M&A Stocks to Buy Now - is Peloton (PTON stock) a target for Apple, Amazon, Nike? (February 2022 Update)

(February 2022 Update) Peloton still has $1.6b in cash so no immediate concerns to be taken over though Nike maybe a strategic fit.

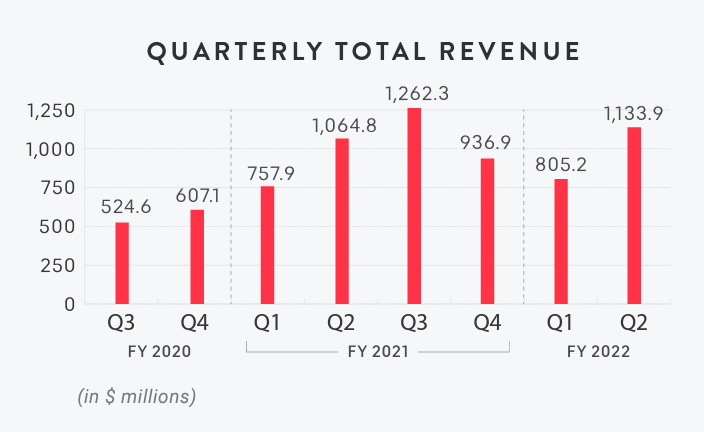

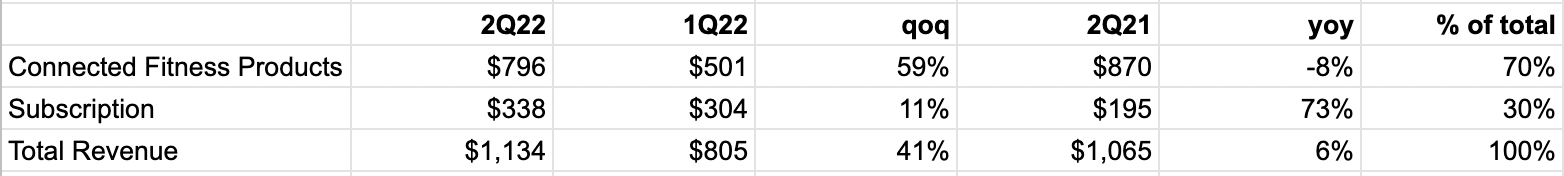

As per Peloton's 2Q22 Shareholder Letter, total revenue is back on a rising trend.

Specifically, revenue is derived from products (70% of total revenue) and subscription (30%).

On a sequential quarter-on-quarter (qoq) basis, products has grown strongly by 59% while subscription 11%. However, the year-on-year (yoy) gives the full picture, products is actually not growing while subscription has seen strong growth.

This seems to suggest that slow down in products has not been affecting subscription revenue at least in the short term.

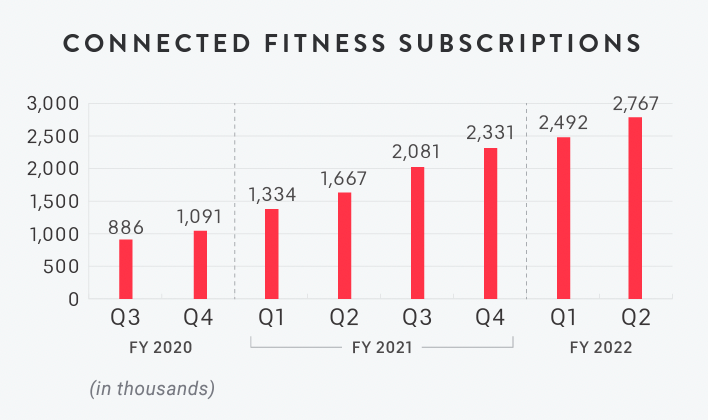

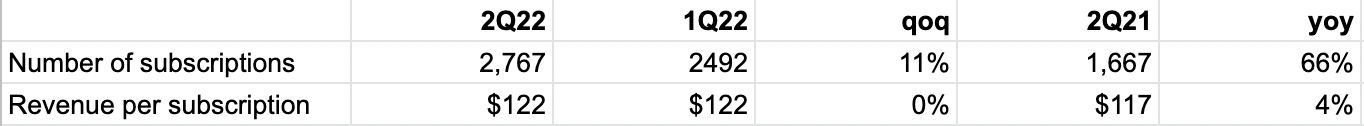

In fact, the number of subscription has continued to rise...

...though revenue per subscription is flattish.

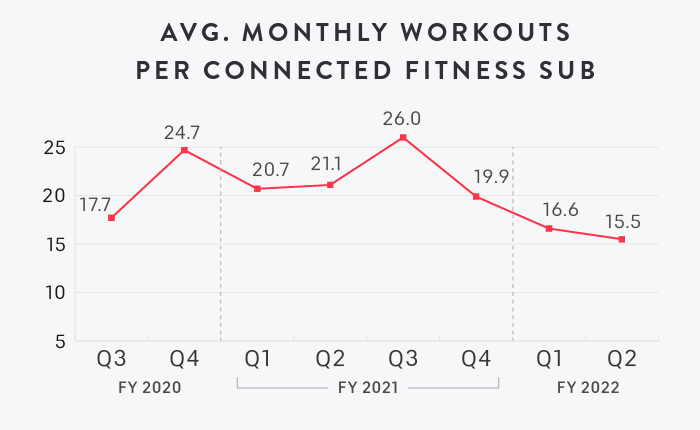

The continued falling monthly workouts per subscription then appears to have minimal impact on revenue per subscription.

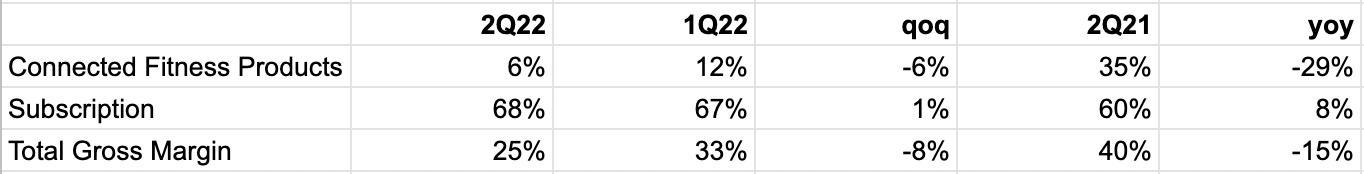

From a profitability standpoint, gross margin of products has fallen substantially to 6% while subscription margin rose moderately.

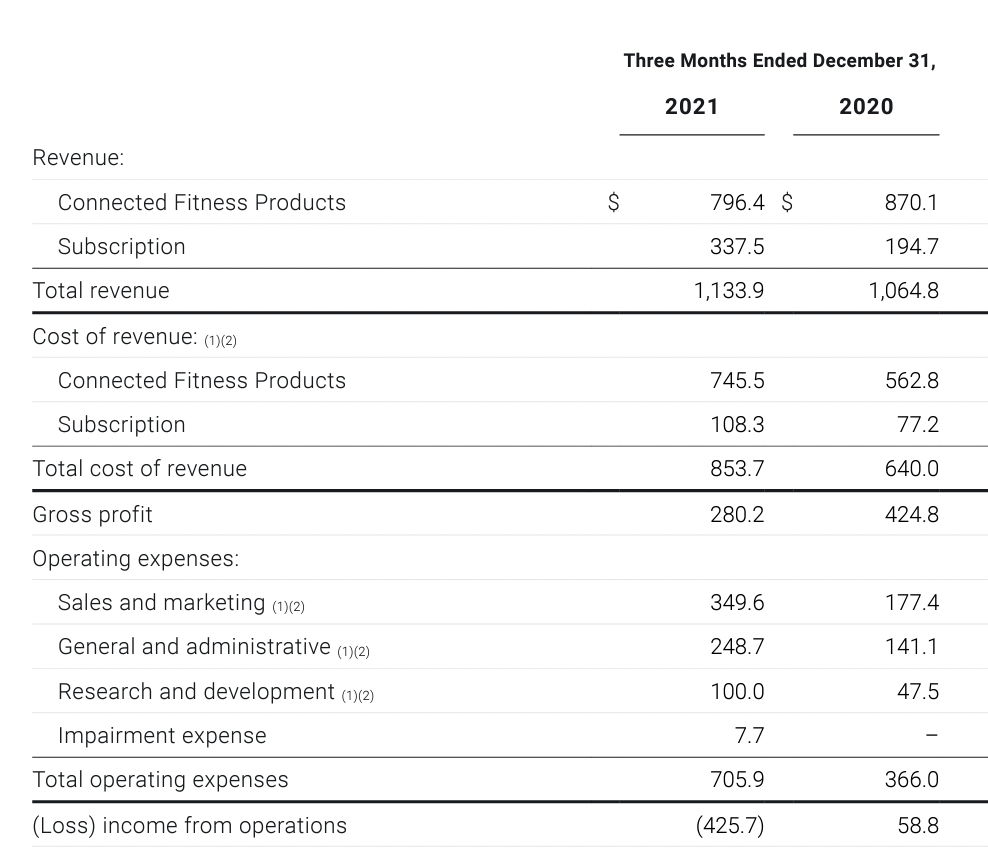

Despite similar total revenue compared to a year ago, the much lower gross margin combined with Peloton spending substantially more in all areas (sales & marketing, general admin and R&D) has led to an operating loss.

This has caused management to react as below...

When fully implemented, we expect our restructuring initiatives to yield at least $800 million in annual run-rate cost savings across operating expense efficiencies and material improvements in our Connected Fitness gross margin. The COGS savings will primarily come from efficiencies in procurement, manufacturing, and logistics. Operating expense savings will come from a wide range of initiatives, including corporate workforce reductions, marketing spend efficiencies, changes to our real estate strategy, optimized software costs, and more tightly controlled outside services spend.

...leading to improved guidances...

FY 2022 Q3 guidance:

–Gross profit margin of approximately 23%

–$(140) million to $(125) million Adjusted EBITDA

Updated Full FY 2022 guidance:

–Gross profit margin of approximately 28%

–$(675) million to $(625) million Adjusted EBITDA

The question then is are these really efficiencies gains or will cutting costs lead to slower growth?

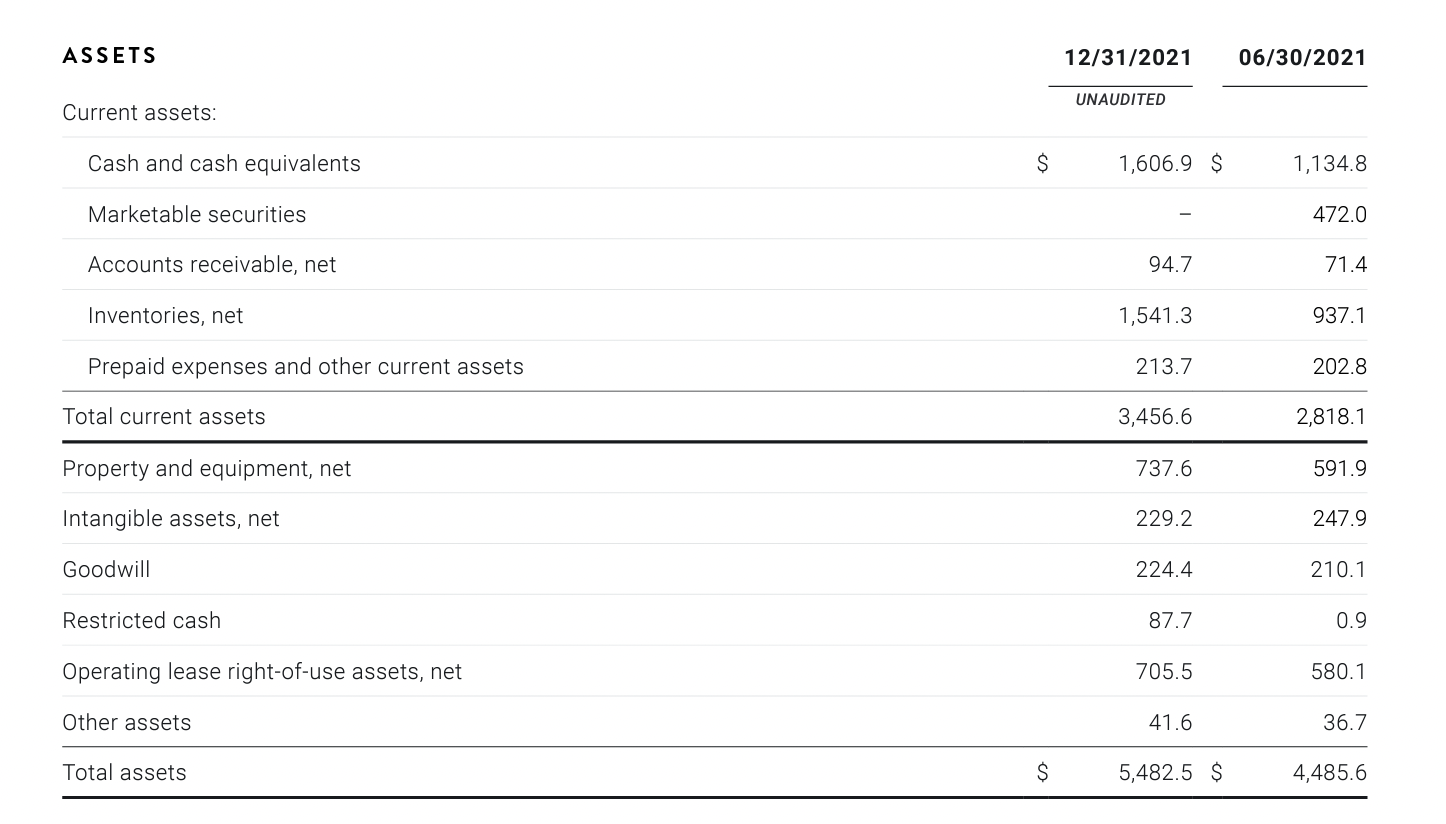

Meanwhile, Peloton still has $1.6b in cash and $1.5b in inventories that can be converted to cash over time so there is no immediate concerns or need to be taken over.

Management has also dismissed the company will be sold.

Nevertheless, we will look at some of the potential M&A suitors - Apple, Amazon and Nike to see where Peloton might fit into their existing businesses, how much Peloton would account for total revenue and their cash on hand (capability in acquiring by cash).

Peloton is currently valued at $12b with a gross profit of around $1b hence 12x multiple.

Apple (Market Cap: $2,750b)

1) where Peloton fits

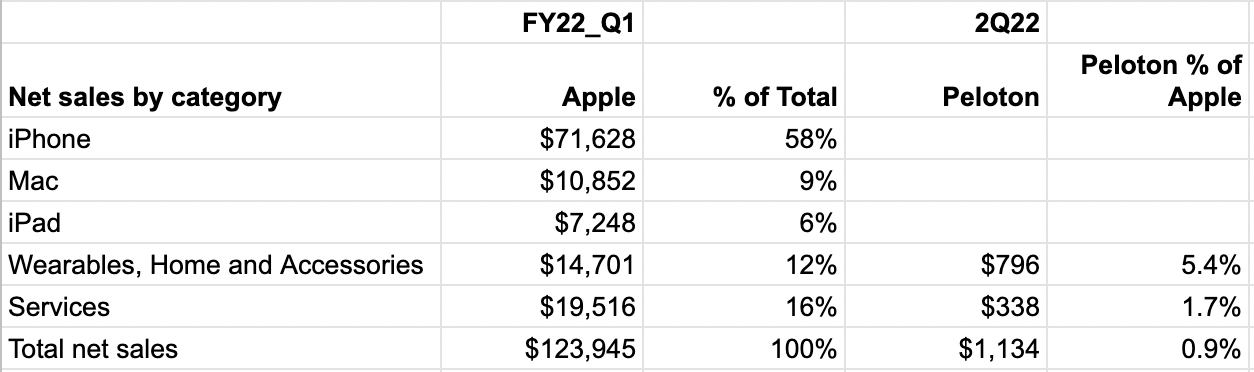

As per the table below, Peloton Products should fit into the Wearables, Home and Accessories division of Apple (with Peloton accounting for 5.4%) and Peloton Subscription into Services (1.7%).

2) Peloton would account for near 1% of Apple's net sales.

3) Cash on hand

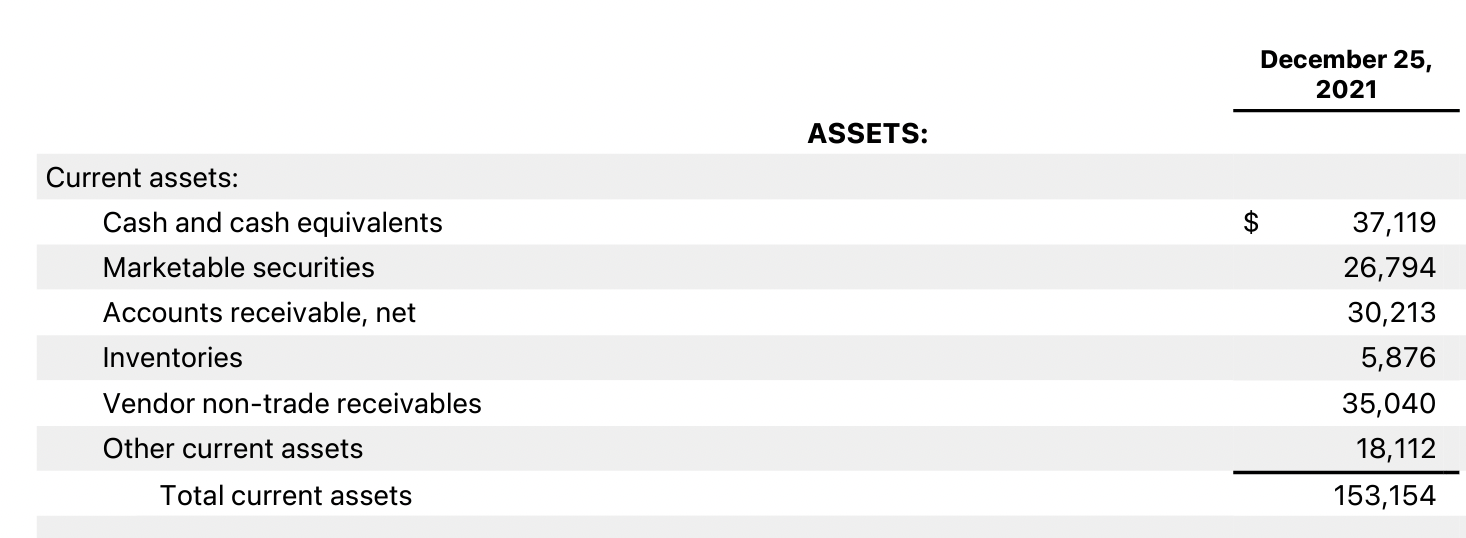

Apple has $37b in cash...

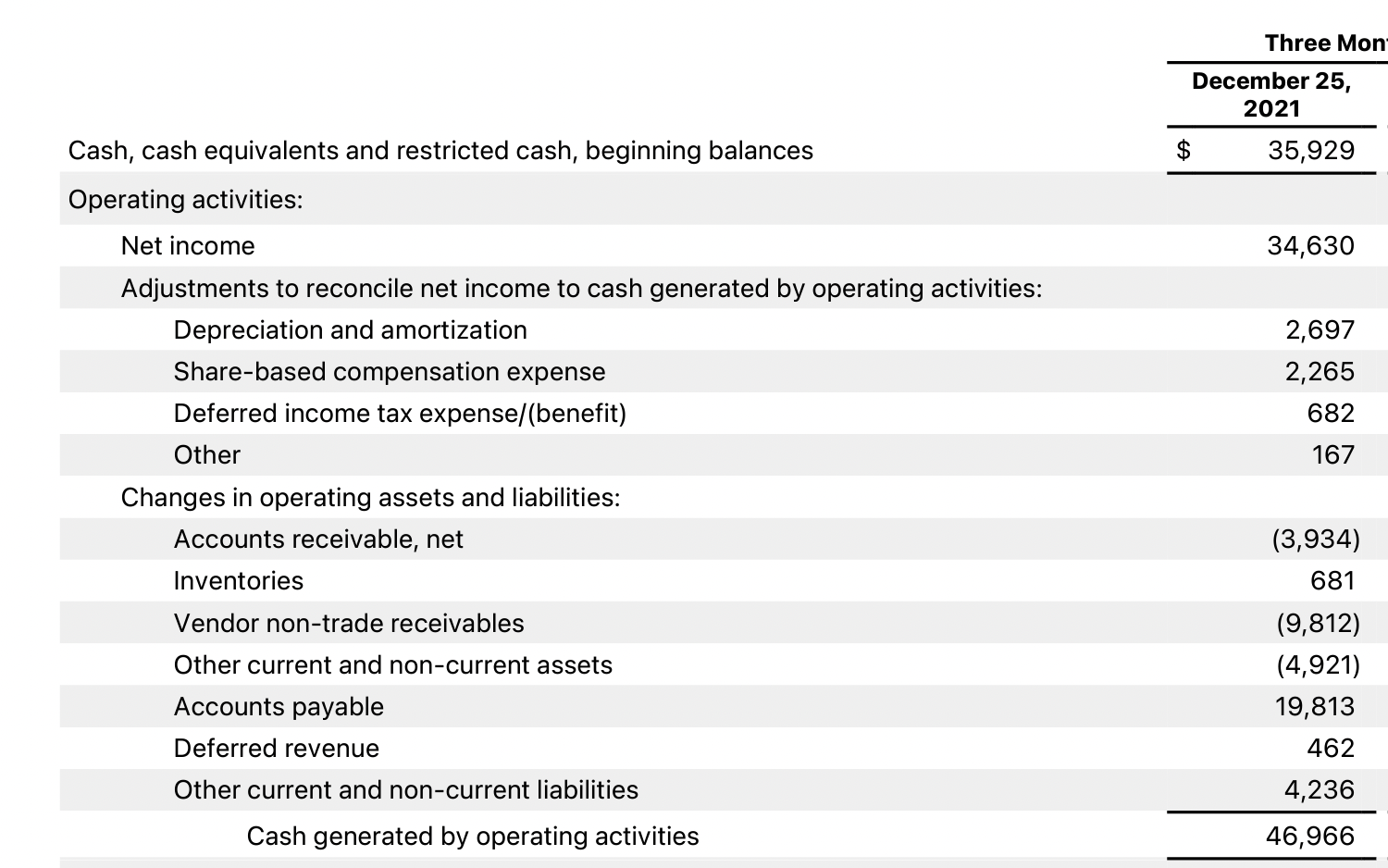

...and generates $47b in cash from operations per quarter so have plenty of capacity to complete this acquisition.

Amazon (Market Cap: $1,560b)

1) where Peloton fits

While Amazon provides highlights by Shopping, Entertainment, Devices and Services and Amazon Web Services (AWS), there are no financial disclosures. Peloton though should fit into the Devices and Services division.

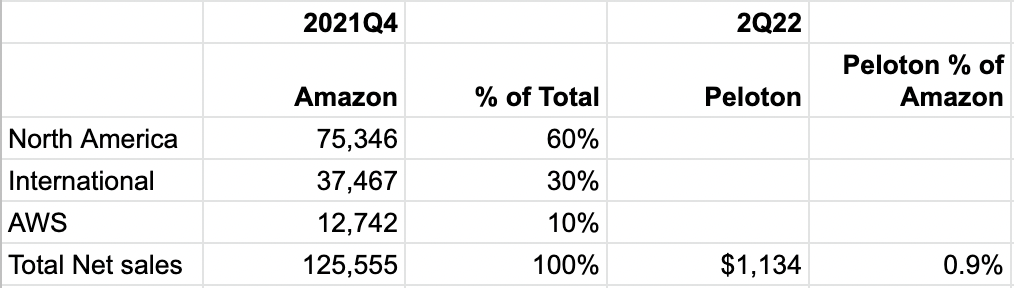

Financial disclosures by segment is only available as per the table below.

2) Peloton would account for near 1% of Amazon's net sales.

3) Cash on hand

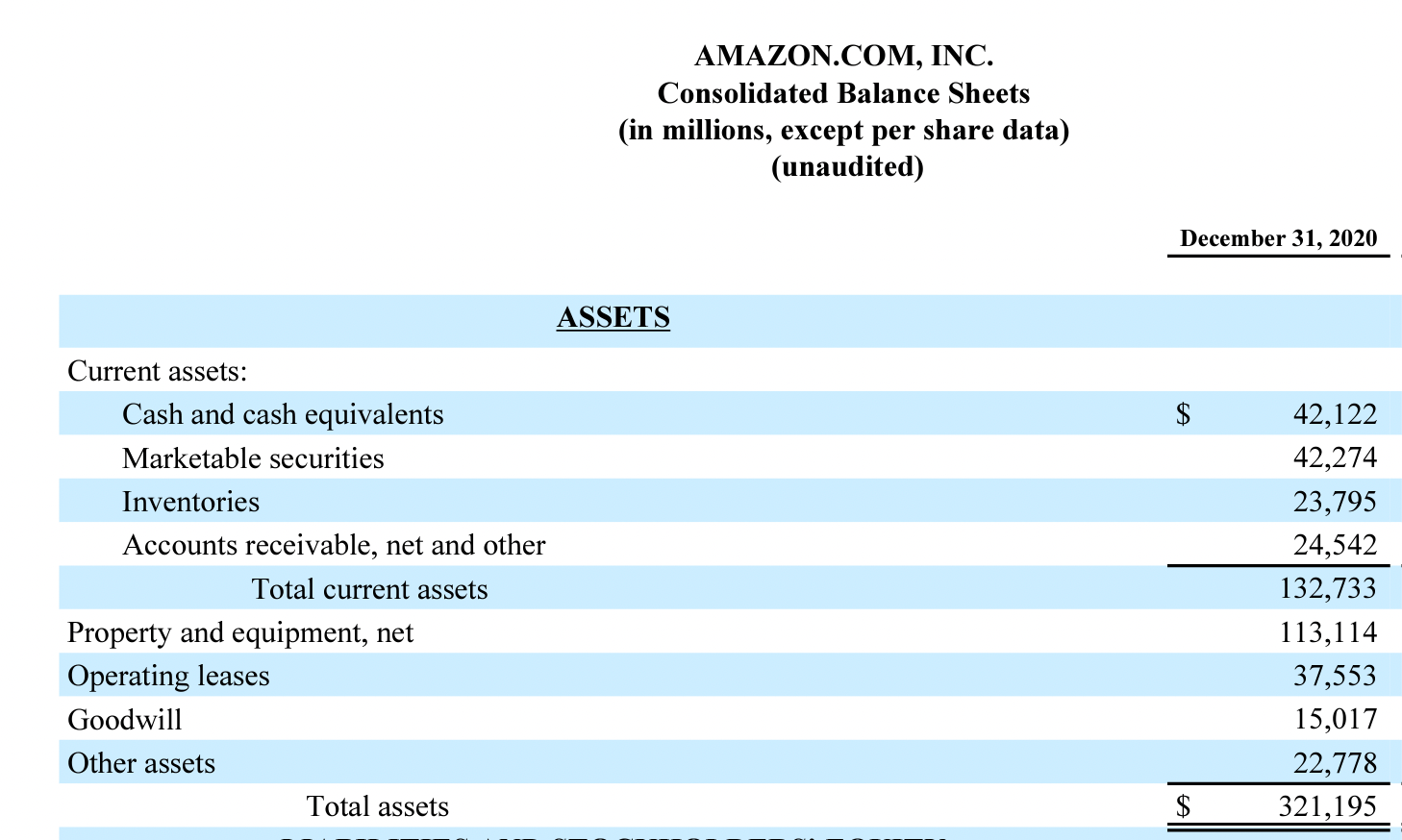

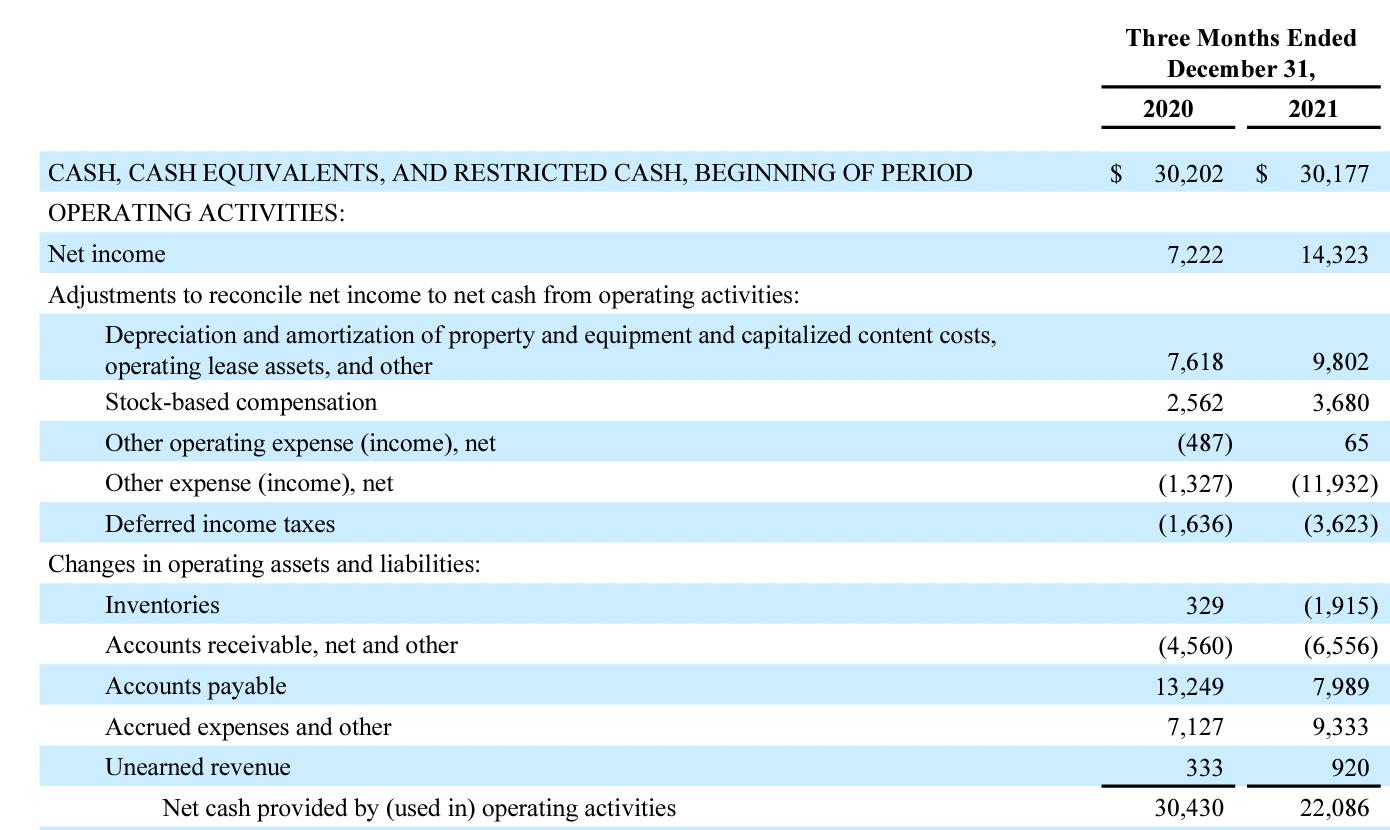

Amazon has $42b in cash...

...and generates $30b in cash from operations per quarter so have plenty of capacity to complete this acquisition.

Nike (Market Cap: $222b)

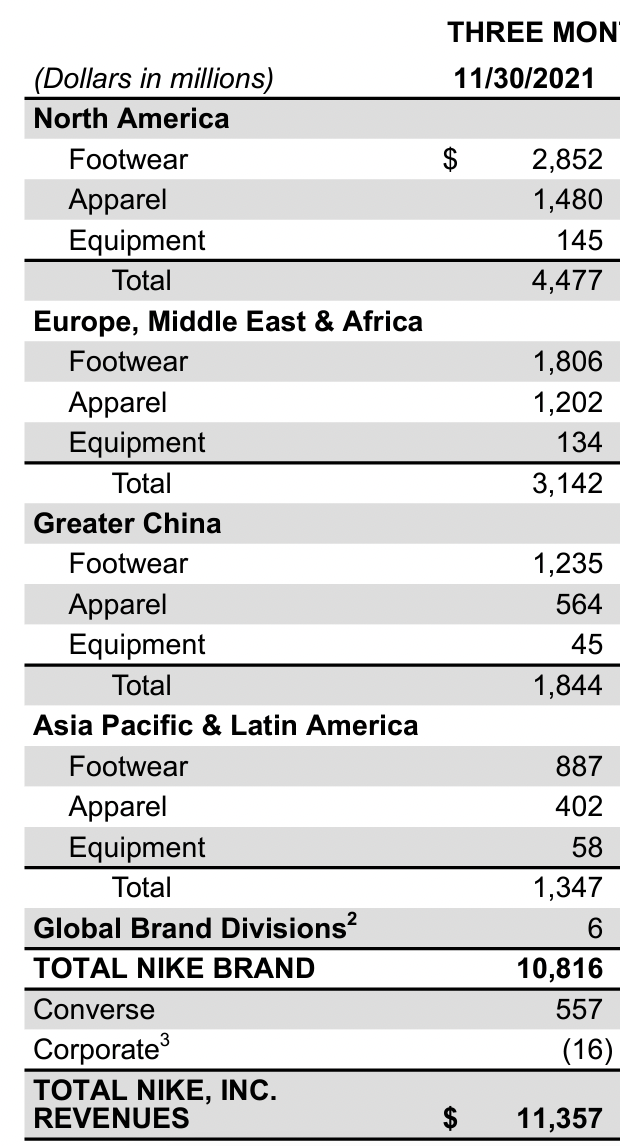

1) where Peloton fits

Peloton fits into North America Equipment and would be a substantial part of the business.

2) Peloton would account for ~10% of Nike's total revenues.

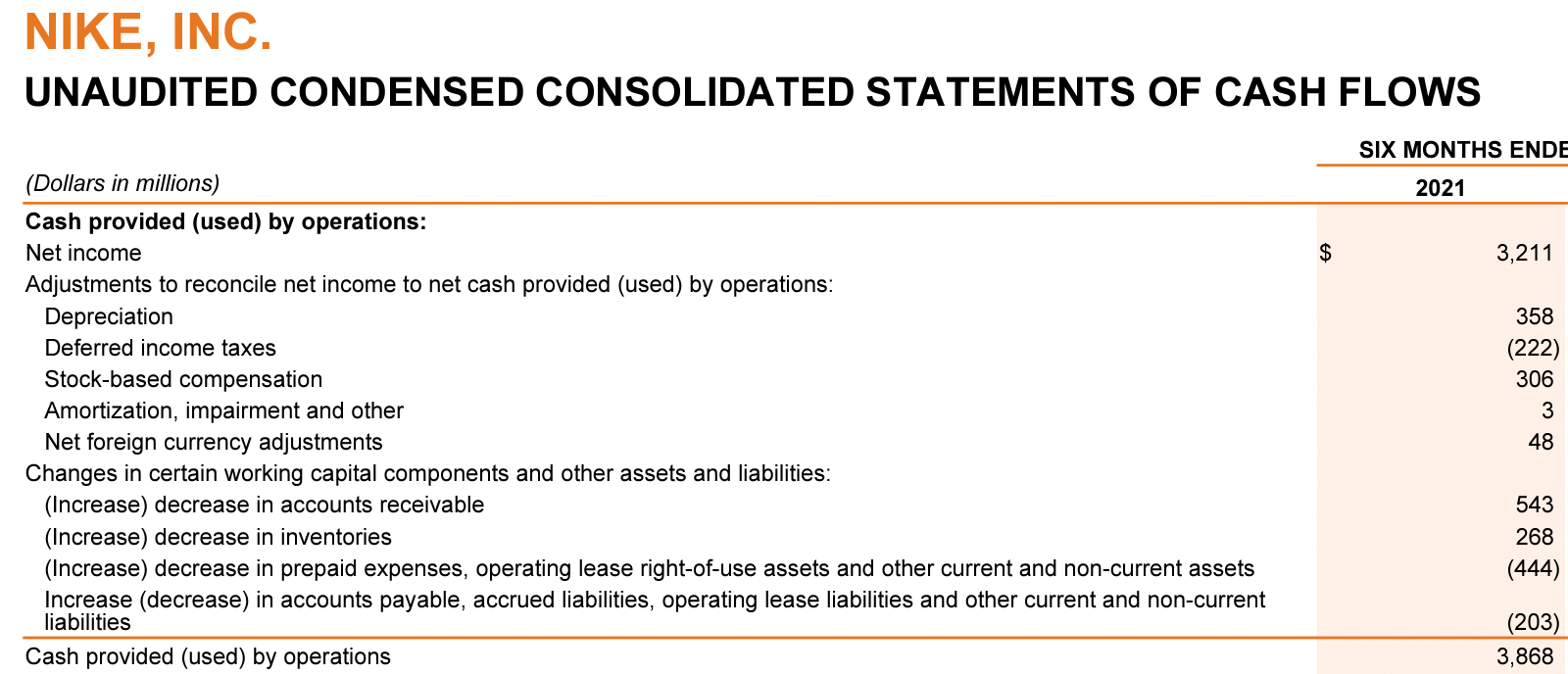

3) Cash on hand

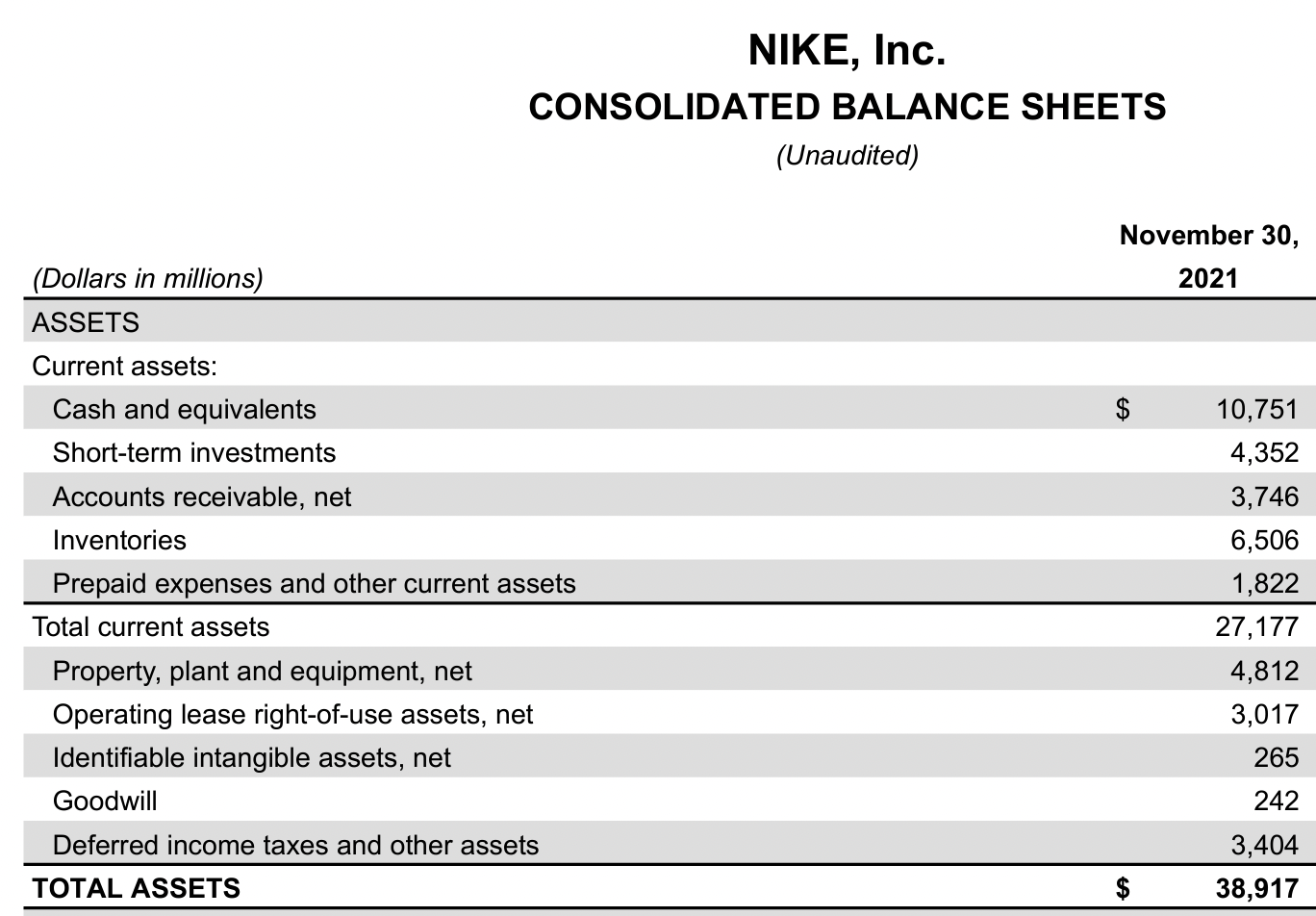

Nike has ~$11b in cash...

...and generates ~$4b in cash from operations per quarter so has capacity to complete this acquisition.