Big Short (Stocks to Sell) - LMND stock analysis (November 2021 Update)

(November 2021 Update) Lemonade's unit economics barely breaks even.

Could Insurtech also be relying on float?

Unlike a typical insurance operator, Warren Buffet as a business investor, sees insurers' investment income as the key to the business and underwriting income as secondary or in fact, a cost.

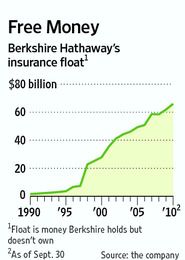

"Insurers receive premiums upfront and pay claims later. In extreme cases, such as those arising from certain workers’ compensation accidents, payments can stretch over decades. This collect-now, pay-later model leaves us holding large sums – money we call “float” – that will eventually go to others. Meanwhile, we get to invest this float for Berkshire’s benefit. Though individual policies and claims come and go, the amount of float we hold remains remarkably stable in relation to premium volume. Consequently, as our business grows, so does our float.

If premiums exceed the total of expenses and eventual losses, we register an underwriting profit that adds to the investment income produced from the float. This combination allows us to enjoy the use of free money – and, better yet, get paid for holding it. Alas, the hope of this happy result attracts intense competition, so vigorous in most years as to cause the P/C industry as a whole to operate at a significant underwriting loss.

This loss, in effect, is what the industry pays to hold its float. Usually this cost is fairly low, but in some catastrophe-ridden years the cost from underwriting losses more than eats up the income derived from use of float."

extract from Berkshire Hathaway's 2009 letter to shareholders

Unit economics calculations using information based on Lemonade's prospectus below indicates barely breakeven.

"The low cost of capital for reinsurance companies creates an opportunity to share premiums and maintain our gross margins while dramatically reducing our capital requirements through a structure called "proportional reinsurance" (also known as "quota share reinsurance"). Beginning on July 1, 2020, we will have proportional reinsurance protecting 75% of our business (the "Proportional Reinsurance Contracts"). Under the Proportional Reinsurance Contracts, which spans all of our products and geographies, we transfer, or "cede," 75% of our premiums to our reinsurers. In exchange, these reinsurers pay us a "ceding commission" of 25% for every dollar ceded, in addition to funding all of the corresponding claims, i.e. 75% of all our claims. This arrangement mirrors our fixed fee, and hence shields our gross margin, from the volatility of claims, while boosting our capital efficiency dramatically.

We currently spend $1 in marketing to generate more than $2 of in force premium ("IFP"), which has been approximately equal to annualized GWP."

The unit economics is not very sensitive to the Gross Loss Ratio given the use of reinsurance. In fact, the unit economics for the reinsurer is also barely breakeven, leaving implications for the pricing of the ceding commission.

Therefore, this leaves us thinking that the profit model created is not extremely profitable for participants in the ecosystem currently.

That said, there are at least a couple of ways that profitability can improve.

One, higher spending from the customers or effectively more return from Lemonade's marketing spend.

Though Lemonade's explanation below appears to suggest this will likely take time and there is also some question on the stickiness of the customers as they purchase additional products.

Unlike many other products or services, the need for insurance grows in line with the wealth and age of its customers, as accumulated assets and growing responsibilities naturally translate into higher insurance spend. One illustration of this trend is how, on average, our renters insurance customers steadily increase spending on their renters insurance policy with us over time. Customers who bought Lemonade renters insurance three years ago spend 56% more on their renters insurance now than when they first joined. This germination can be observed across our book of business, spurred by the accumulation of wealth people typically enjoy during their working years. According to the Federal Reserve, the median net worth of an adult American under the age of 35 is about $11,000. By their 40s and 50s, their net worth has grown by 10 to 15 times, and that growth peaks at 25 times after the age of 75.

This propensity towards asset accumulation is reflected in our numbers. As of March 31, 2020, the median age of a Lemonade customer with an entry level $60 a year policy — corresponding to $10,000 of possessions — is about 30 years old. This climbs towards 40 for customers with policies of about $600, and among the handful of customers paying approximately $6,000 a year, the median age is about 50.

Further demonstration of this progression is found in a phenomenon we call "graduation," which is when a customer upgrades their policy from a Lemonade renters policy to a Lemonade condo or homeowner policy. As of March 31, 2020, we had 12,445 customers of condo insurance policies, 10% of whom had graduated with us from a renters policy, a percentage that has grown steadily over the life of the company.

Second, investment income.

According to its Q3'21 Shareholder Letter, Lemonade has about $1.1b in investments ($0.8b) and cash($0.3b).

Assuming the investments are mostly at the 1y Treasury yield at around 0.2% and cash at 0.1%, this generates an additional $2m so the contribution to the bottomline is not very significant until Lemonade's in-force premium hence its reserves build up over time.

Source: https://www.wsj.com/articles/SB10001424052748704520504576162782244276342

The Unit Economics spreadsheet is available in our Members section.