Stocks to Buy Now from Chamath Palihapitiya's portfolio -SoFi stock analysis (February 2022 Update)

(February 2022 Update) Using its technology platform as a medium, SoFi consolidates consumers' financial products and effectively replaces incremental marketing cost.

The story of the Three Kingdoms begins with

The world under heaven, after a long period of division, tends to unite; after a long period of union, tends to divide. This has been so since antiquity.

SoFi unites financial products into a single world, which replaces incremental marketing cost. In personal finance, it appears some consumers are entering in a cycle where they are looking to unite their financial products into a single platform hence creating the demand for a technology like SoFi.

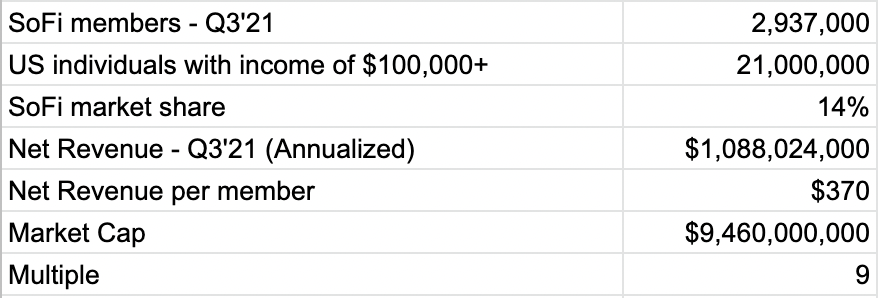

The value or market cap of SoFi can be broken down as the multiple of

A) the total number of accounts

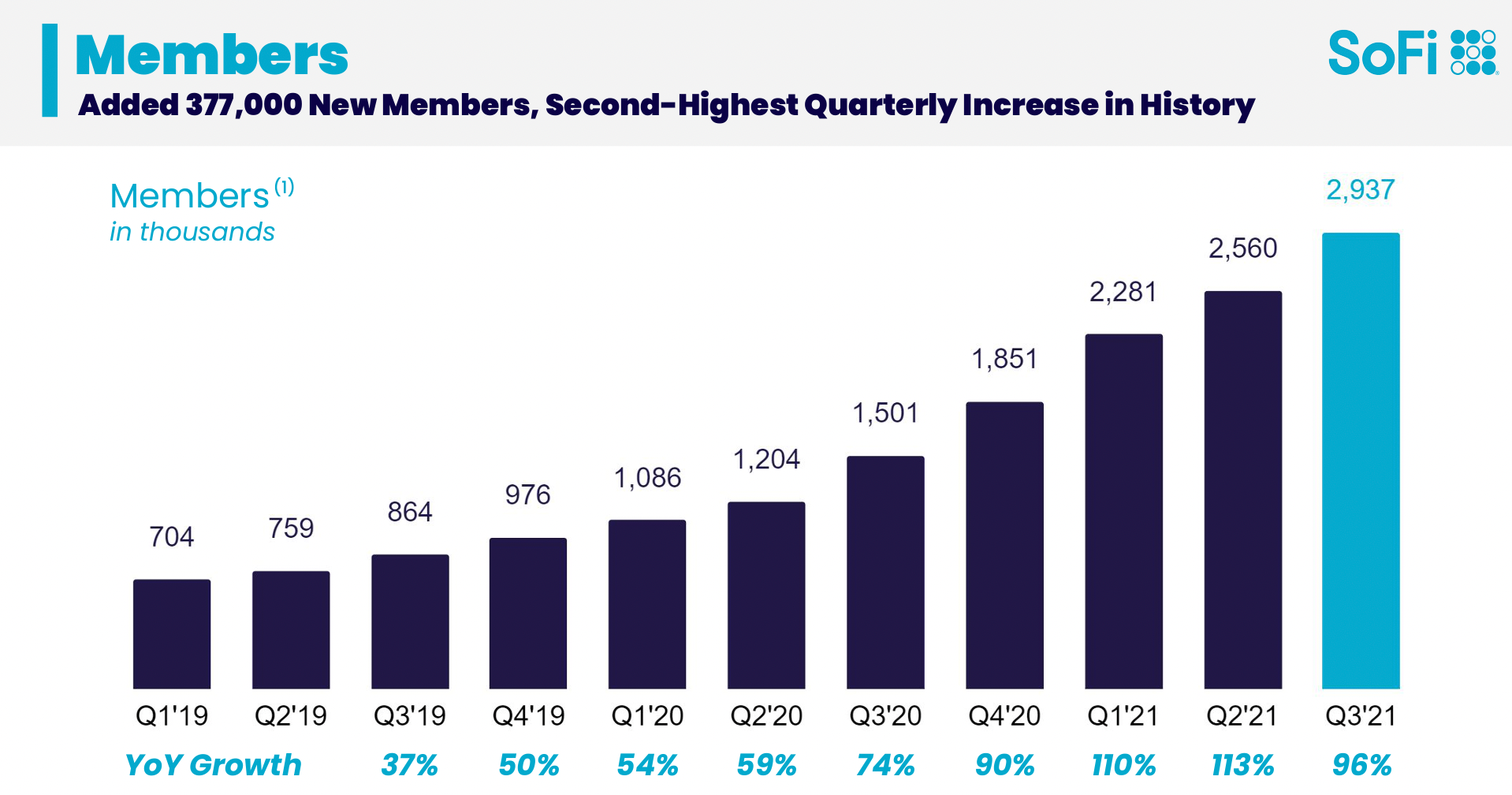

As per SoFi's Q3'21 Earnings Presentation, it has ~2.9m members. Encouragingly, it is also growing at a growing rate, ie, the yoy growth at the bottom of the below chart is on an up trend.

According to SoFi, it is "targeting high earners not well served (HENWS)

ages 22+ predominantly earning $100,000+".

About 21m US individuals have income of $100,000+, which implies SoFi has a market penetration of 14% currently.

B) average number of financial products per individual

The number of products available on SoFi continues to rise.

While this is important as it means members have more choices and likely to acquire more products, the more important metric is the average number of products per member, which SoFi does not disclose.

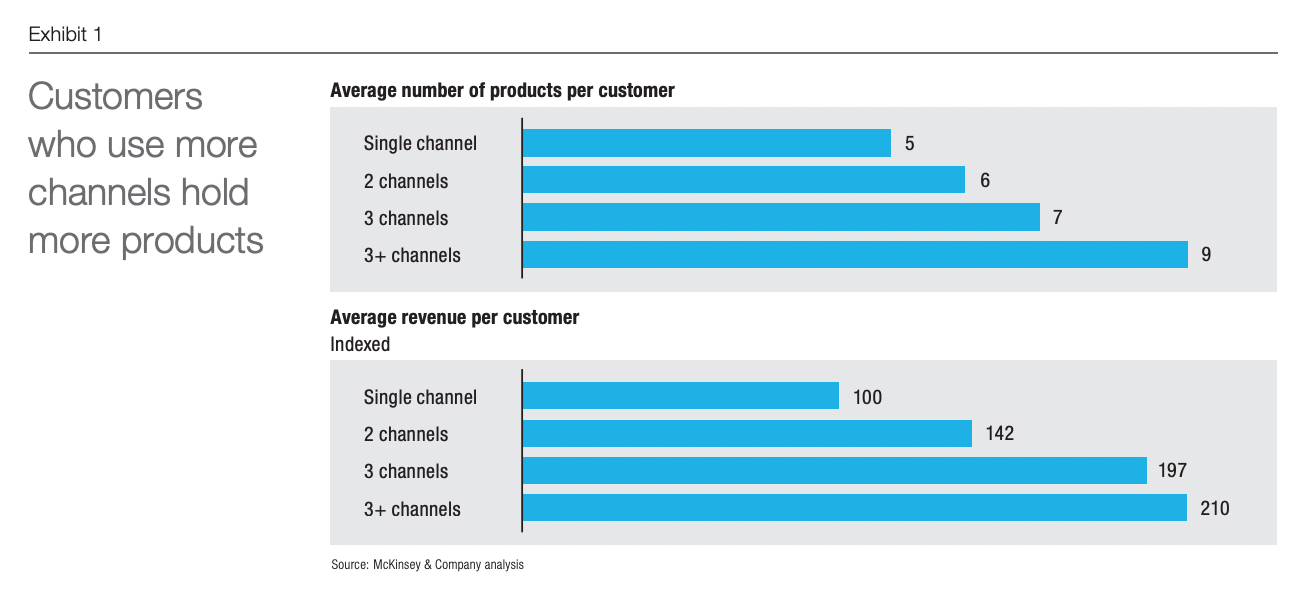

The following chart is from a McKinsey report.

This implies a member could purchase up to 9 products on paper.

C) Average profit per product

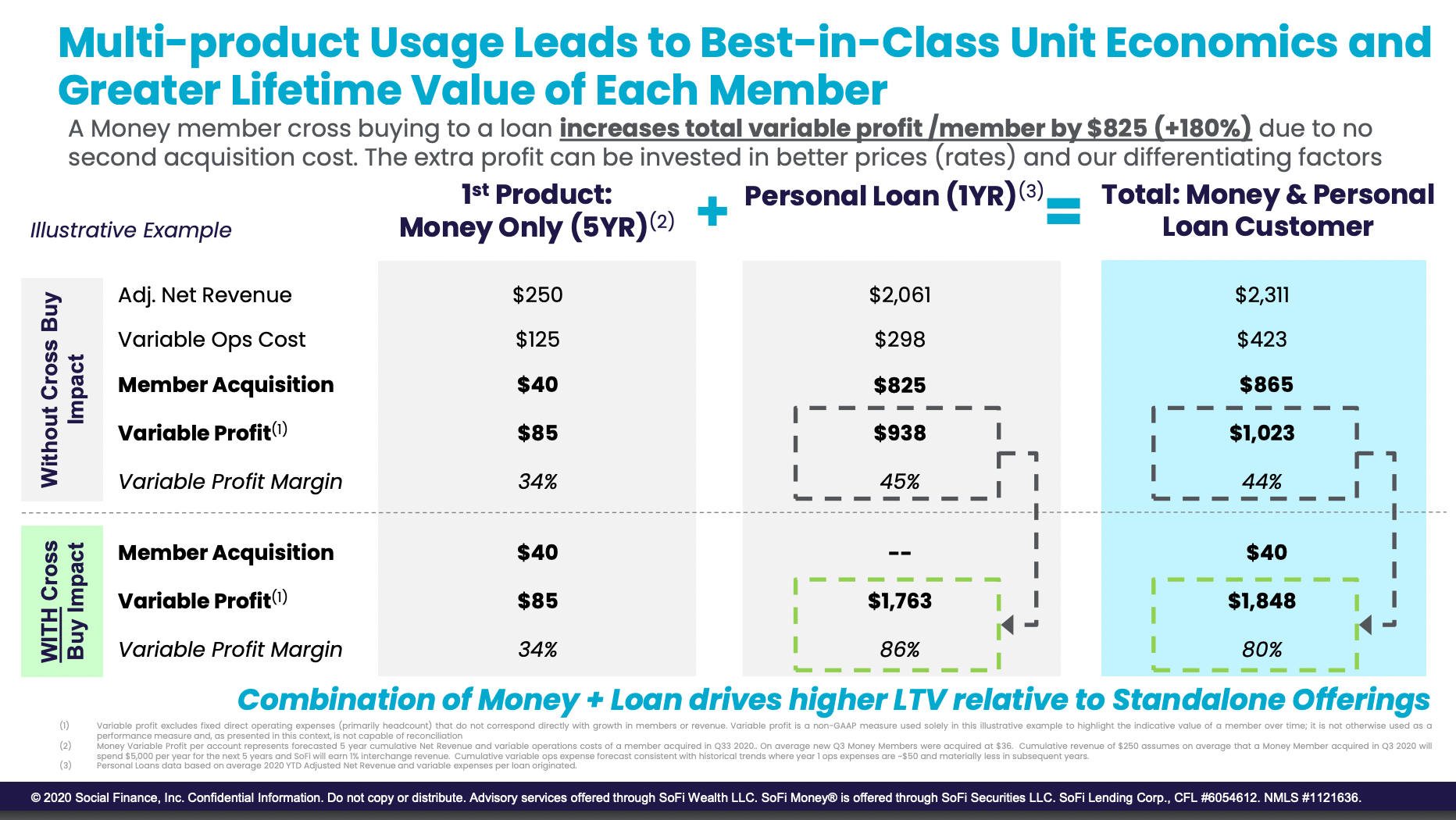

According to SoFi's Investor Presentation – January 2021,

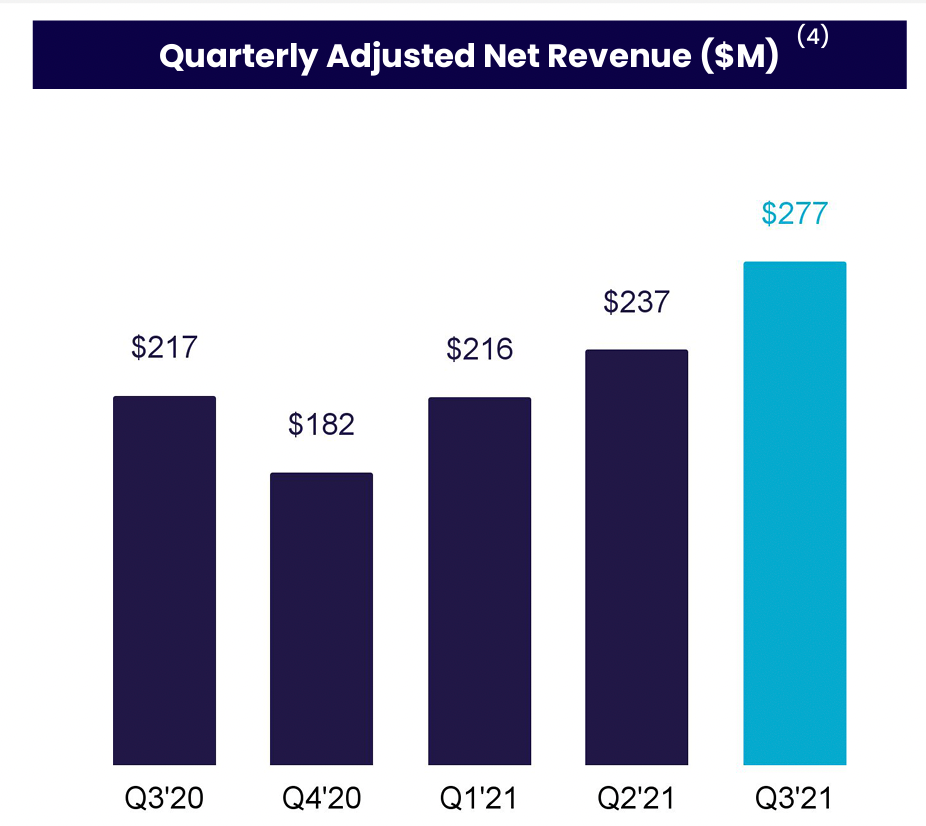

Since we cannot further breakdown into average number of products per member and average profit per product, we can only more crudely look at net revenue growth at 28% yoy. This compares with members growing at 96% yoy implying net revenue per member has actually fallen.

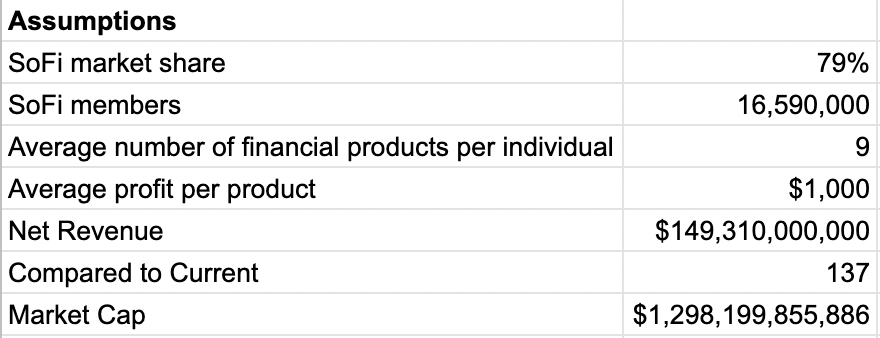

SoFi can be worth >$1t if executed well

SoFi currently has a market cap of ~$9.5b, which is ~9x its net revenue.

If we make certain assumptions on SoFi, it could potentially be a trillion dollar business:

A) total number of members of 16.6m or equivalent to 79% market share, similar to Facebook;

B) average number of products per member is 9, similar to the above McKinsey report;

C) Average profit per product is $1000, similar to SoFi's presentation above.

Multiplying A, B and C yields $149b or more than 100x current net revenue then applying the above 9x multiple will be more than $1t in market cap.

We are clearly NOT saying this will necessarily happen but that is the potential and is therefore an opportunity worth pursuing from a business perspective.

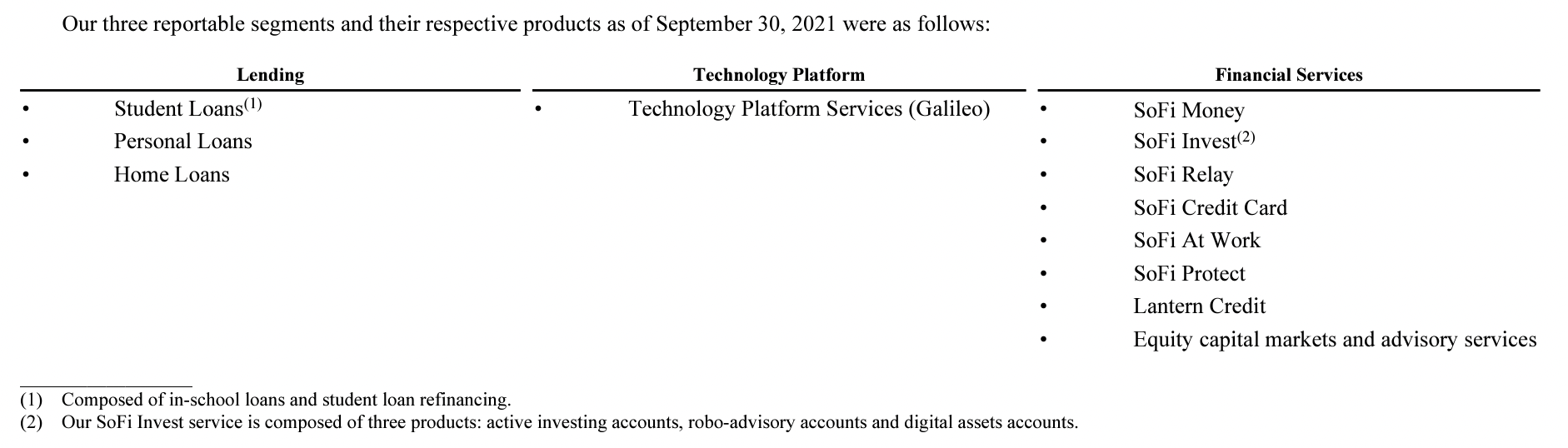

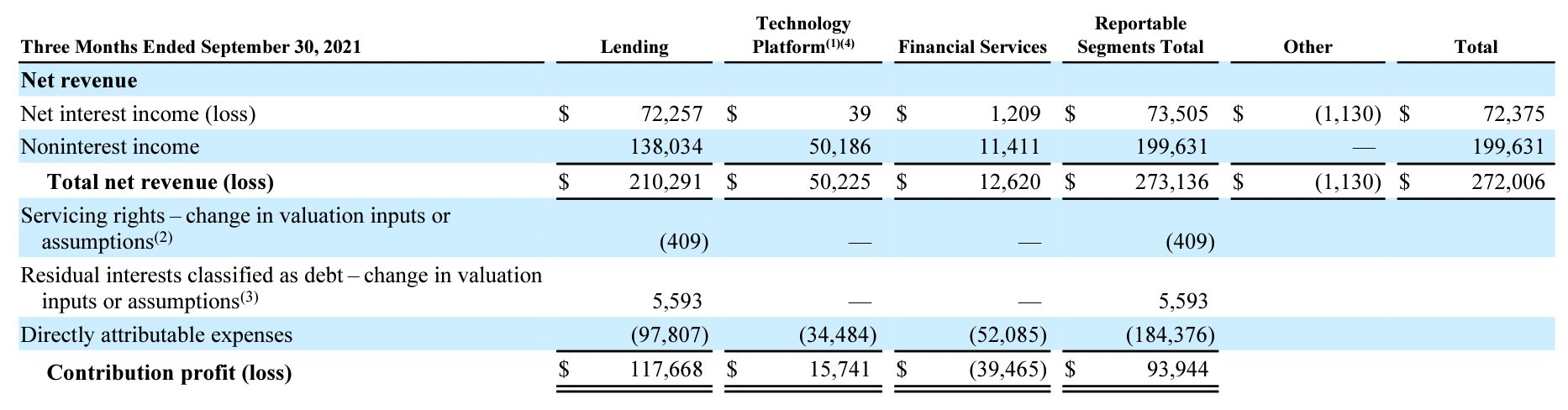

SoFi's business is divided into 3 segments as per its Q3 2021 10-Q below:

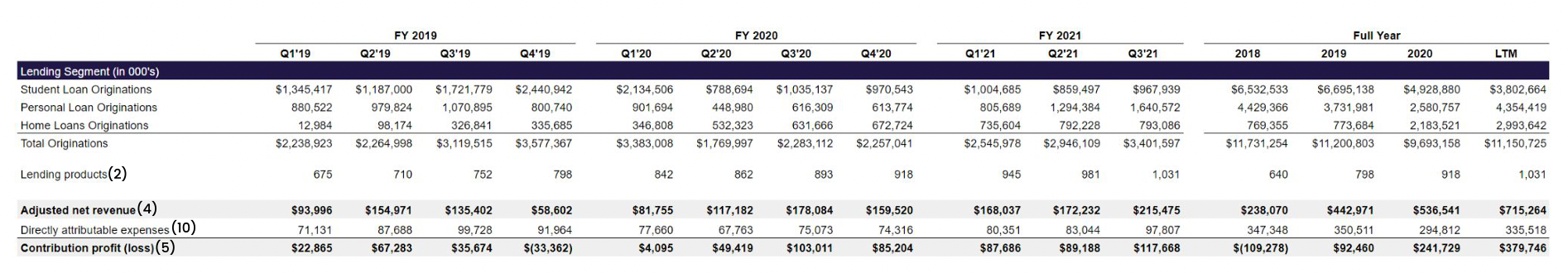

Lending accounts for 77% of total net revenue. Within this, 26% is net interest income or effectively an interest spread business with carrying assets and liabilities on the balance sheet, which is further explained below.

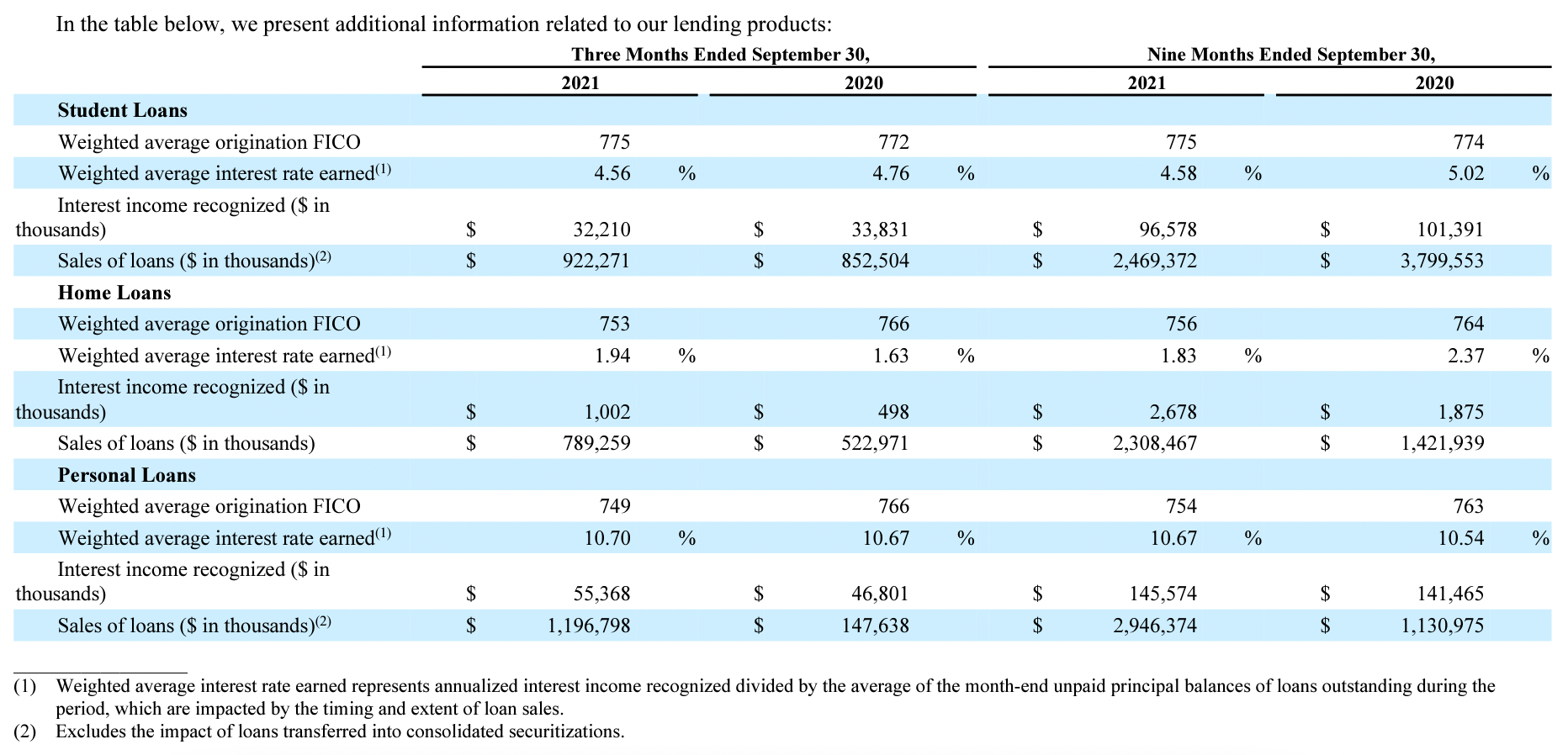

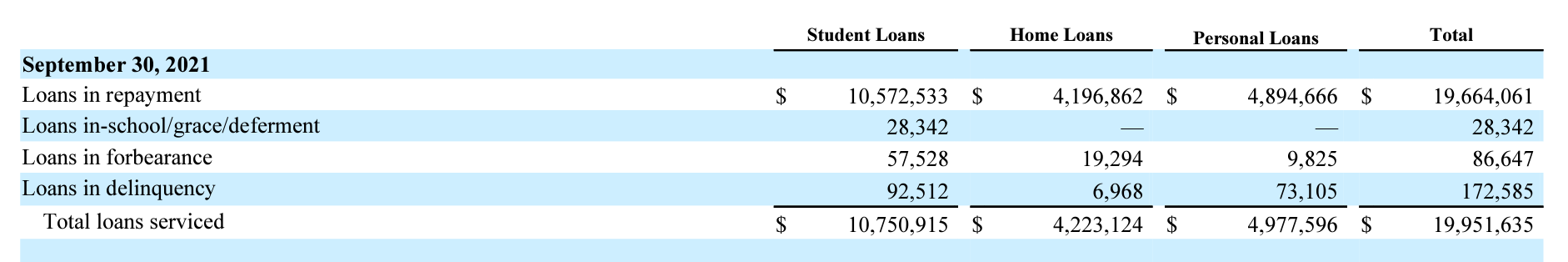

The lending segment comprises of 3 types of loans, student, personal and home with student been replaced by personal and home in the last couple of years.

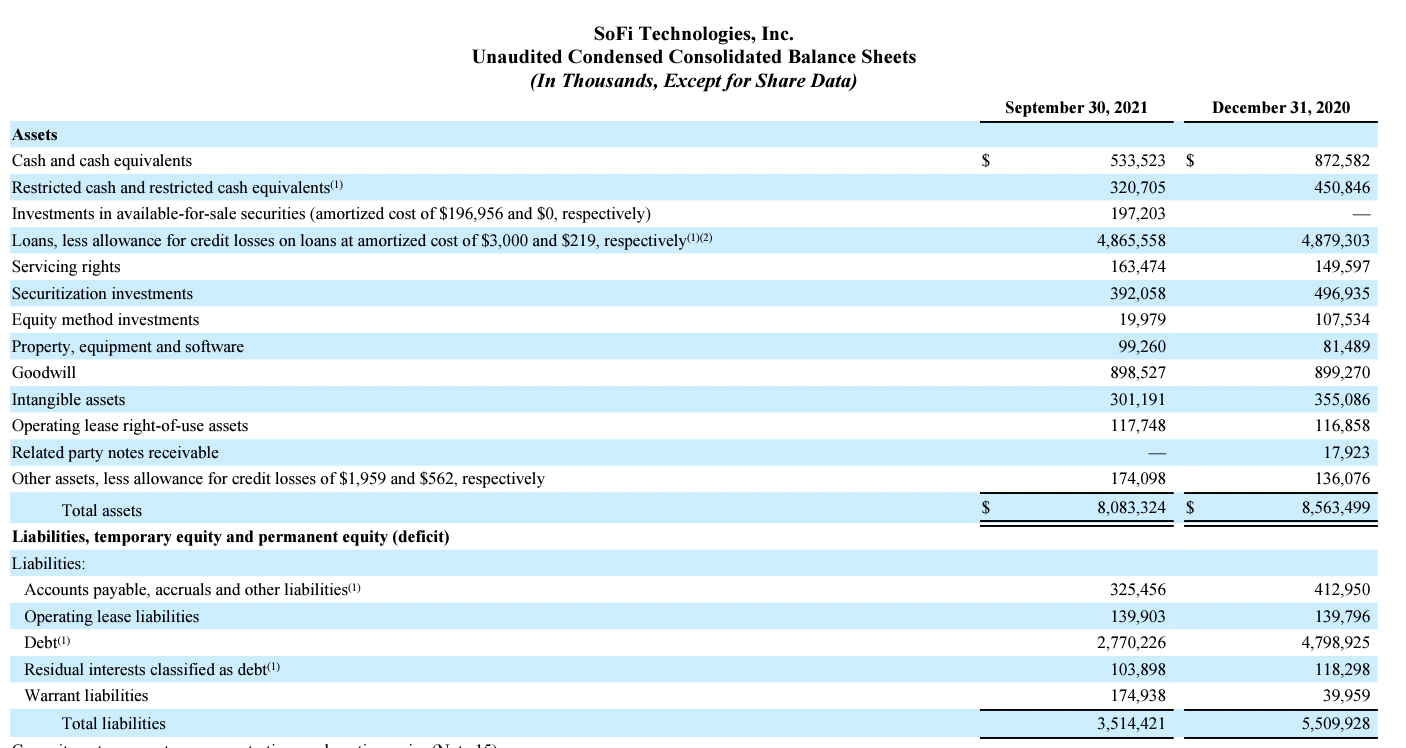

Within the balance sheet, these are loans and funded by debt, which are partly VIEs (variable interest entities). Note that there are minimal allowance for credit losses.

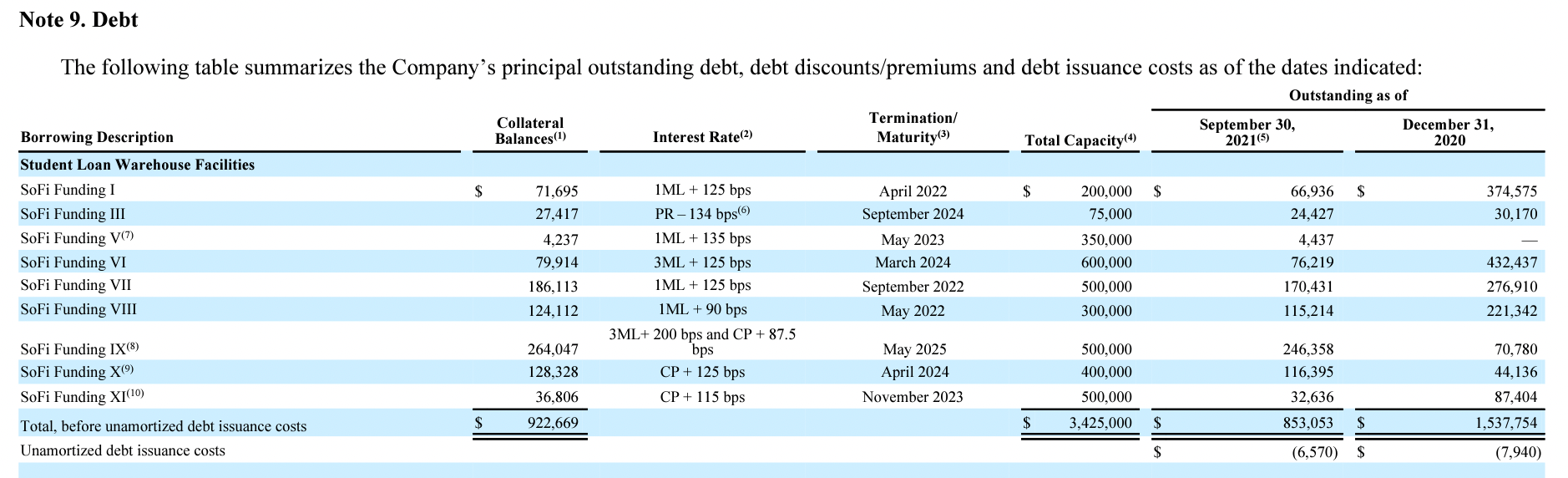

A detailed breakdown of debt can be found in Note 9 in the Q3 2021 10-Q.

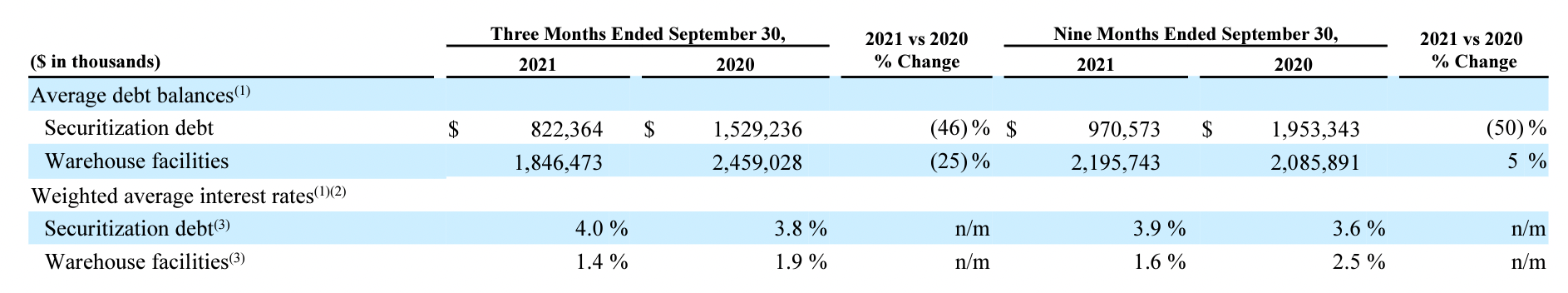

The weighted average interest rates by debt below.

The weighted averages of FICO and interest rates of the loans are also disclosed.

Student loans has a delinquency ratio of 0.9% while personal 1.5%.

Related Articles

Stripe IPO Competitor - PayPal Stock Analysis vs Adyen (January 2022 Update) - https://www.whichequities.com/stripe-ipo-paypal-pypl-adyen/

Peter Thiel portfolio - Affirm Stock Analysis (November 2021 Update) - https://www.whichequities.com/affirm-afrm-stock/