EV Stocks to Buy Now - NIO stock vs XPeng (XPEV, 9868), Tesla (TSLA) (February 2022 Update)

(February 2022 Update) NIO is trading at a discount to XPEV because investors prefer higher growth and lower price points. Specifically, XPEV will need to deliver on selling more vehicles compared to NIO.

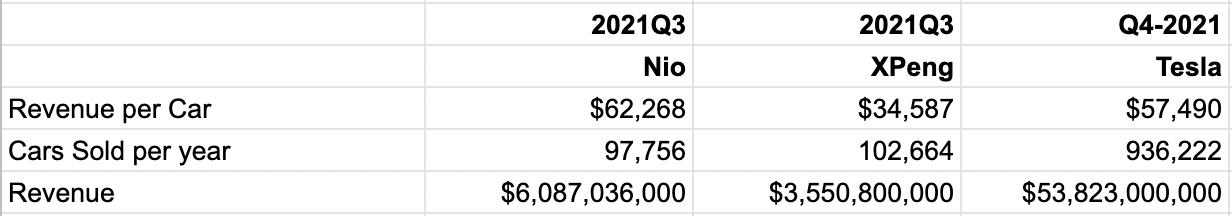

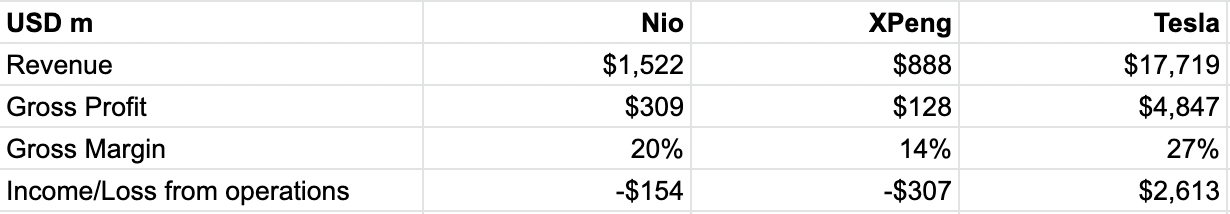

Using their respective quarterly disclosures, we have compiled the following figures for NIO, XPEV and TSLA.

NIO's average revenue per car is almost double that of XPEV, implying it is targeting the more upper end market while XPEV is more the mass market. In fact, NIO's average price point is even slightly higher than Tesla.

NIO sells about the same number of cars per year compared with XPEV at around the 100k mark with Tesla currently selling 9-10x more.

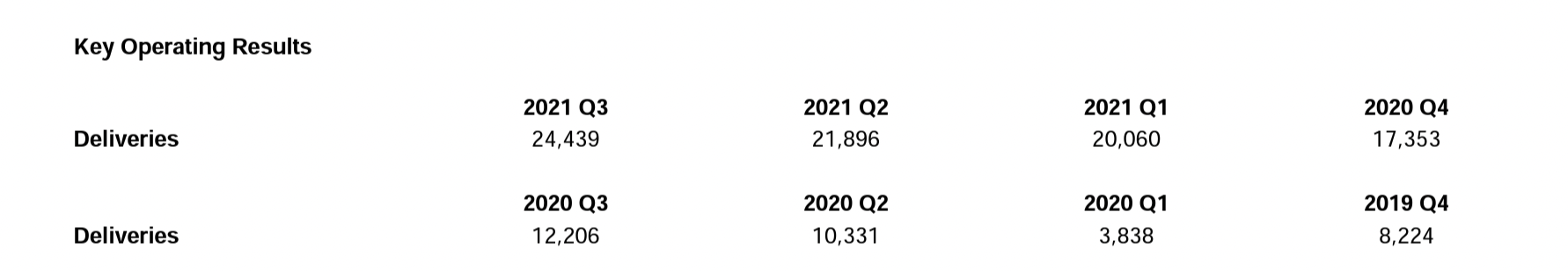

In terms of year on year (yoy) growth, NIO doubled their deliveries...

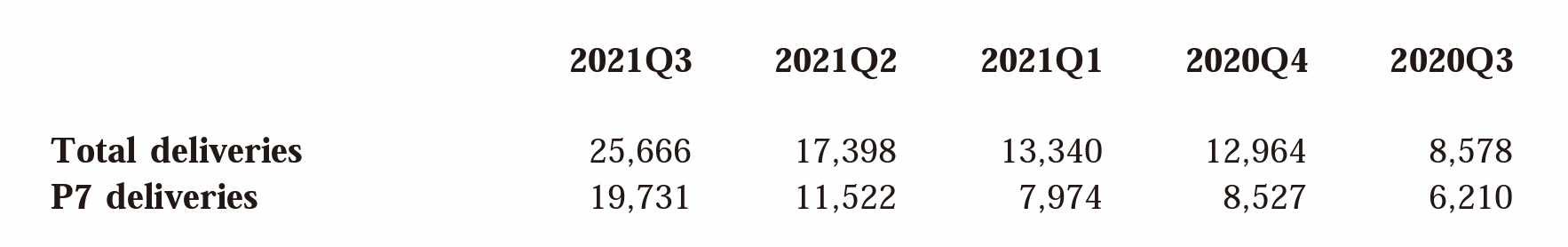

while XPEV tripled their deliveries.

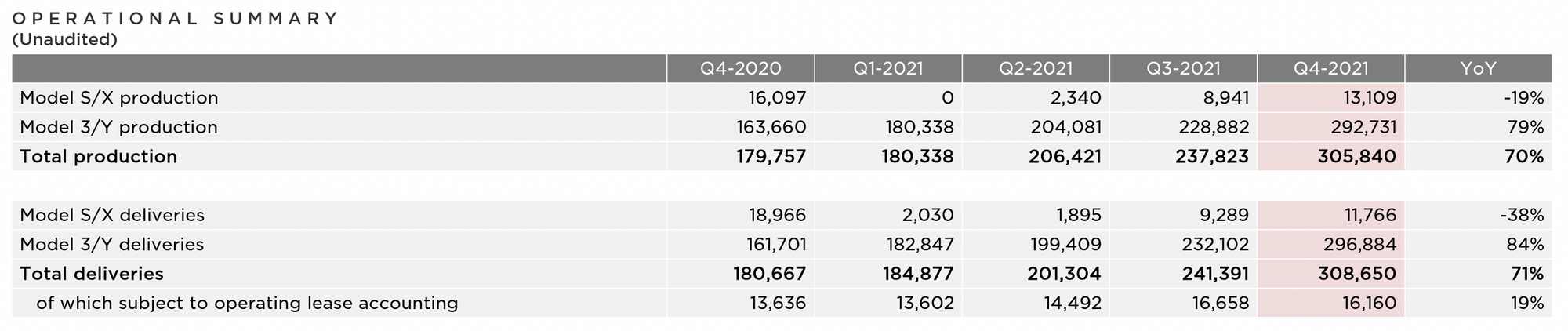

Meanwhile, Tesla also grew deliveries by 71%.

The EV market appears to be an aggressive land grab. The companies' growth (hence valuation) will rely on their abilities to ramp up production significantly.

NIO has higher gross margin compared to XPEV though both are still loss making currently.

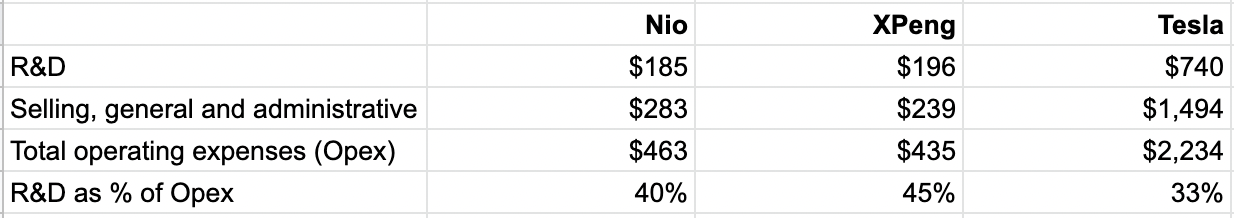

NIO spends slightly less in R&D compared with XPEV both in absolute and relative (to total opex) terms.

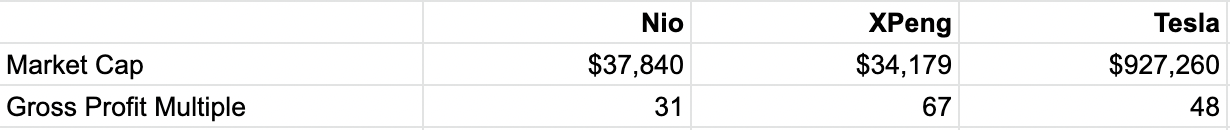

NIOis trading at quite a significant discount in terms of Market Cap by Gross Profit compared with XPEV.

As per above, NIO is a more premium brand with a higher gross margin. Though it appears investors are preferring XPEV, which has higher growth and lower price points (so may possibly take a larger share of the market).

According to the China Association of Automobile Manufacturers (CAAM), around 26m cars were sold in China in 2021, up ~4% yoy.

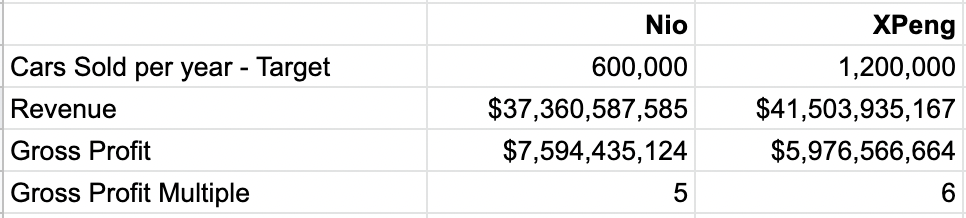

Given their respective price points, we crudely assume NIO will ultimately sell similar number of vehicles as BMW and Mercedes-Benz while XPEV will be similar to Toyota and Geely.

Using data from this article, we compiled the table below.

If ultimately, NIO sells around half the number of vehicles of XPEV at around 600k a year, they would both achieve about $40b in revenue given NIO's price point is double that of XPEV.

NIO will have slightly higher gross profit because it has a slightly higher gross margin leading to a slightly lower market cap to gross profit multiple currently.

This implies while NIO is trading at a discount currently, if XPEV delivers and ultimately sells more than NIO, the discount disappears.

Finally, different listings will entail different investor bases with their different appetite/choices impacting valuation as well.

Specifically, since XPEV has listing in Hong Kong (9868) where there are likely less EV listings, local investors maybe more willing to pay a premium for the exposure.

In any case, always worth listening to Warren Buffet's take on the evolution of the world's largest companies especially towards the end where he discusses the motor industry back 100 years ago in the early 1900s.

Related Articles

Lucid Stock Analysis vs Tesla (February 2022 Update) - https://www.whichequities.com/tesla-tsla-lucid-lcid/

LMND Stock Analysis - Lemonade (November 2021 Update) - https://www.whichequities.com/lemonade-lmnd-stock-insurtech-warren-buffet-float/