How would Microsoft (MSFT Stock) look like after Activision Blizzard (ATVI Stock)? (January 2022 Update)

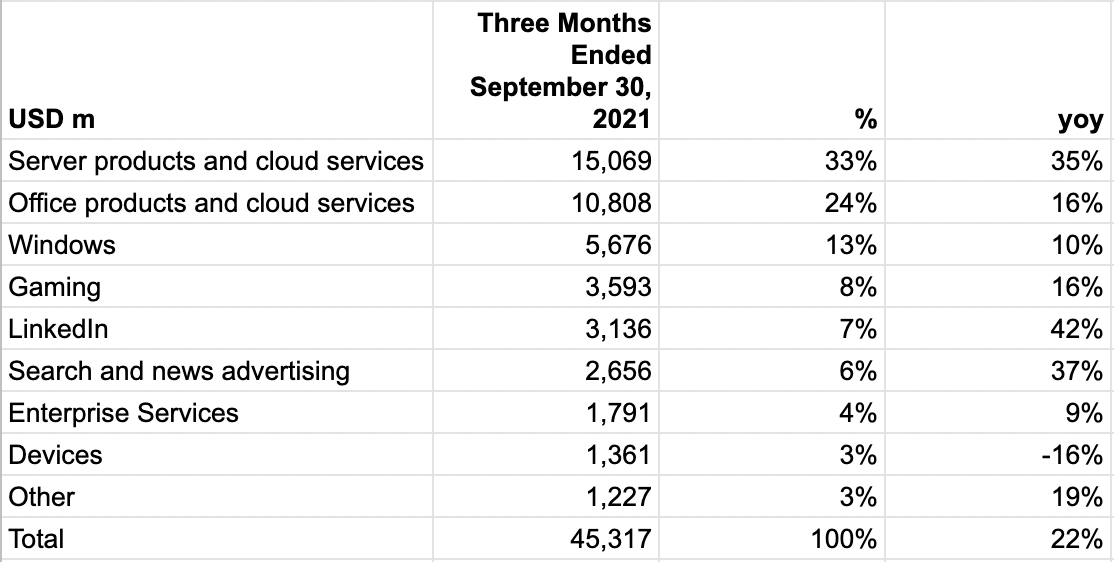

The Activision Blizzard acquisition accounted for less than three quarters of operating cash flows and about half of the cash and short term investments balance. Microsoft Gaming revenue accounted for 8% of the total before this acquisition and will account for ~12% following.

Unlike tech startups, a mature big tech such as Microsoft (the business behind Xbox, Skype, LinkedIn, Github, Minecraft) is mostly profitable and cash generating.

As per Microsoft's FY22 Q1, during the quarter, it generated net income of $20b, operating cash flow of $24b and had cash and short term investments totalling $131b.

Some of these cash are returned to shareholders through dividends and stock repurchases as per below...

On September 14, 2021, our Board of Directors approved a share repurchase program authorizing up to $60.0 billion in share repurchases. This share repurchase program will commence following completion of the program approved on September 18, 2019, has no expiration date, and may be terminated at any time.

...as well as investments back into the business.

We will continue to invest in sales, marketing, product support infrastructure, and existing and advanced areas of technology, as well as continue making acquisitions that align with our business strategy. Additions to property and equipment will continue, including new facilities, datacenters, and computer systems for research and development, sales and marketing, support, and administrative staff. We expect capital expenditures to increase in coming years to support growth in our cloud offerings. We have operating and finance leases for datacenters, corporate offices, research and development facilities, Microsoft Experience Centers, and certain equipment. We have not engaged in any related party transactions or arrangements with unconsolidated entities or other persons that are reasonably likely to materially affect liquidity or the availability of capital resources.

Activision Blizzard was acquired for $69b, implying less than three quarters of operating cash flows and about half of the cash and short term investments balance.

Activision Blizzard makes about $2b in net revenue per quarter, accounting for about 4-5% of Microsoft's total revenue.

Specifically following the acquisition, the Activision Blizzard business will report to Microsoft Gaming. Microsoft Gaming revenue accounted for 8% of the total before this acquisition and will account for ~12% following.

Server products and cloud services, LinkedIn and Search and news advertising have been the key growth drivers during the quarter. Following this acquisition, Gaming would likely be expected to grow faster.

Microsoft defines its Gaming business as below.

Gaming, including Xbox hardware and Xbox content and services, comprising digital transactions, Xbox Game Pass and other subscriptions, video games, third-party video game royalties, cloud services, and advertising.

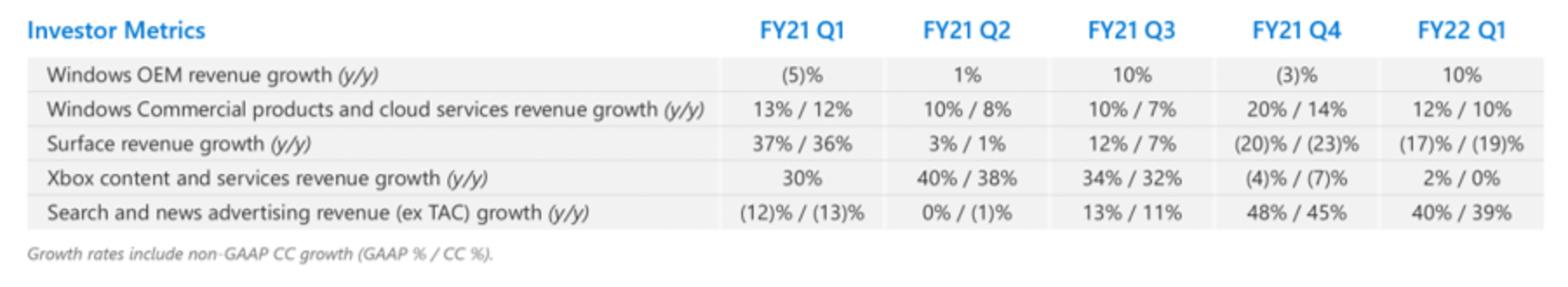

As per the below, Xbox content and services revenue growth has slowed in the last couple of quarters likely due to PS5 launch.