Meme Stocks to Buy Now - Robinhood (HOOD stock) analysis - will it slide to $10? and what price to buy? (February 2022 Update)

(February 2022 Update) Options and cryptos are swing factors to HOOD's revenue. Trading at 7x revenue, HOOD gives long term investors exposures in high beta, growth and cryptos when market sentiment returns.

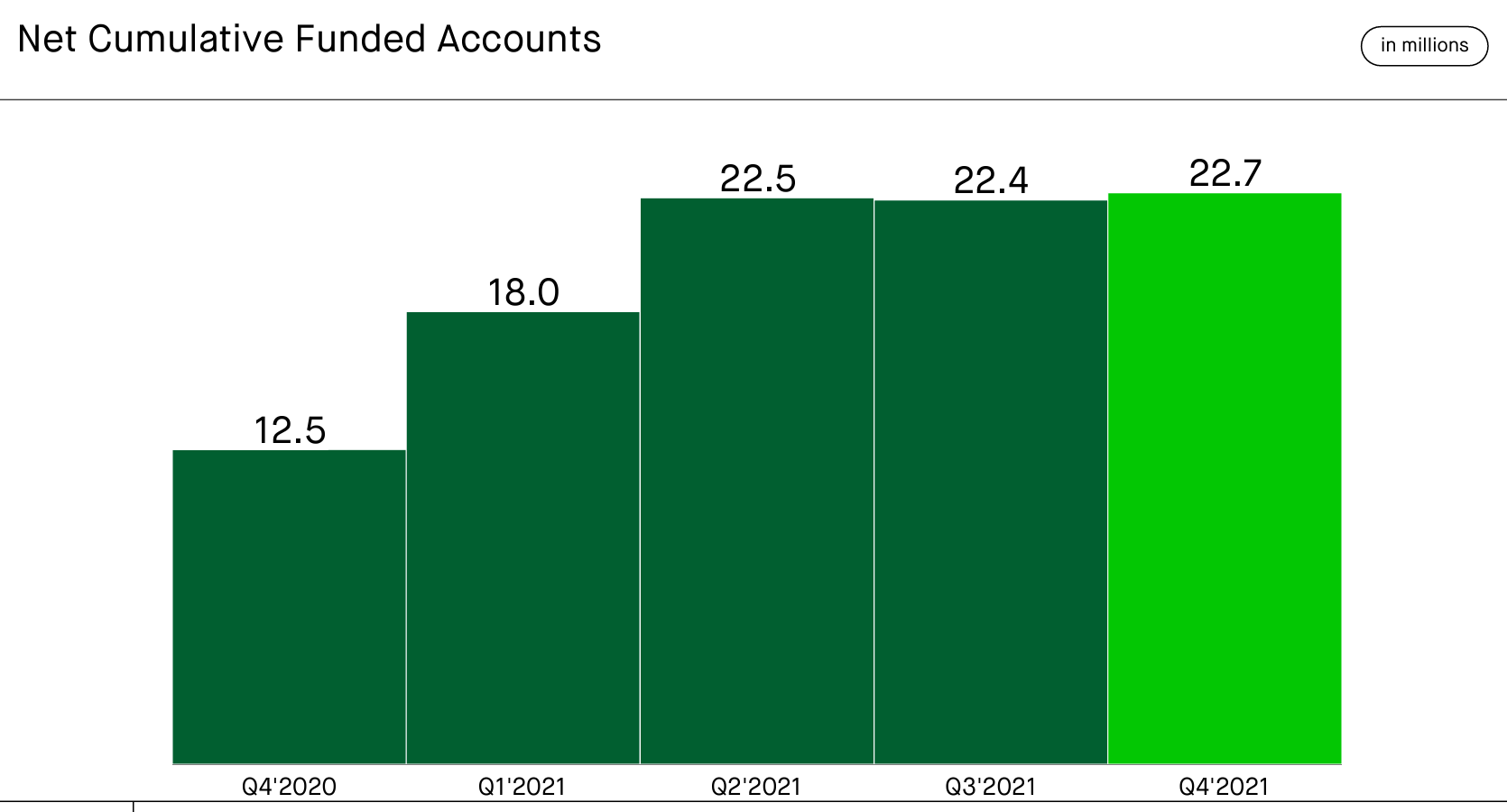

As per the Q4 2021 presentation, account growth has stalled on a sequential basis...

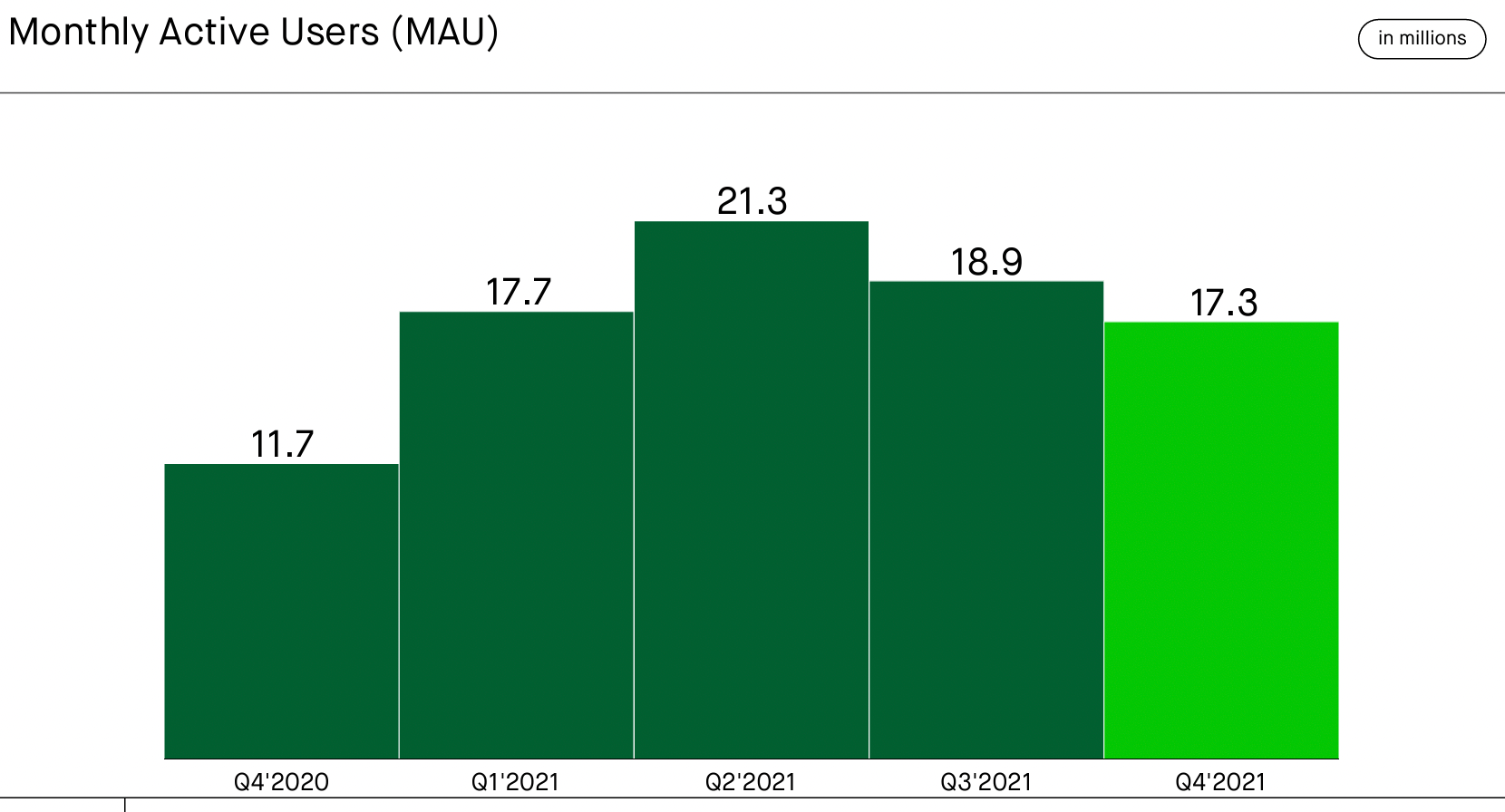

...while Monthly Active Users (MAU) has fallen due to the bear markets in equities and cryptos...

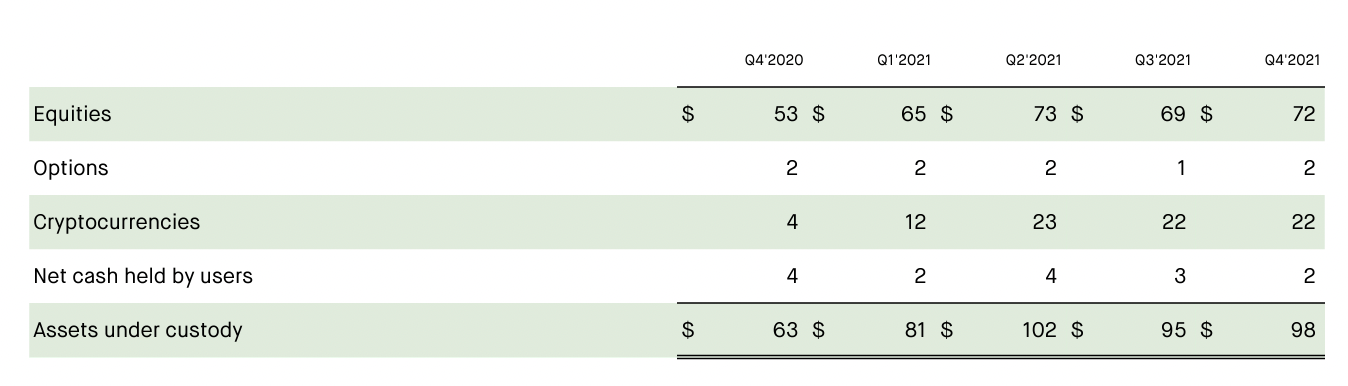

...despite this, assets under custody has remained flattish. Note that the key growth area has been crypto.

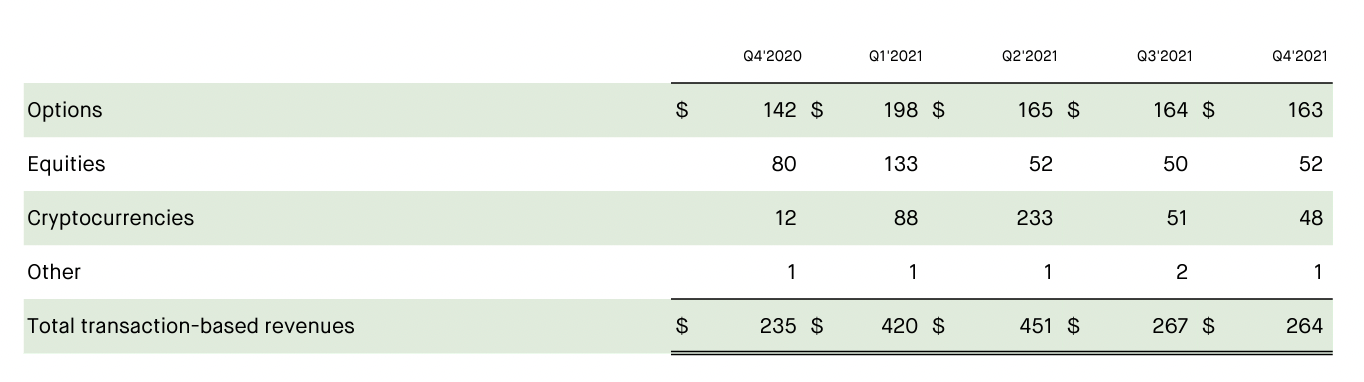

While options is minuscule in assets under custody, it is a significant part of transaction-based revenues...

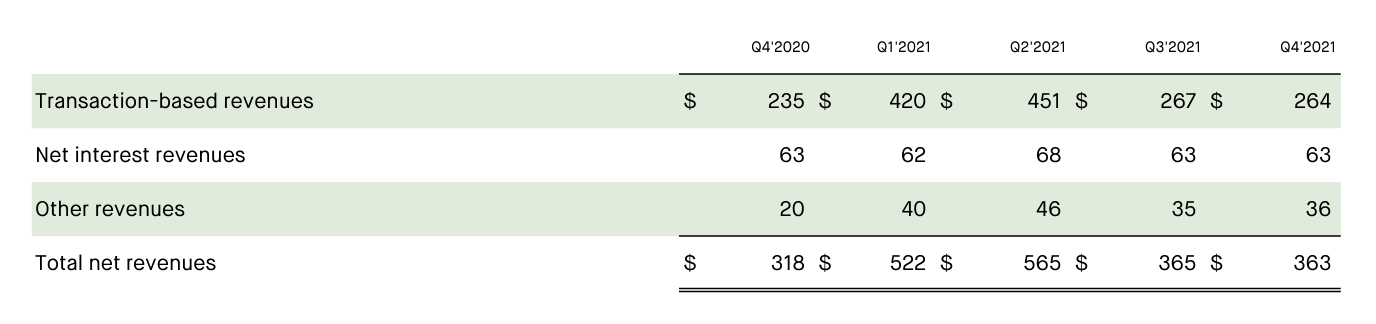

...which is a key part to total net revenues.

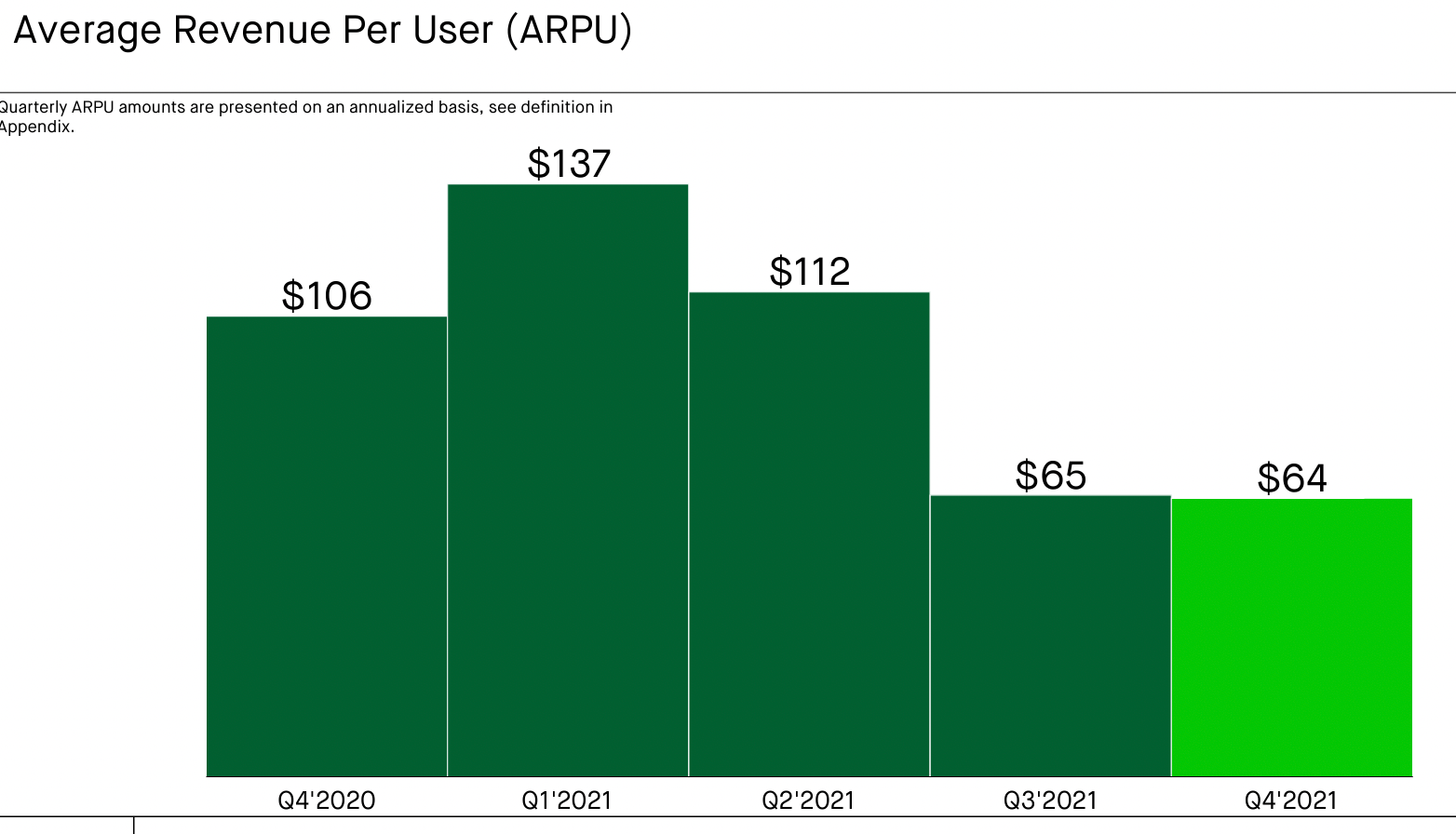

This makes HOOD an extremely high beta stock, meaning HOOD's stock price is very sensitive to market sentiments on equities and cryptos. While the current bear markets in equities and cryptos have seen HOOD derated, when market sentiment turns more positive, HOOD could be subject to sharp spikes.

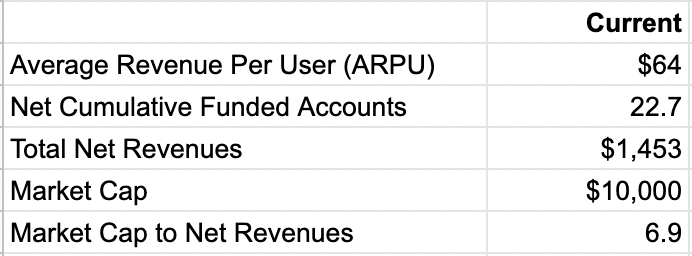

Specifically, using HOOD's Q4-2021 data and annualized, we calculate the market cap to net revenues at about 7x.

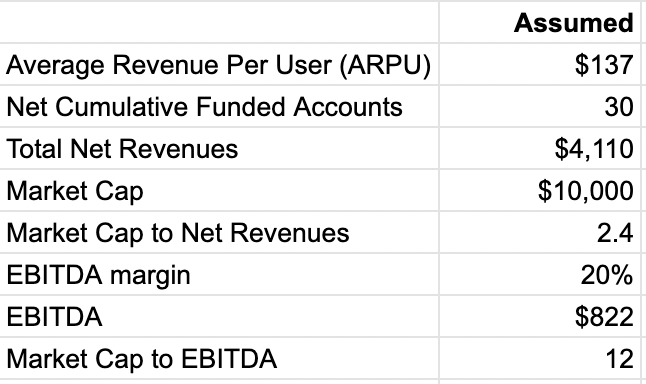

We calculate an assumed scenario where ARPU returns to $137 or the quarterly historical peak.

Net Cumulative Funded Accounts grow to 30m.

Then Market Cap to Net Revenues would drop to 2.4x.

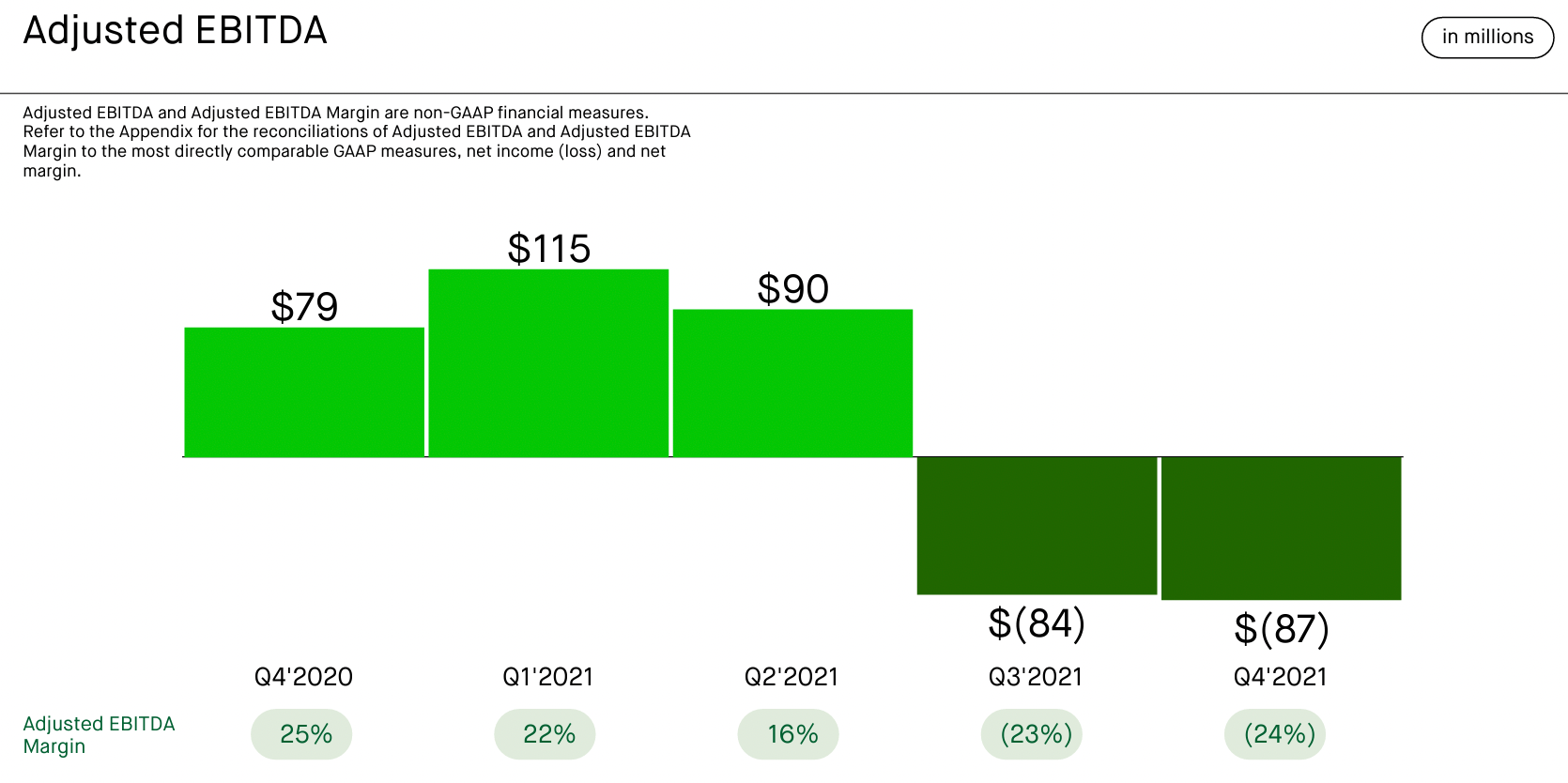

Further, if we assume EBITDA margin is ~20%, which is about the midpoint before HOOD's listing in Q3'2021.

The Market Cap to EBITDA is 12x.

While it is impossible to pick bottom, current valuation is not so unreasonable for more long term investors seeking high beta, growth and crypto exposures.