Stocks to Buy Now for Starlink IPO - February 2022 Update

(February 2022 Update - shh... this stock is well held by Seth Klarman's Baupost...)

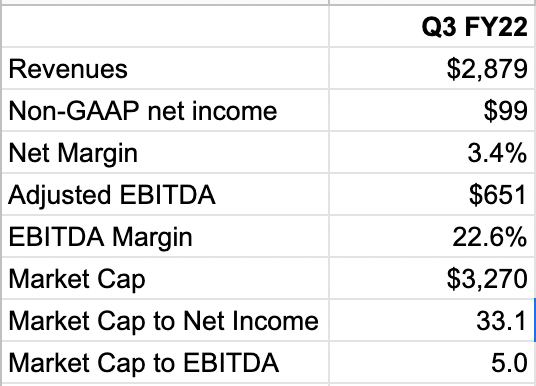

The stock in discussion is Viasat (VSAT), which is trading at 5x EBITDA, and could benefit from 1) the tailwind of increased in-flight connectivity (IFC) from resumed travelling; 2) increased government awards and; 3) ViaSat-3 service launch by end of 2022.

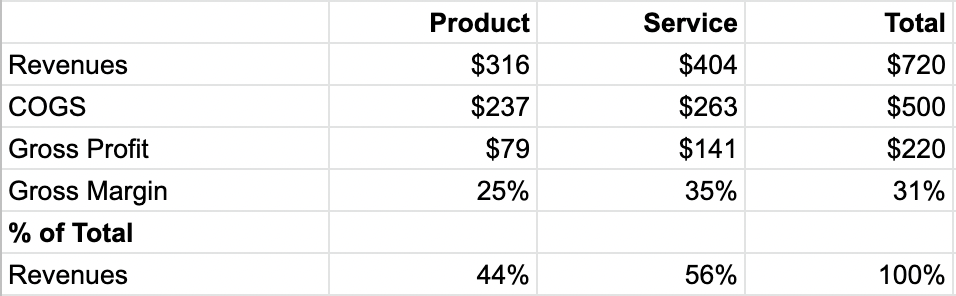

Using data from its Q3 FY22 Shareholder Letter, we have compiled the following table.

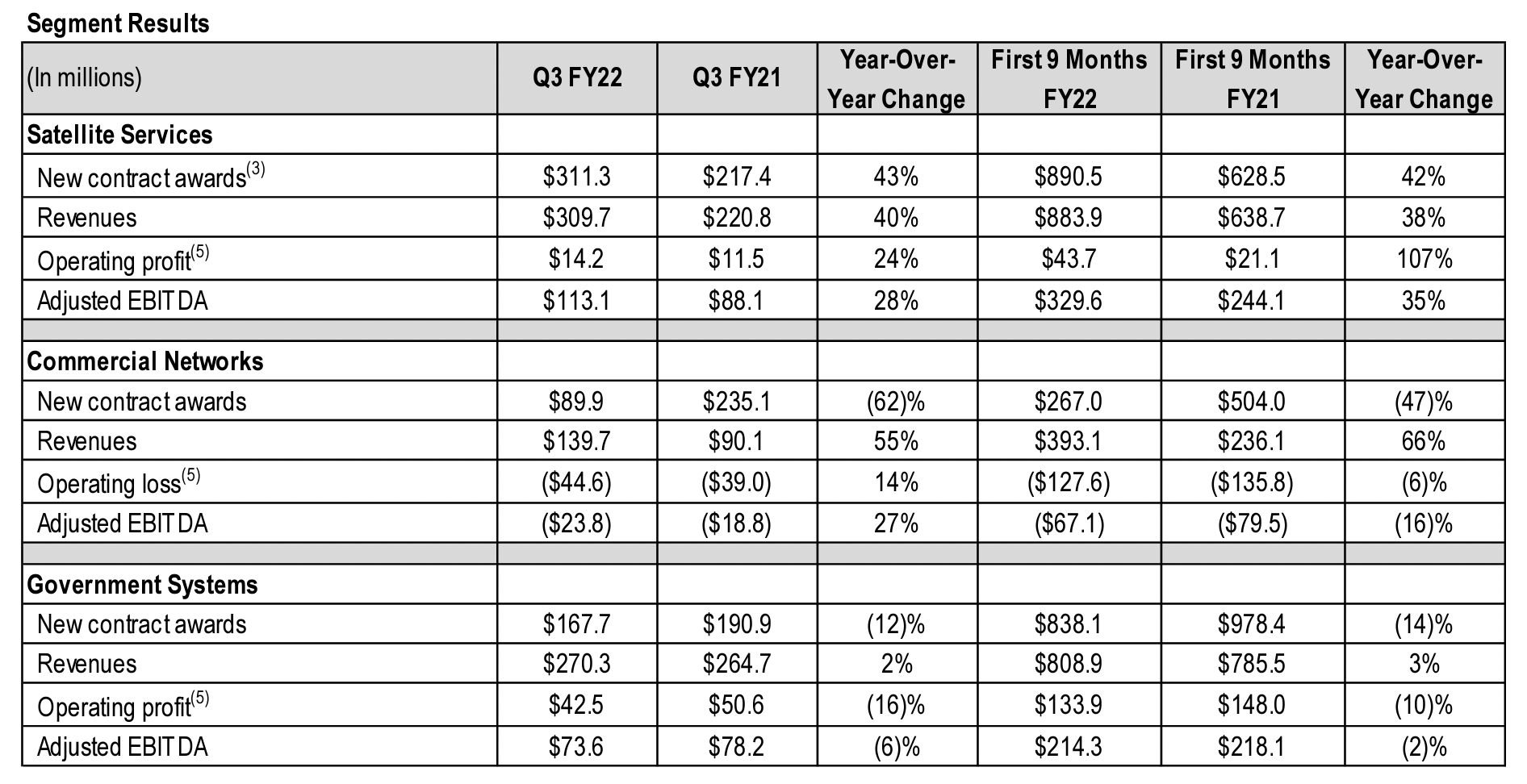

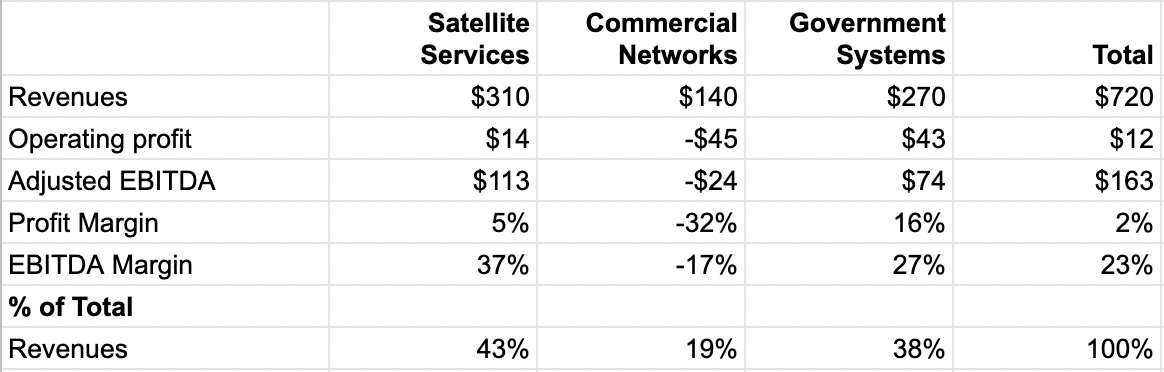

The business is divided into three segments, namely, Satellite Services, Commercial Networks and Government Systems.

Notice that revenues are derived from contract awards, which appears to be large lump sums hence making it difficult to make any forecasts.

The largest segment, Satellite Services, accounts for 43% of total revenues with 5% profit margin and 37% EBITDA margin.

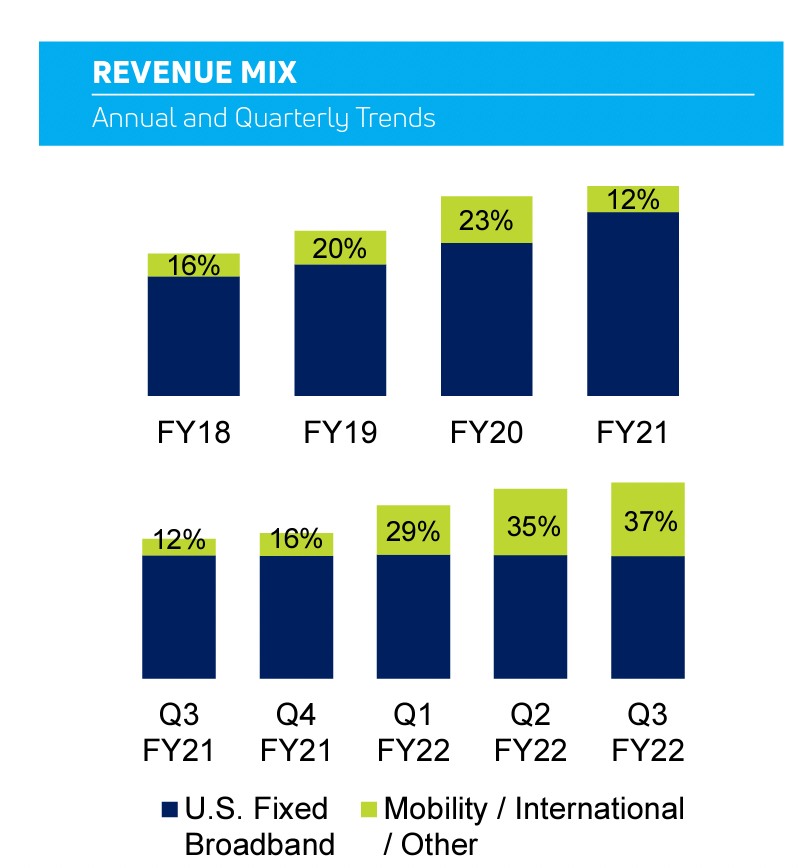

Following the RigNet and EBI acquisitions that closed in Q1 FY2022, Mobility/International is accounting for a larger share of revenue compared with US Fixed Broadband.

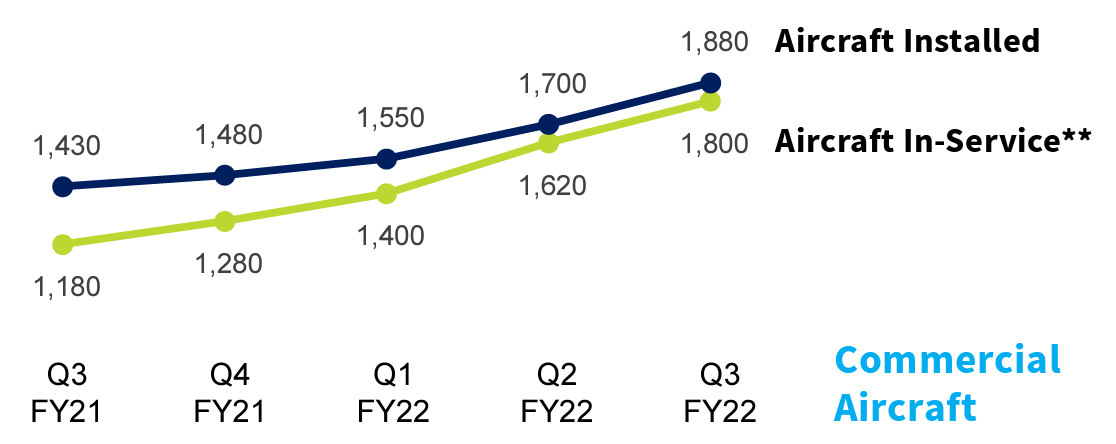

Management expects another ~860 commercial aircrafts (48% increase) in service with in-flight connectivity (IFC) under existing customer agreements.

Government Systems accounts for 38% of total revenues with 16% profit margin and 27% EBITDA margin.

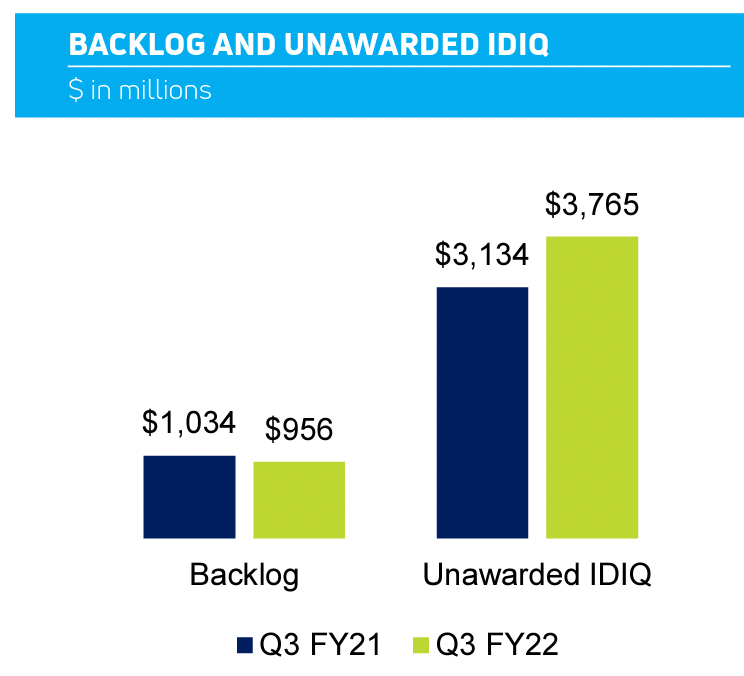

The unawarded IDIQ (indefinite delivery/indefinite quantity) grew by 20% yoy to $3.8b, which accounts for >3x annualized revenue, highlighting the potential in this segment.

Finally, Commercial Networks is the smallest segment and accounts for 19% of the total but is loss making.

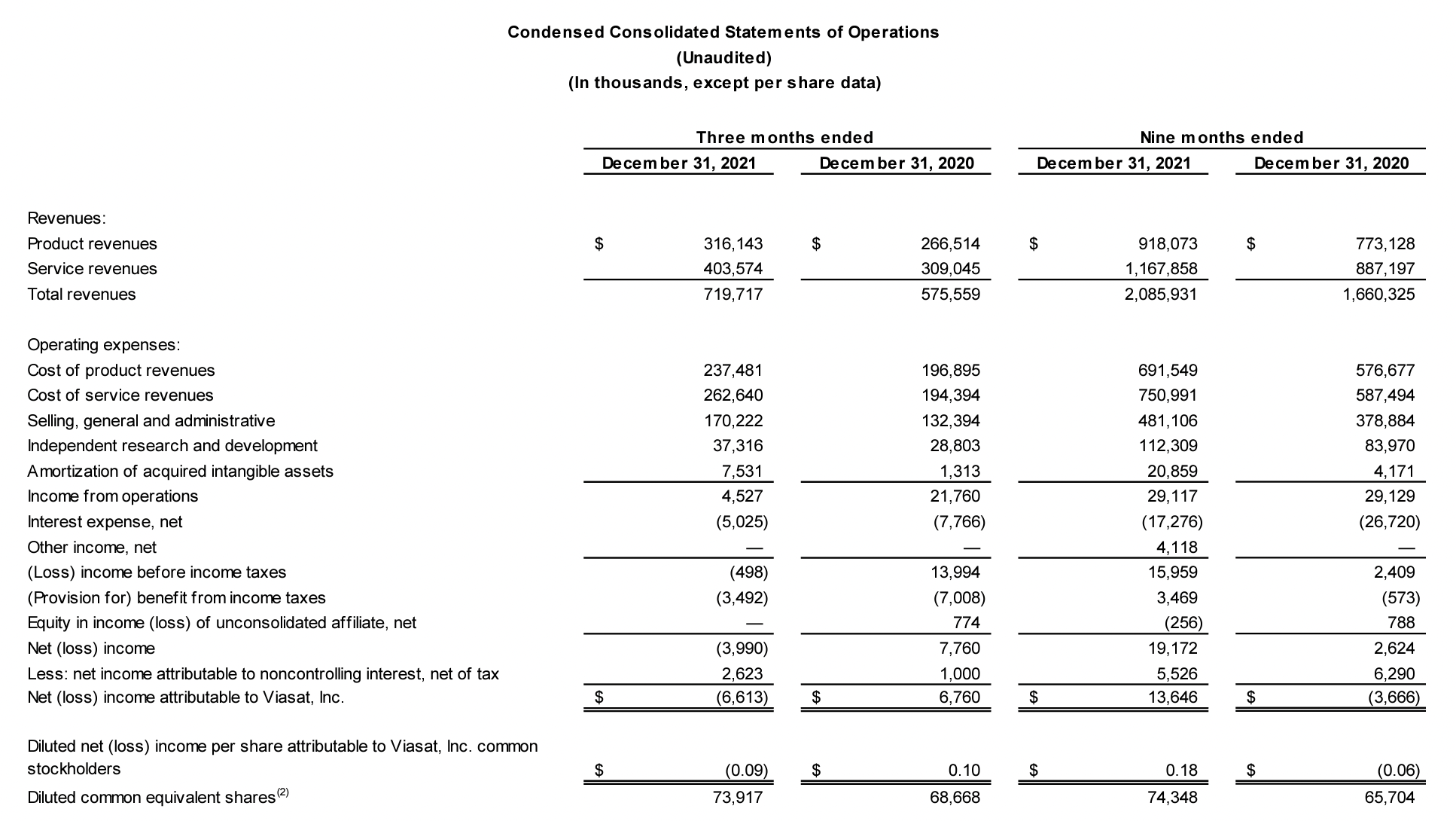

Product accounts for 44% of total revenues with a 25% gross margin. Service accounts for 56% with 35% gross margin.

R&D accounted for 18% of total opex.