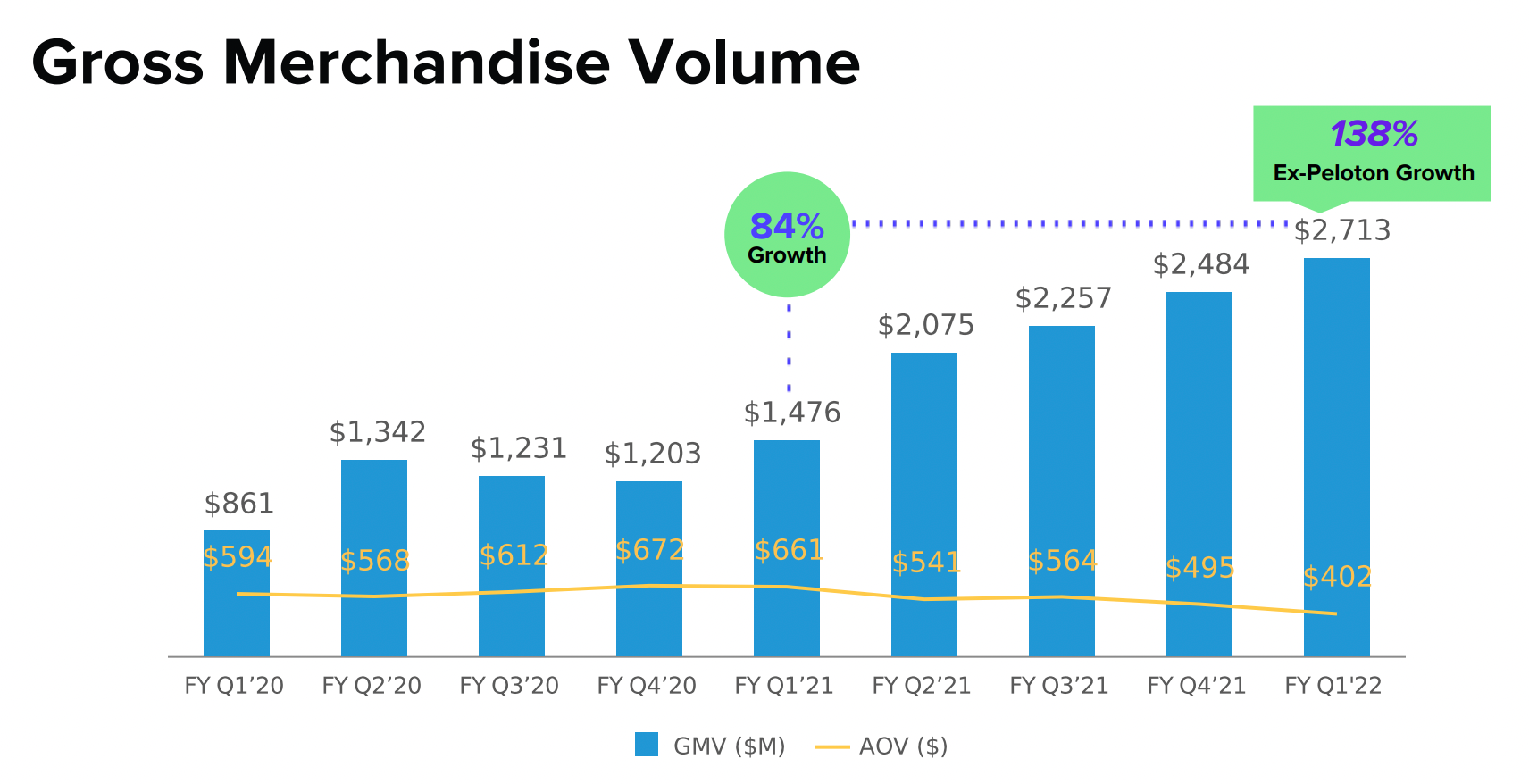

Annualizing Affirm's Q1'22 GMV implies 0.24% of the above global e-commerce transactions market share.

C) Affirm's margin, which is proxied by its total net operating income as % of GMV, is ~10%.

D) Market Cap to Total net operating income

Dividing Affirm's market cap of ~$35b and total net operating income of $1.1b (Q1'22 annualized) gives a multiple of around 32x.

Multiplying A, B, C and D gives the market cap of Affirm.

Our Members' section has a spreadsheet that can change the size of the global e-commerce transactions and Affirm's market share to see the potential impact on market cap. Email [email protected] for details.

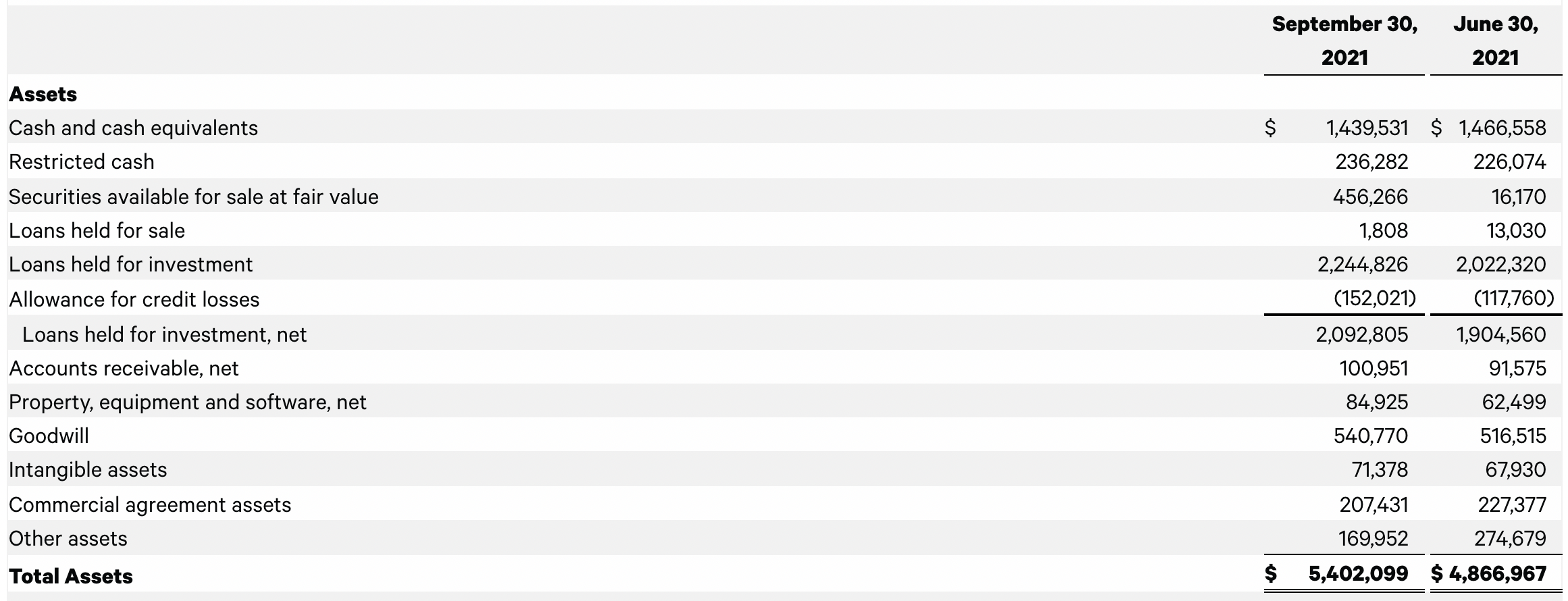

Balance Sheet

The extract below from Affirm's 2021 Annual Report provides a detailed explanation of its on balance sheet commitments on the asset side.

A substantial majority of the loans facilitated through our platform are originated through our originating bank partners: Cross River Bank, an FDIC-insured New Jersey state-chartered bank, and Celtic Bank, an FDIC insured Utah state-chartered industrial bank.

These partnerships allow us to benefit from our partners' ability to originate loans under their banking licenses while complying with various federal, state, and other laws. Under this arrangement, we must comply with our originating bank partners' credit policies and underwriting procedures, and our originating bank partners maintain ultimate authority to decide whether to originate a loan.

When an originating bank partner originates a loan, it funds the loan out of its own funds and may subsequently offer and sell the loan to us. Pursuant to our agreements with these partners, we are obligated to purchase the loans facilitated through our platform that our partner offers us and our obligation is secured by cash deposits. To date, we have purchased all of the loans facilitated through our platform and originated by our originating bank partners.

When we purchase a loan from an originating bank partner, the purchase price is equal to the outstanding principal balance of the loan, plus a fee and any accrued interest. The originating bank partner also retains an interest in the loans purchased by us through a loan performance fee that is payable by us on the aggregate principal amount of a loan that is paid by a consumer.

Since Affirm originates loans under the banking licenses of its partnering banks, Affirm is not subject to regulatory capital requirements itself.

Below is the Asset breakdown as per Affirm's Q1'22.

The cash and cash equivalents should be the cash deposits used to secure and purchase the loans Affirm's partner offers it (as per the extract above).

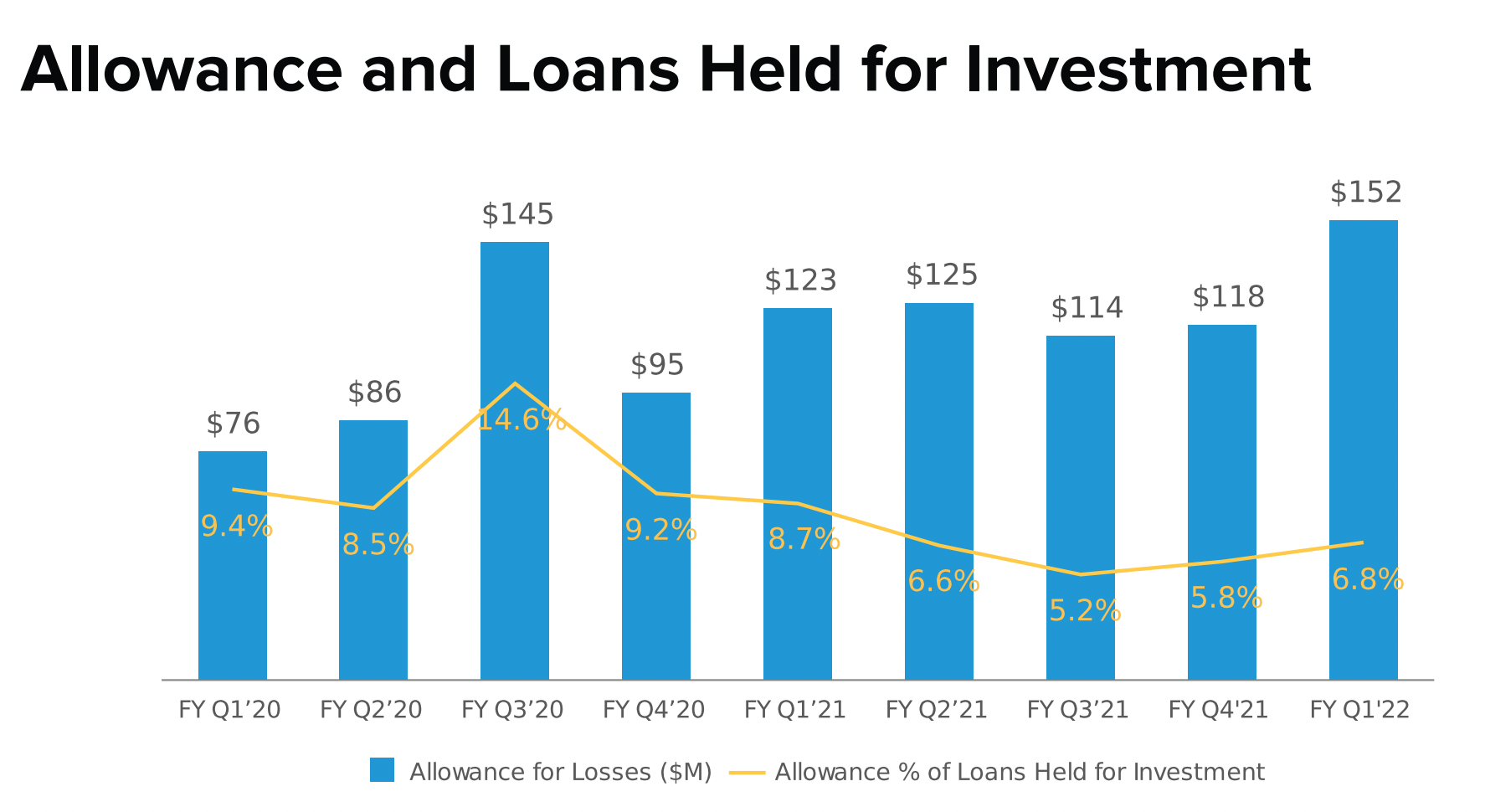

Affirm also maintains ~7% in allowance for its loans held for investment for bad debt purposes as per the Q1'22 Earnings Supplement.

The below extract from the 2021 Annual Report explains how this allowance is calculated.

We maintain an allowance for credit losses at a level sufficient to estimate expected credit losses based on evaluating known and inherent risks in our loan portfolio.

This estimate is highly dependent upon the reasonableness of our assumptions and the predictability of the relationships that drive the results of our valuation methodologies.

The method for calculating the best estimate of expected credit losses takes into account our historical experience, adjusted for current conditions, and our judgment concerning the probable effects of relevant observable data, trends, and market factors. Changes in such estimates can significantly affect the allowance and provision for losses.

It is possible that we will experience credit losses that are different from our current estimates. If our estimates and assumptions prove incorrect and our allowance for credit losses is insufficient, we may incur net charge-offs in

excess of our reserves, or we could be required to increase our provision for credit losses, either of which would adversely affect our results of operations.

Therefore, there is a fair amount of subjective judgement in the allowance.

However, the relatively high interest rates between 17-25% (details below) meant excluding other costs, bad debts can go as high as these levels in year 1 before losses are reported (and twice this amount after year 2).

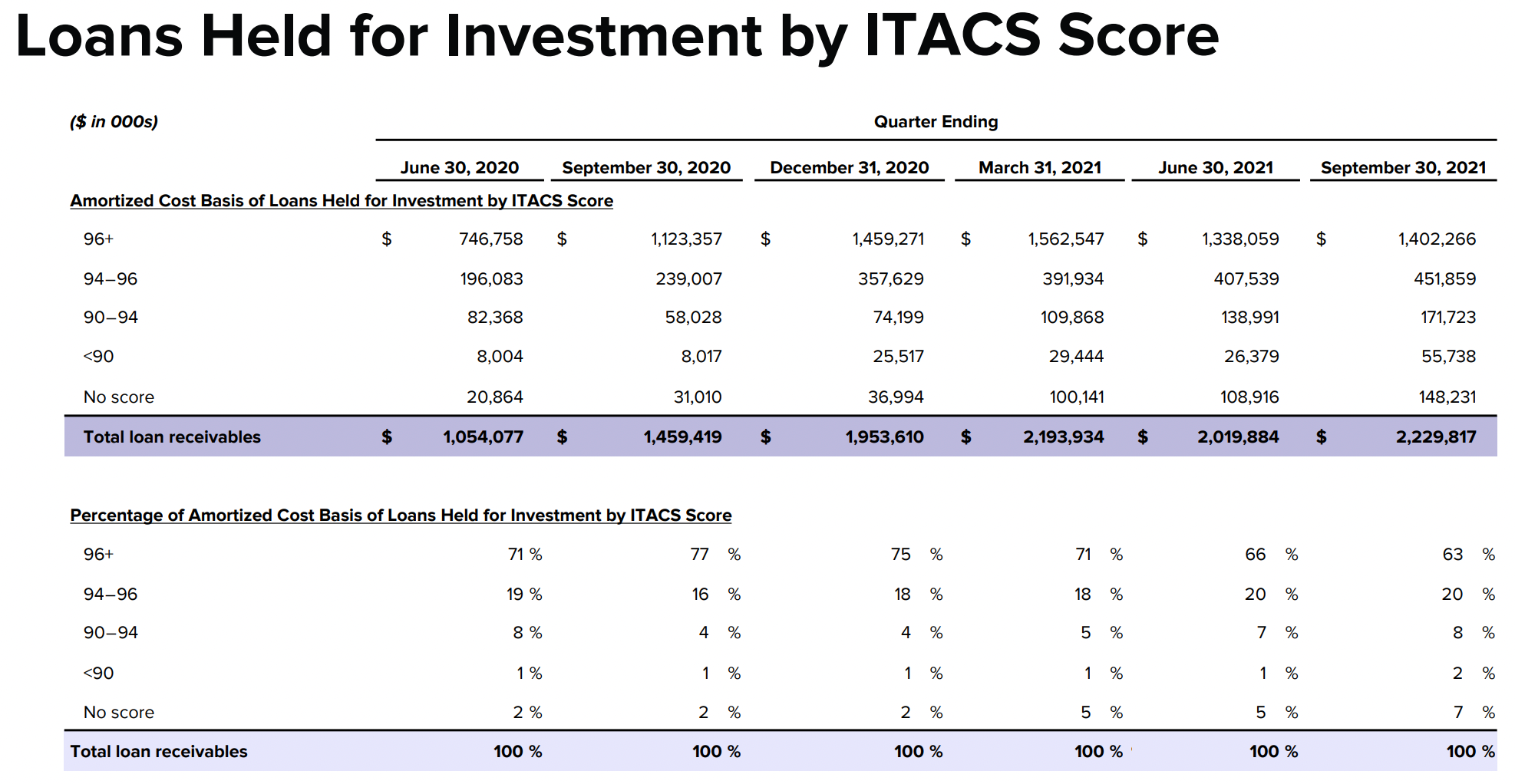

In fact, Affirm has a proprietary score, which it explains below.

Our proprietary score (“ITACs”) is assigned to most loans facilitated through our technology platform, ranging from zero to 100, with 100 representing the highest credit quality and in turn the lowest likelihood of loss.

It also discloses its loan portfolio breakdown by this score.

However, what it does not disclose are the actual default rates for the different ITACS Scores.

Therefore, there is limited transparency as to how the allowance is calculated leaving room for the unpredictability of earnings.

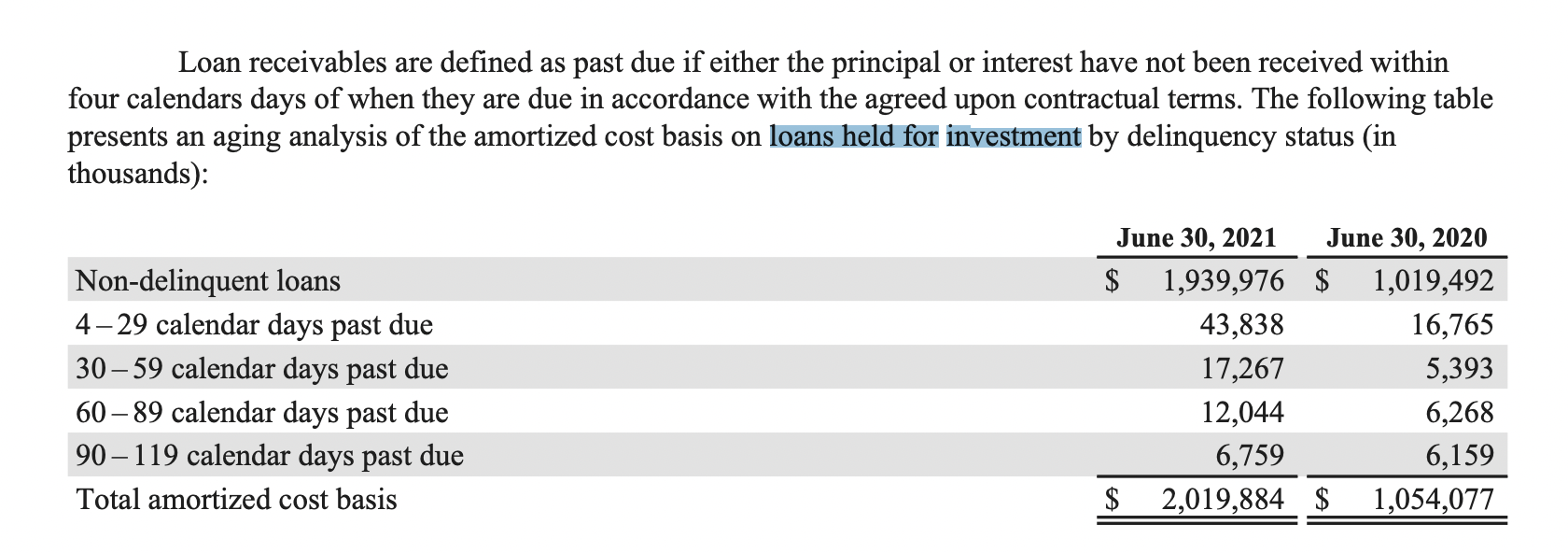

That said, there is disclosure on loan breakdown by past due days in the 2021 Annual Report.

Summing all the loans past due over 4 days gives ~$80m. This compares with the $108m of no score (defined as loan receivables in new markets without sufficient data currently available for use of the Affirm scoring methodology as well as loan receivables originated by PayBright) or $26m of <90. This implies very limited past due for >90 Score, or Affirm has been taking on good risks on its book.

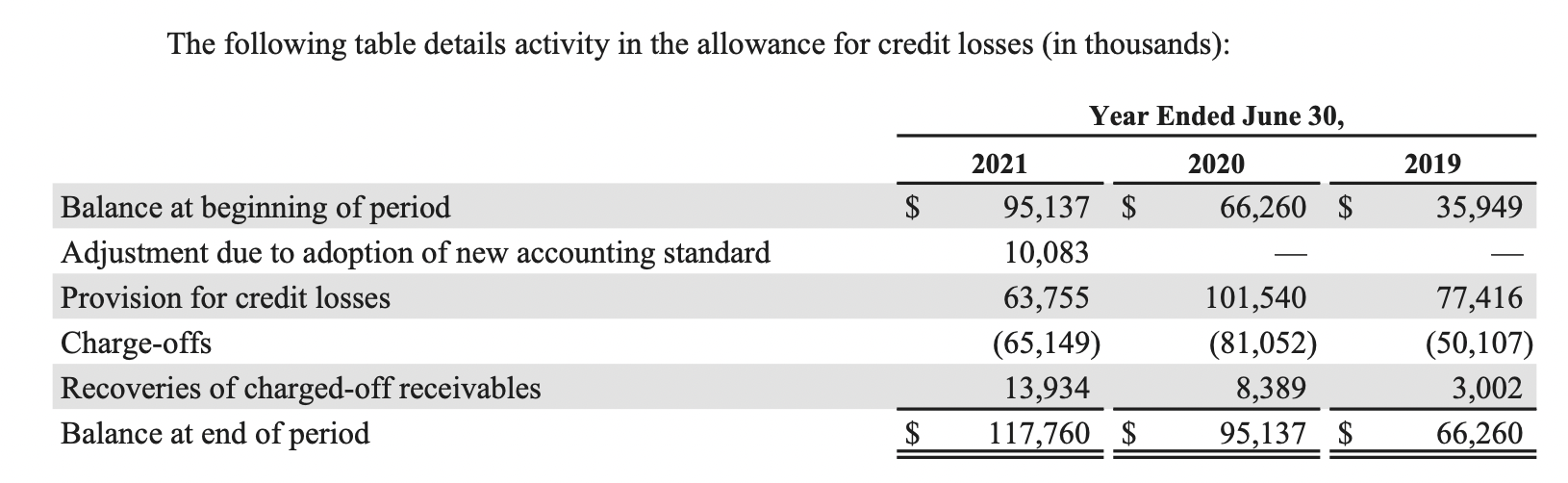

Charge-offs below also indicates asset quality changes.

Dividing the charge-offs in 2021 of $65m by the beginning of the year's loan balance of $1,054m gives 6%, implying the yearly provision for credit losses should be at least 6%. In other words, as per above, the ~7% in allowance as at Q1'22 is around a year's worth in charge-offs.

As a sensitivity exercise, a 1% loss on the $2.2b loan portfolio implies ~3% impact on net revenue.

Affirm's interest rate is ~17-25%

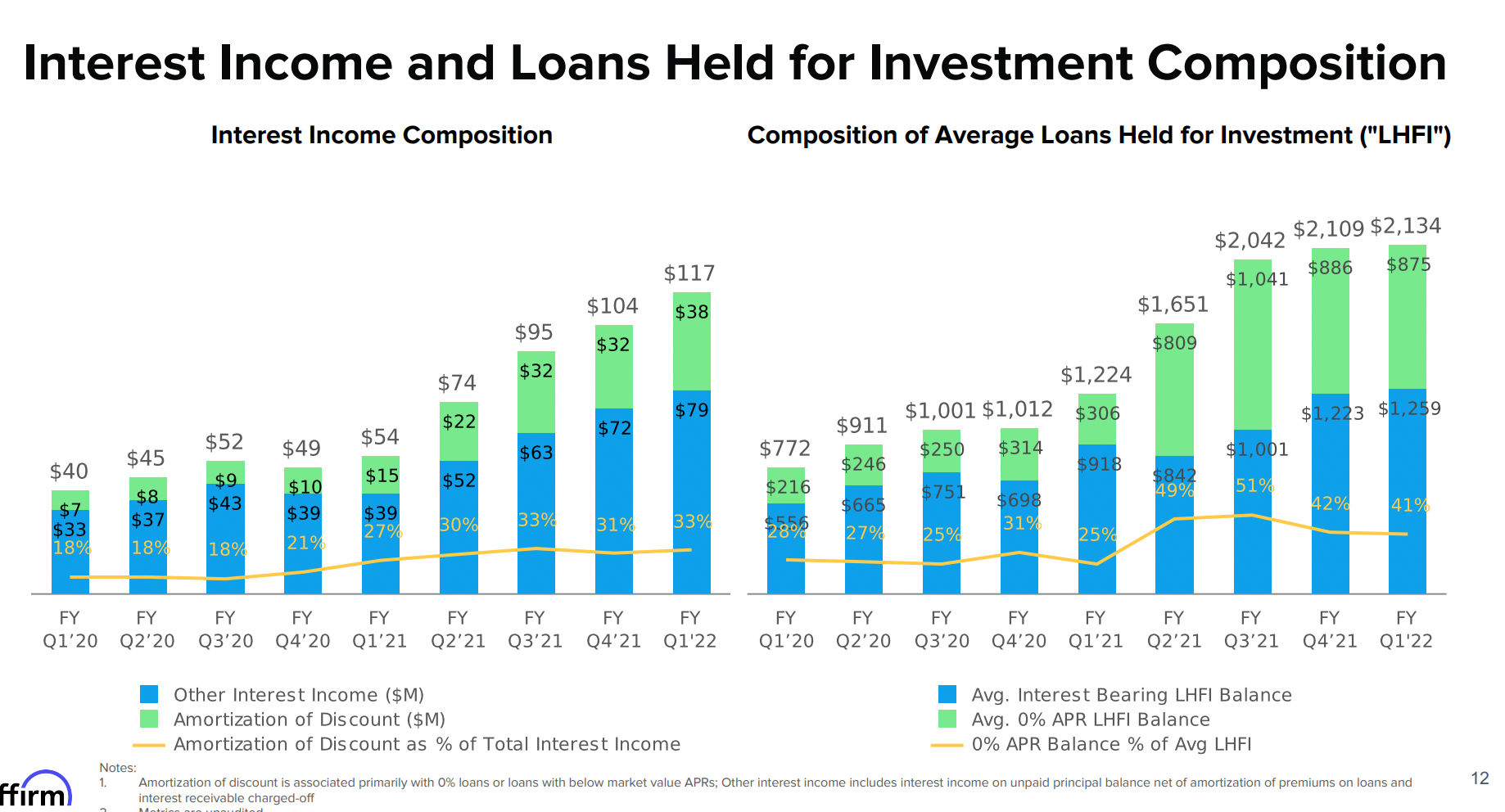

Using data from its Q1'22 Earnings Supplement, interest income from

A) Amortization of Discount is ~17% annualized relative to the Average 0% APR LHFI (Loans Held for Investment) Balance;

B) Other Interest Income is ~25% annualized relative to the Average Interest Bearing LHFI Balance.

Funding

Unlike traditional banks, Affirm does not have deposits on its balance sheet. Its funding is primarily supported by Funding debt and Notes issued by securitization trusts.

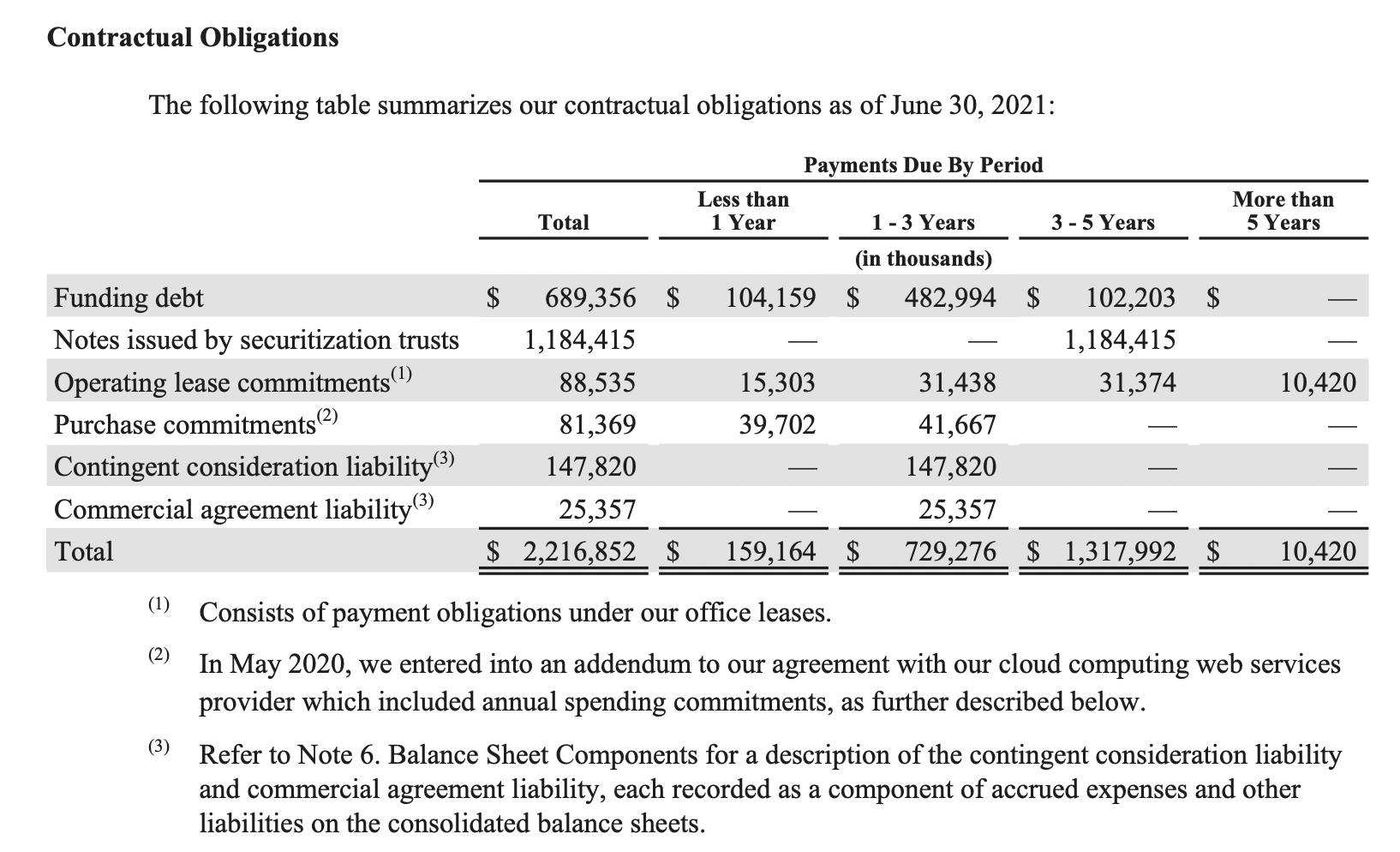

As per the below table from its 2021 Annual Report, "Our debt financing and loan sale forward flow facilities are generally short-term in nature, with term lengths ranging between one to three years...".

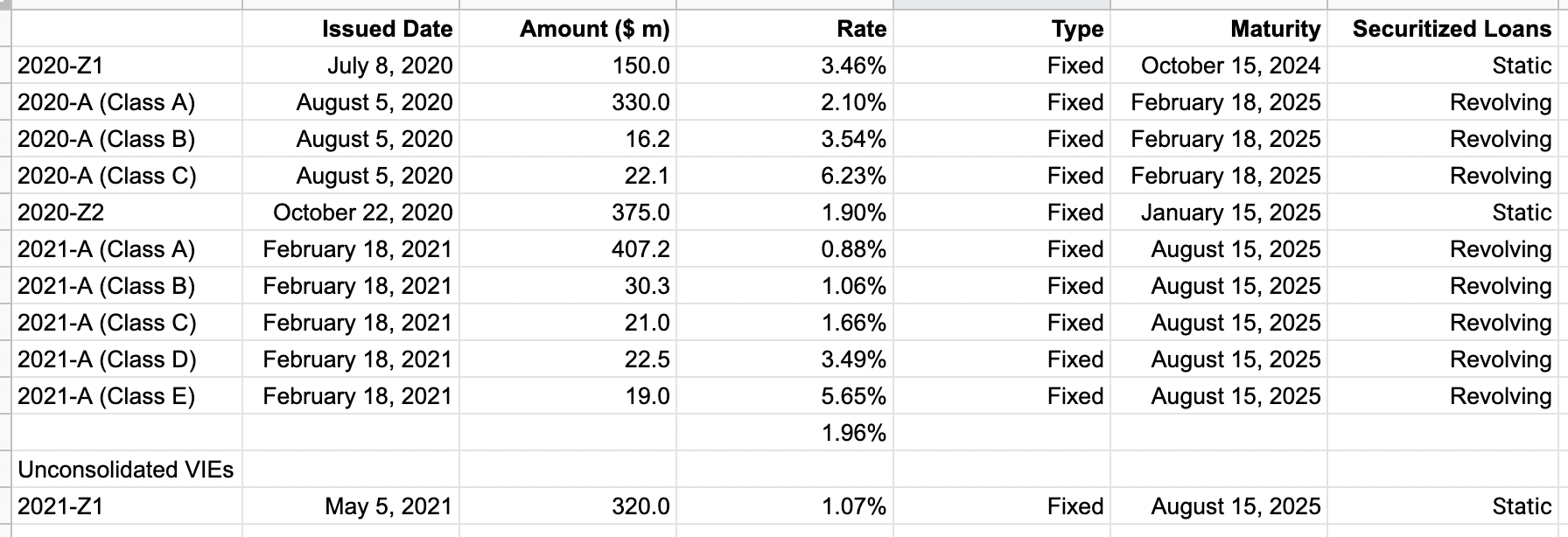

Notes issued by securitization trusts have ~4y maturity as per the table below.

2020-A (Class A) was issued in August 2020 at 2.10% while 2021-A (Class A) was issued ~6 months later at 0.88%. That is, Affirm is able to reduce its funding cost by more than 1pct in 6 months.

Affirm has off balance sheet exposures through the Unconsolidated VIEs, which it explains below.

For the year ended June 30, 2021, Affirm Asset Securitization Trust 2021-Z1 (“2021-Z1”) was an unconsolidated VIE. As the servicer of the loans held within the trust, we have the power to direct the activities that are most significant to the performance of the VIE. However, we did not retain significant economic exposure through our variable interests and therefore we determined that we are not the primary beneficiary as of June 30, 2021.

At closing, we retained 5% of the 2021-Z1 notes and 86.9% of the residual certificates issued by the 2021-Z1 trust. The third-party loan contributor received 13.1% of the residual certificates at closing. On May 17, 2021, we sold a majority of the residual certificates retained at closing, comprising 81.9% of the par value, to five third-party investors. Subsequent to this sale, we retained only a 5% vertical interest in the 2021-Z1 trust via our ownership of 5% par amount of the 2021-Z1 notes and 5% par amount of the residual interests. We were required to retain these interests for compliance with U.S. risk retention rules.

Cross River Bank

As per Affirm's Form S-1 extract below, Cross River Bank is a significant banking partner.

Once approved and the consumer selects their preferred repayment option, the substantial majority of loans are funded and issued by Cross River Bank, one of our originating bank partners.

Our agreement with one of our originating bank partners, Cross River Bank, which has originated the substantial majority of loans facilitated through our platform to date, is non-exclusive, short-term in duration and subject to termination by Cross River Bank upon the occurrence of certain events, including our failure to comply with applicable regulatory requirements.

The Cross River Bank loan program agreements have initial three-year terms ending in November 2023, which automatically renew twice for successive one-year terms unless either party provides notice of non-renewal to the other party at least 90 days prior to the end of any such term.

While we recently entered into an origination program agreement with Celtic Bank, a Utah state-chartered industrial bank whose deposits are insured by the FDIC, Celtic Bank has only originated a de minimis amount of loans facilitated through our platform which are not reflected in our financial results for the periods presented in this prospectus, and Celtic Bank is not yet able, and may never be able, to provide meaningful originating bank partner services in the event our relationship with Cross River Bank were adversely impacted.

Peloton

As per the extract from Affirm's Q1'22 Form 10-Q and Earnings

Supplement below, Peloton is accounting for a lesser % of total revenue.

For the three months ended September 30, 2021 and 2020 approximately 10% and 30% of total revenue, respectively, was driven by one merchant partner, Peloton.