Why does this famous Warren Buffett follower hold FB stock (FaceBook, Meta)? (March 2022 Update)

(March 2022 Update) FB is trading at a discount despite better cash flow margin, due to Reality Labs.

Warren Buffett and Charlie Mungers' dislike of FB is fairly well documented.

Yet, Li Lu whose Himalaya Capital's website mentioned "embrace the value investment principles of Benjamin Graham, Warren Buffett, and Charles Munger", has been buying FB stock since Q2 2020 and holds about $300m according to its 13F. FB stock accounts for ~11% of his portfolio or just slightly higher than the 10% for Warren Buffett and Charlie Mungers' Berkshire Hathaway even. In fact, Li Lu holds BAC and AAPL just as Berkshire Hathaway does. So why the divergence in FB stock? As usual, we will explore FB's financials to look for any clues.

To begin with, Facebook has officially changed its name to Meta though its ticker code is still FB.

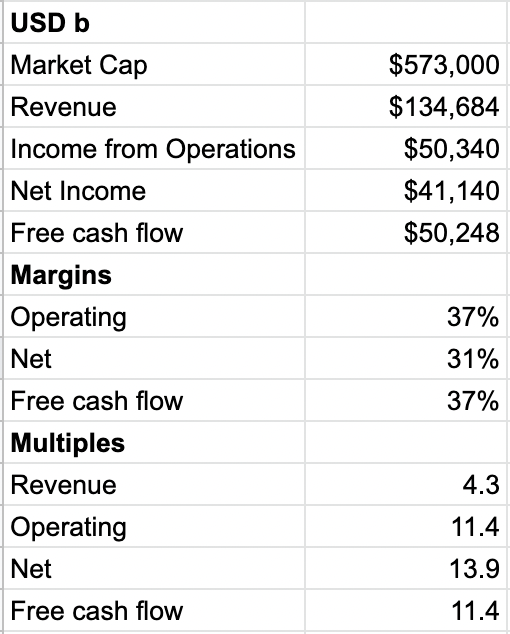

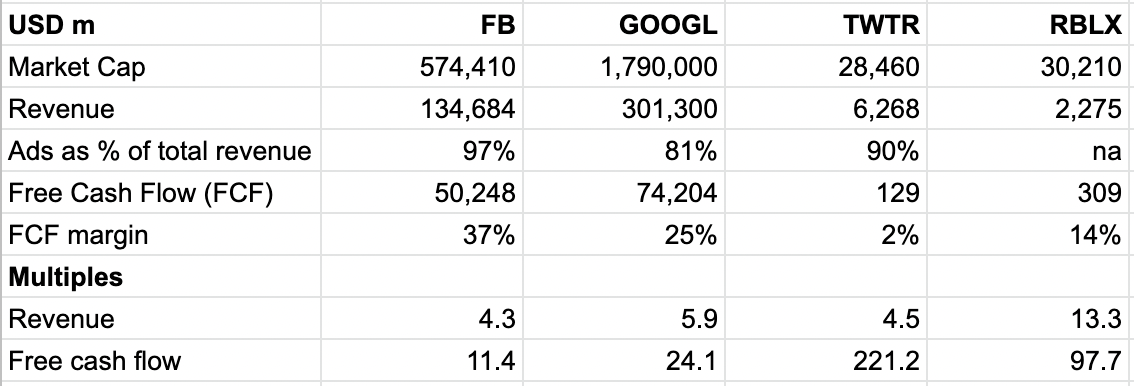

Taking figures from its Q4 2021 Earnings Slides, FB has a free cash flow (fcf) margin of 37% and is valued at $573b or ~11x fcf.

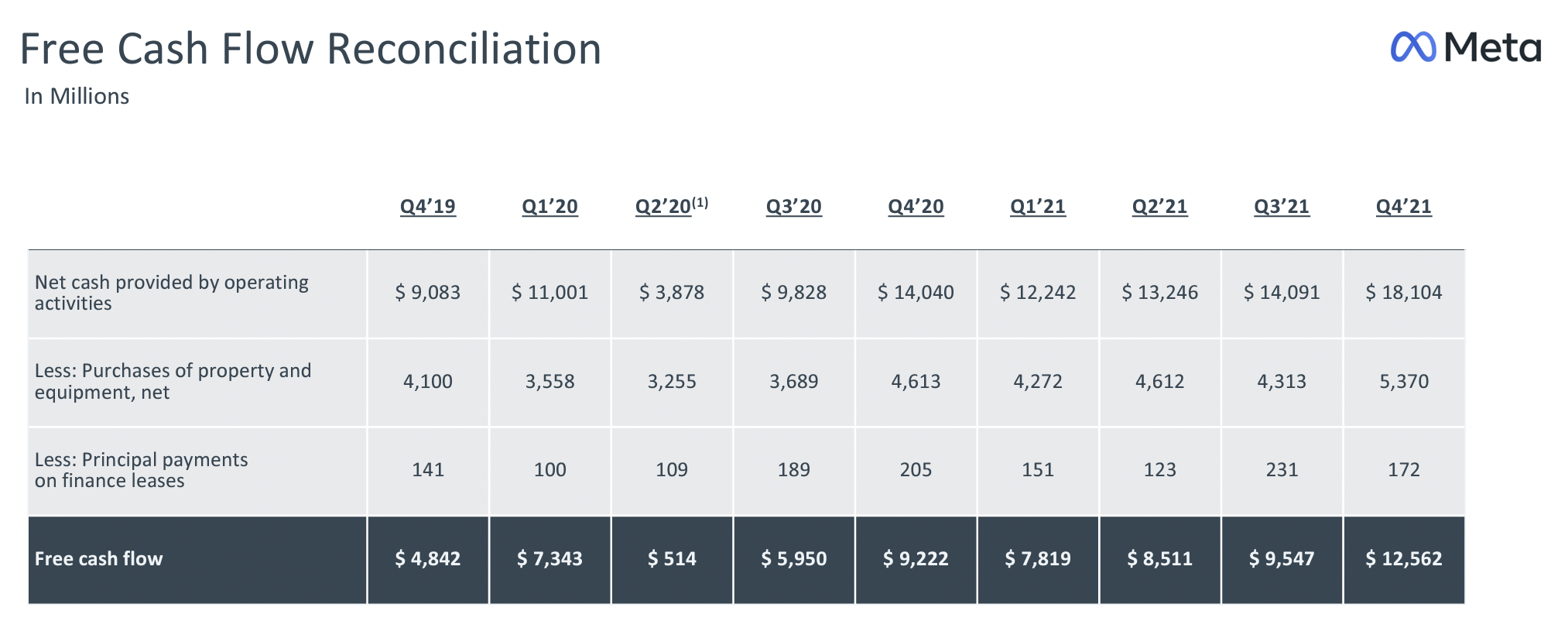

As a mature big tech, FB has been generating a significant amount of free cash flow.

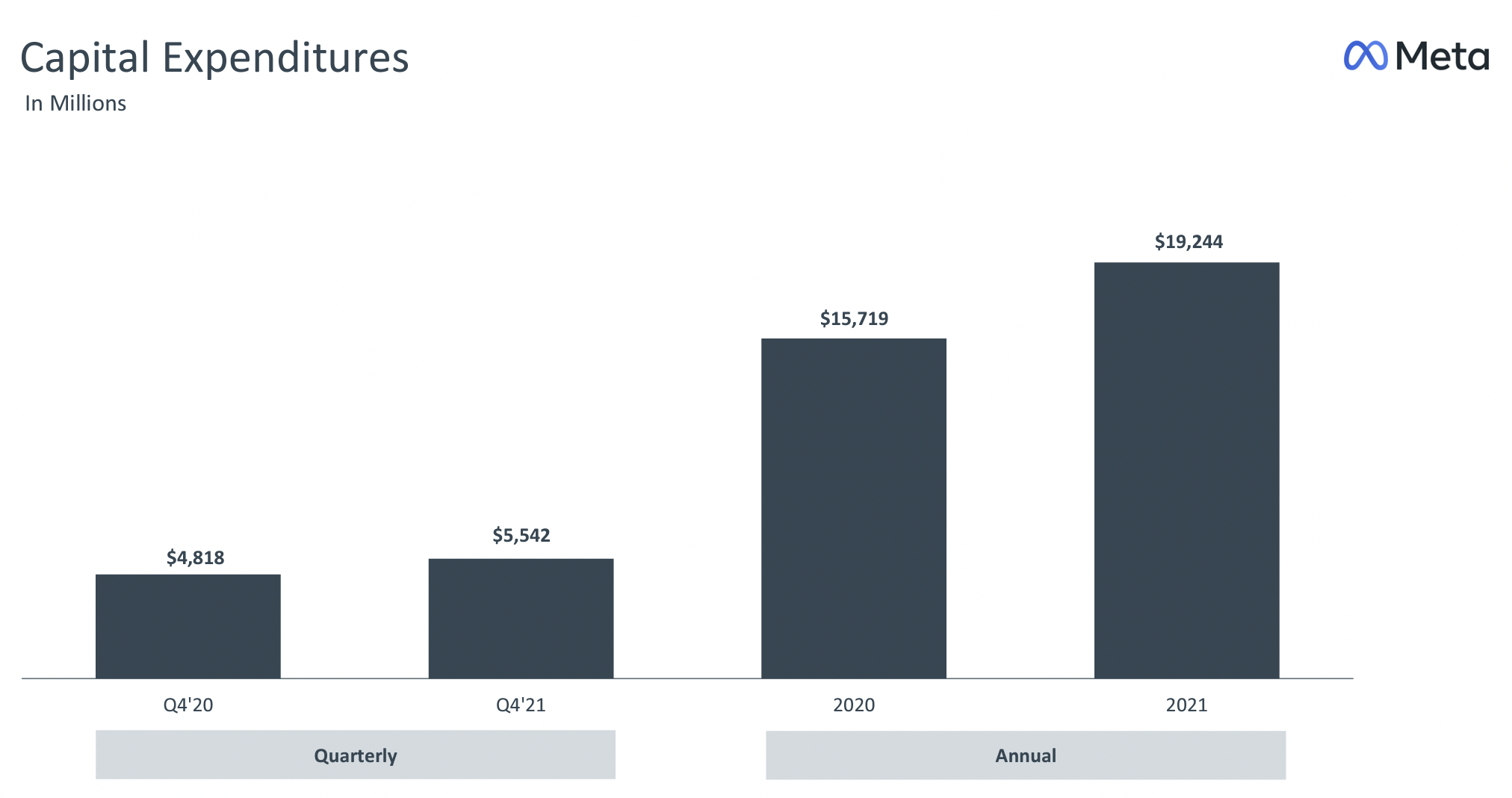

Capital expenditures is also well covered by the free cash flow so there appears limited need for financing / dilution for the Reality Labs project.

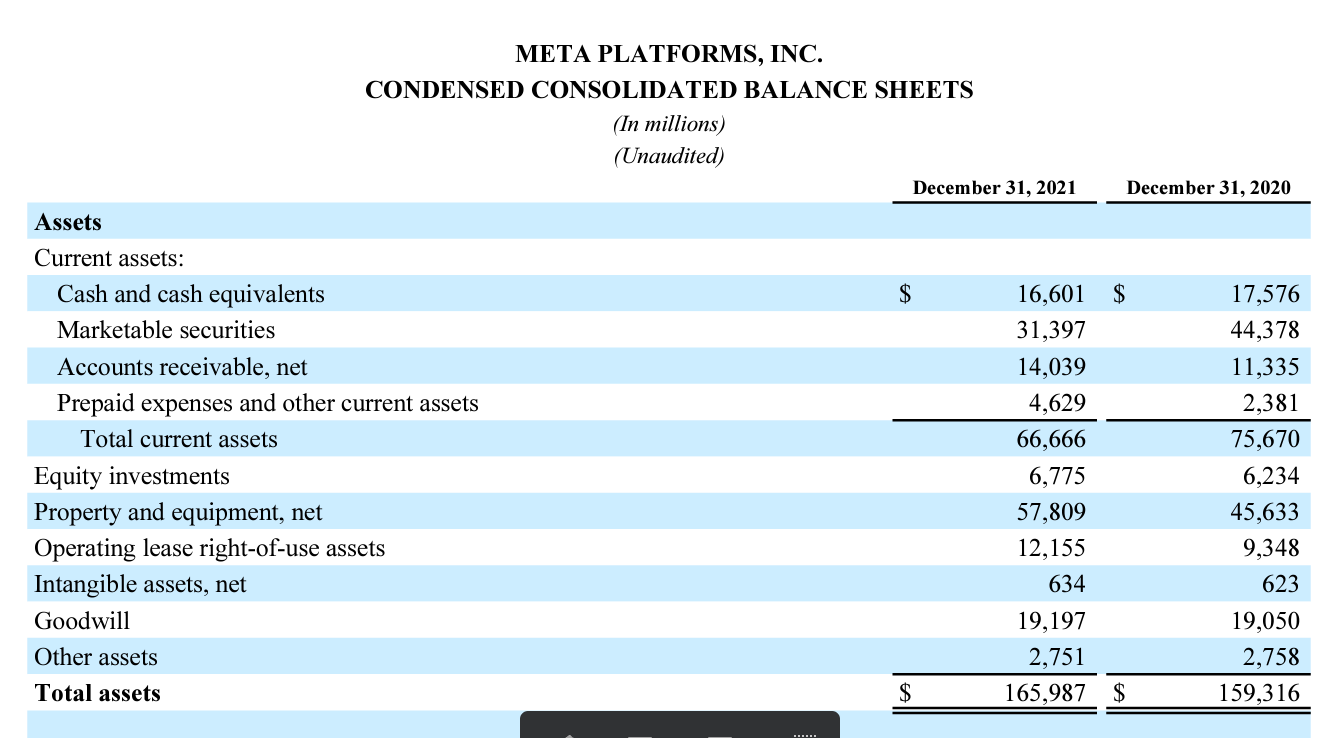

Capital position is strong with ample cash and marketable securities for deployment as well as a debt free balance sheet so significant ability to raise debt if required.

Next, we compare FB's cash flow margin and market cap multiples with two other Ads driven businesses namely, GOOGL (Alphabet, the parent company of Google) and TWTR (Twitter) as well as a metaverse business, RBLX (Roblox).

Specifically, while FB trades at a slight discount to GOOGL and TWTR in terms of revenue, it trades at quite a significant discount in terms of free cash flow because of FB's high free cash flow margin. This discount is even more significant when compared with RBLX. This discount appears to be due to FB's investment in the Reality Labs project but perhaps somewhat unjustified given FB's relatively strong capital position demonstrated above. That is, even if Reality Labs turned out to be a failure, the impact to FB's balance sheet is limited. In fact, free cash flow would increase further without the investments. In our view, this gives FB a lot of room to take on risks and new unconventional projects.

We explore in some more details below FB's financials and their key drivers.

The following is an extract from FB:

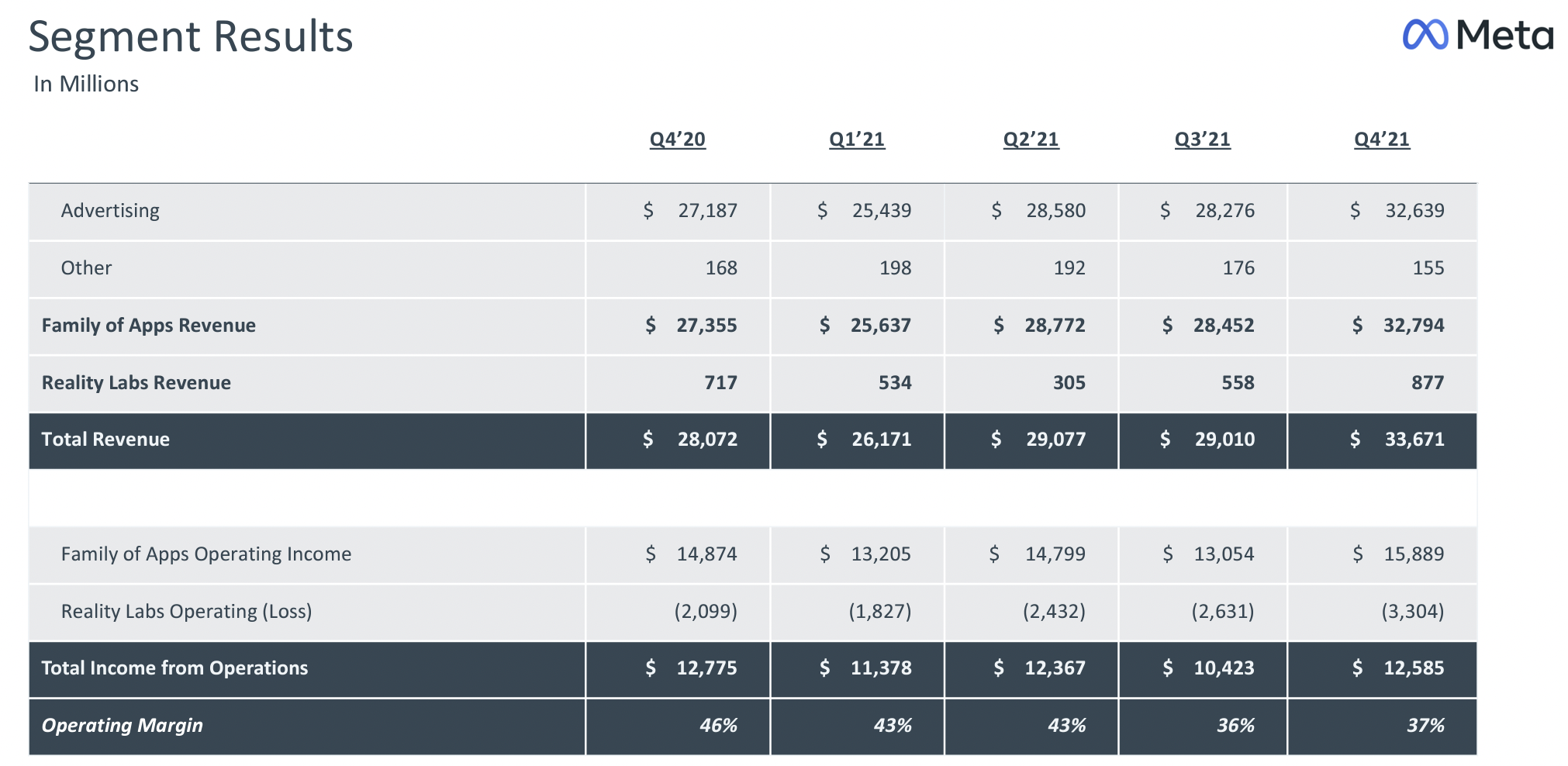

Beginning in the fourth quarter of 2021, we report our financial results based on two reportable segments: Family of Apps (FoA) and Reality Labs (RL).

FoA includes Facebook, Instagram, Messenger, WhatsApp, and other services.

RL includes augmented and virtual reality related consumer hardware, software, and content.

As per the below tables, Advertising is the majority of revenue. Reality Labs is also revenue generating though it is still operating at a loss.

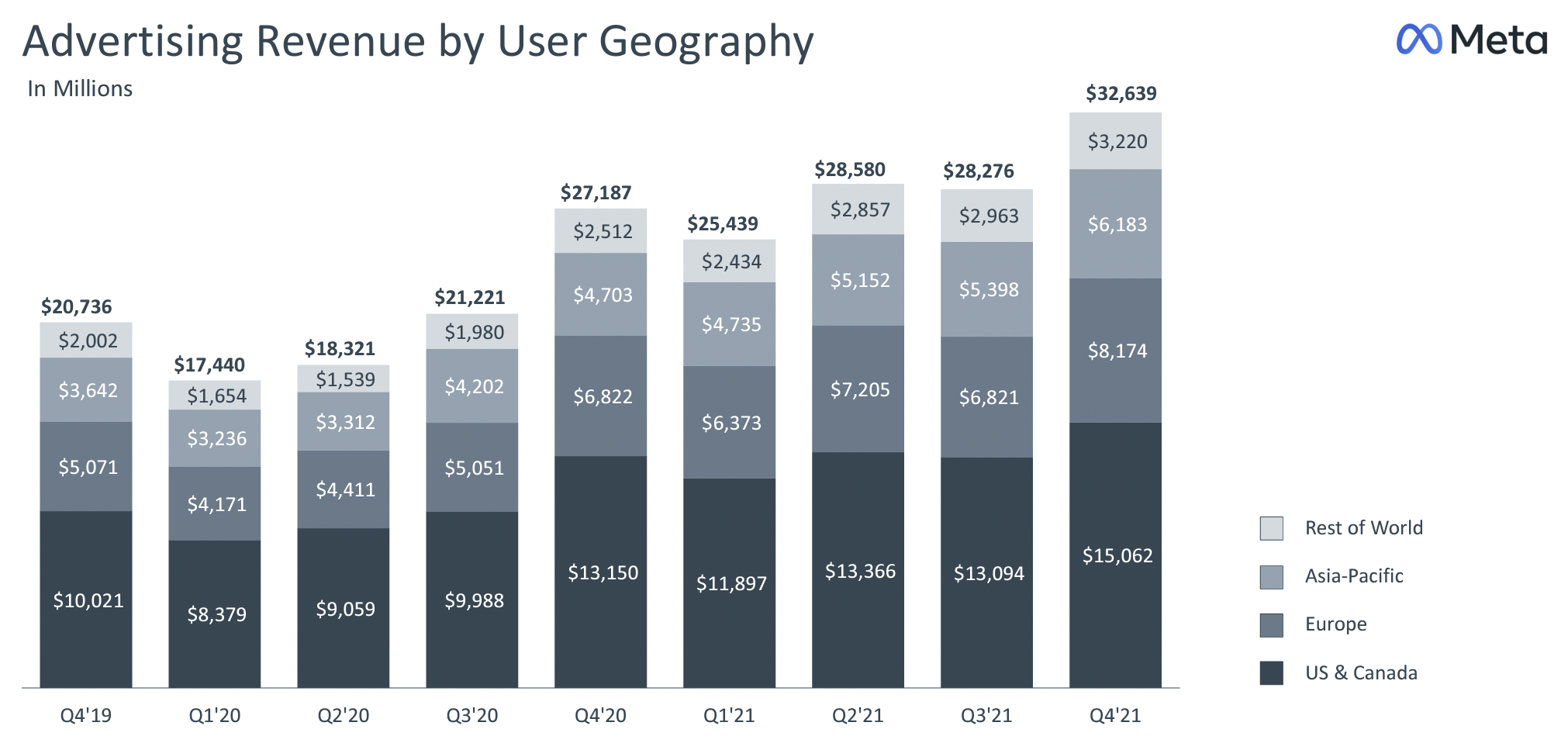

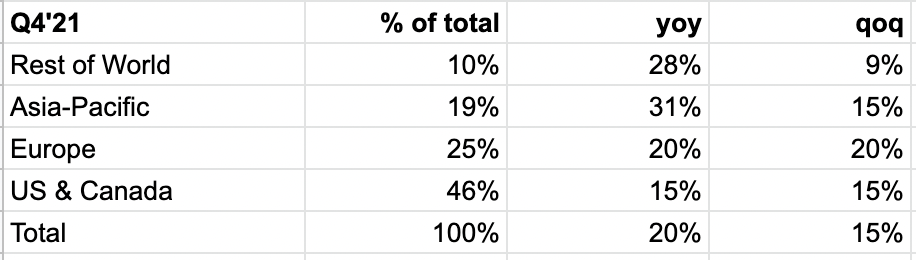

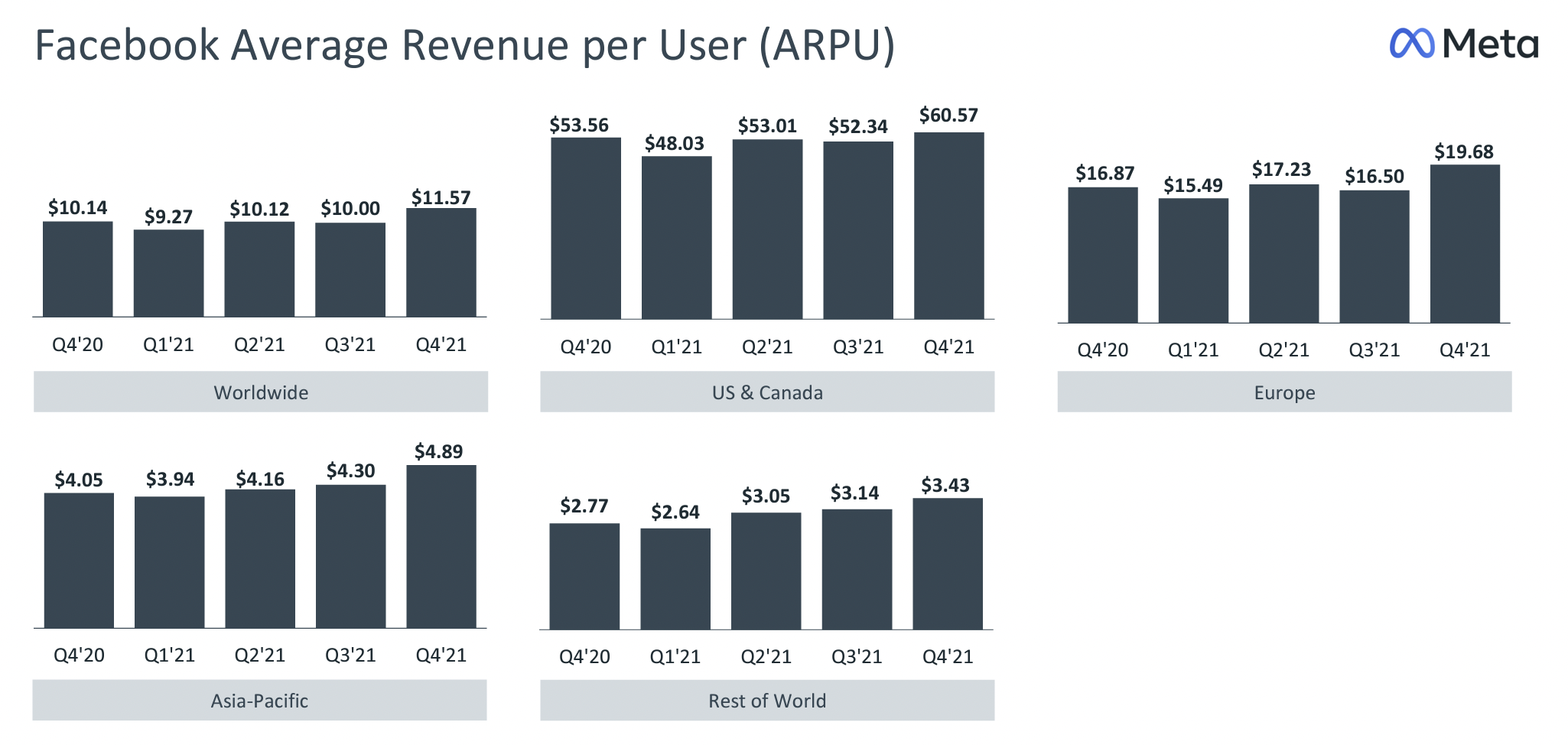

The following is FB's advertising revenue by geography.

While US & Canada are still the largest region, there is higher growth from aboard including Asia-Pacific and Rest of World.

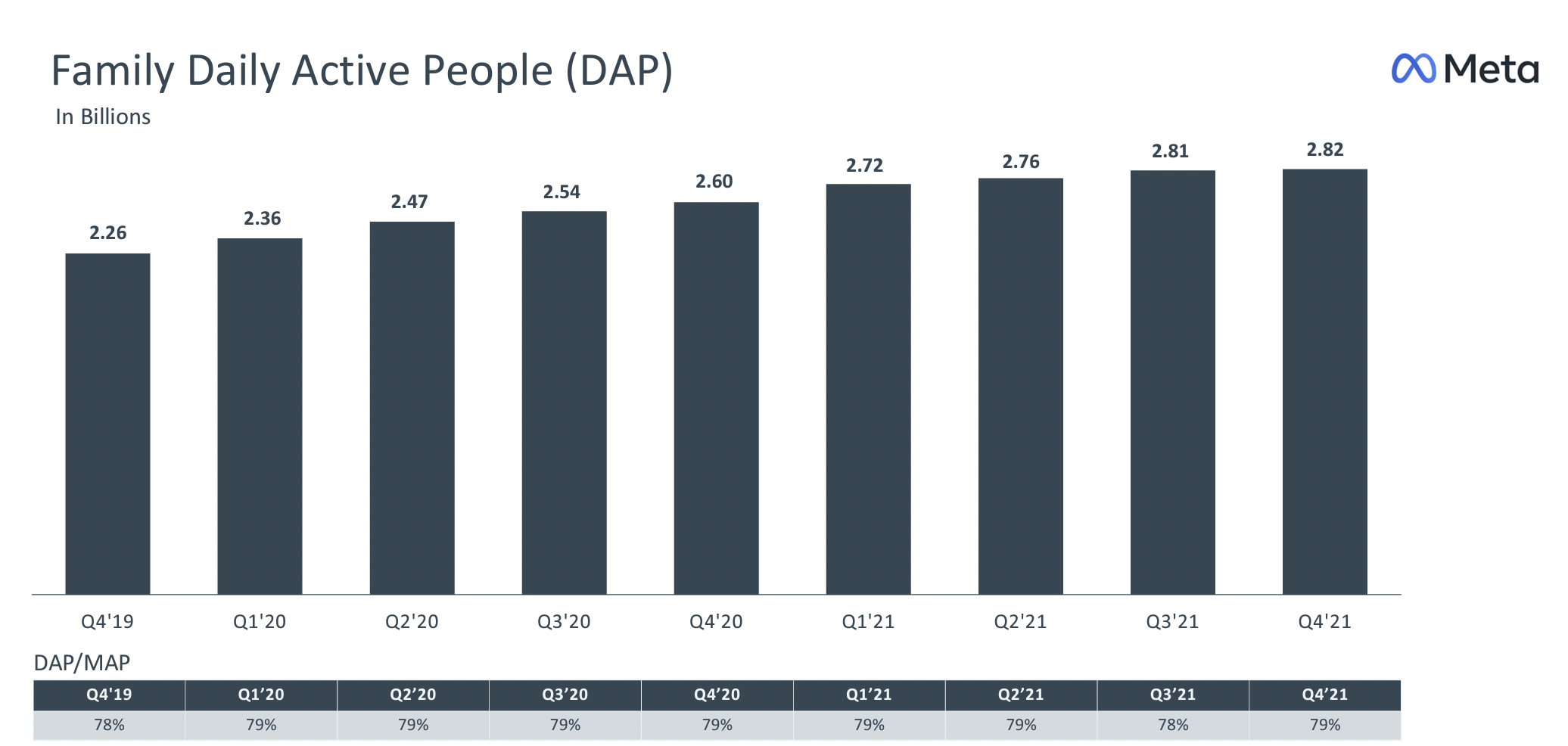

The following is the Family Daily Active People (DAP)...

which FB defines as...

a daily active person (DAP) as a registered and logged-in user of Facebook, Instagram, Messenger, and/or WhatsApp (collectively, our "Family" of products) who visited at least one of these Family products through a mobile device application or using a web or mobile browser on a given day.

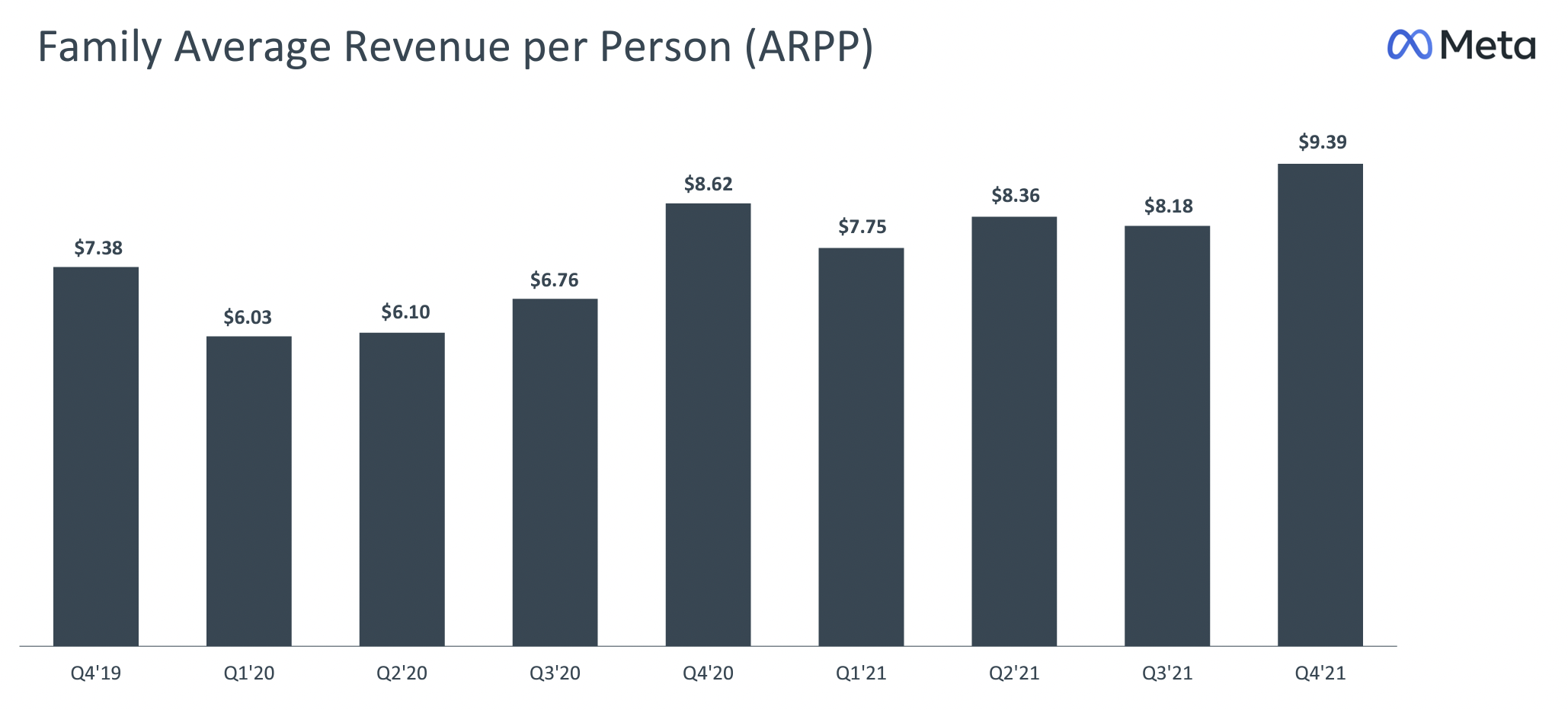

While the following is the Family Average Revenue per Person (ARPP)...

...therefore, both the quantity (DAP) and quality (ARPP) are on a rising trend, which is positive.

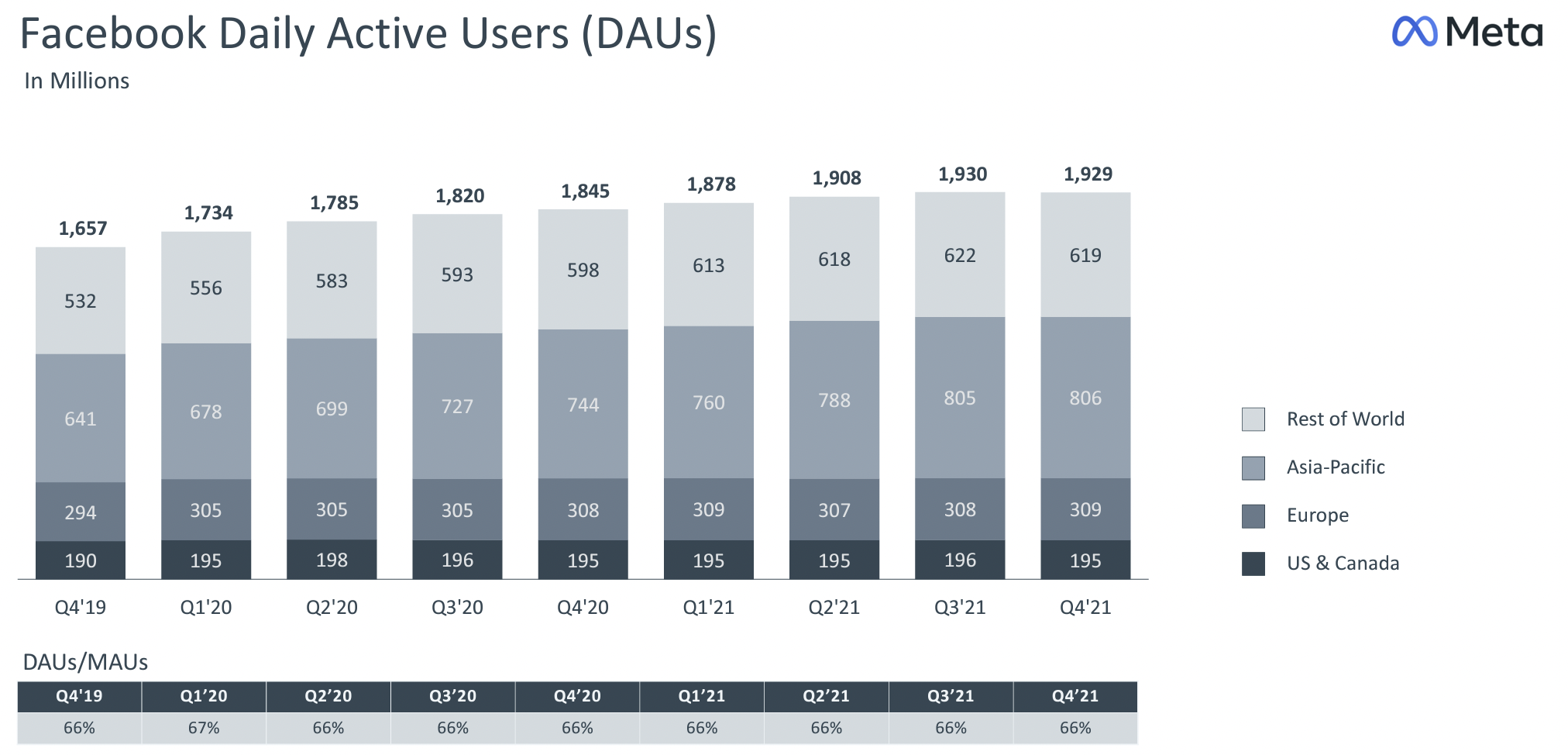

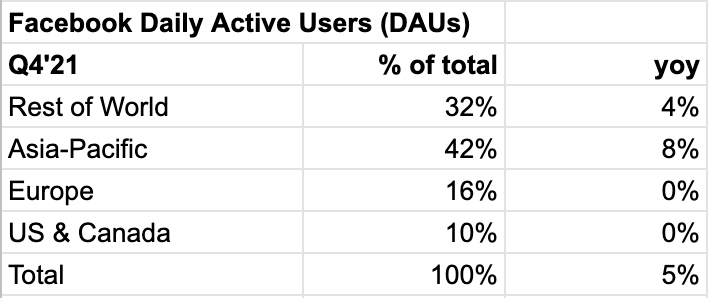

Specifically, the below is FB's Daily Active Users (DAUs).

Apparently, Asia-Pacific and Rest of World account for the majority of DAUs and growth.

However, obviously, the most profitable markets are still the developed regions, ie, US & Canada and Europe.

You maybe interested in...

Warren Buffett portfolio - Why did Berkshire Hathaway issue Yen bonds? (January 2022 Update)