IPO Stocks to Buy Now - ZipRecruiter (ZIP stock) analysis (November 2021 Update)

(November 2021 Update) ZipRecruiter's potential value can be simply derived from its Quarterly Paid Employers and Revenue per Paid Employer.

ZipRecruiter's potential value is basically driven by two factors (the Key Operating Metrics as outlined by management):

A) Quarterly Paid Employers

This can be deduced by using the number of US small businesses and a couple of assumptions on 1) the percentage willing to pay $400/month for recruitment and 2) ZipRecruiter's Market Share.

Specifically though, we would be interested in learning more from management about

1) the average paying duration of a Paid Employer. That is, is there a high tendency for employers to stop paying after the candidates are hired?

2) the dynamics of the reported Quarterly Paid Employers, how many are new, retained and left. That is, the gross and net figures.

3) how many employers have been on the platform in total since inception? That is, to work out the total penetration thus far.

4) how many have paid, stopped and paying again?

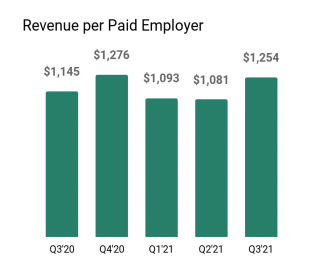

B) Revenue per Paid Employer

Using (A) and (B), a margin and a discount factor, we can derive the potential value of ZipRecruiter.

The spreadsheet is available in our Members' section. Email [email protected] for details.