Stocks to Buy Now for Stripe IPO - PayPal (PYPL stock) analysis vs Adyen (January 2022 Update)

(January 2022 Update) Adyen trades at premium to PayPal due to faster growth and being an Enterprise business. PayPal has higher profitability.

Stripe's IPO is upcoming though there is limited official investors and financials disclosures available at this stage.

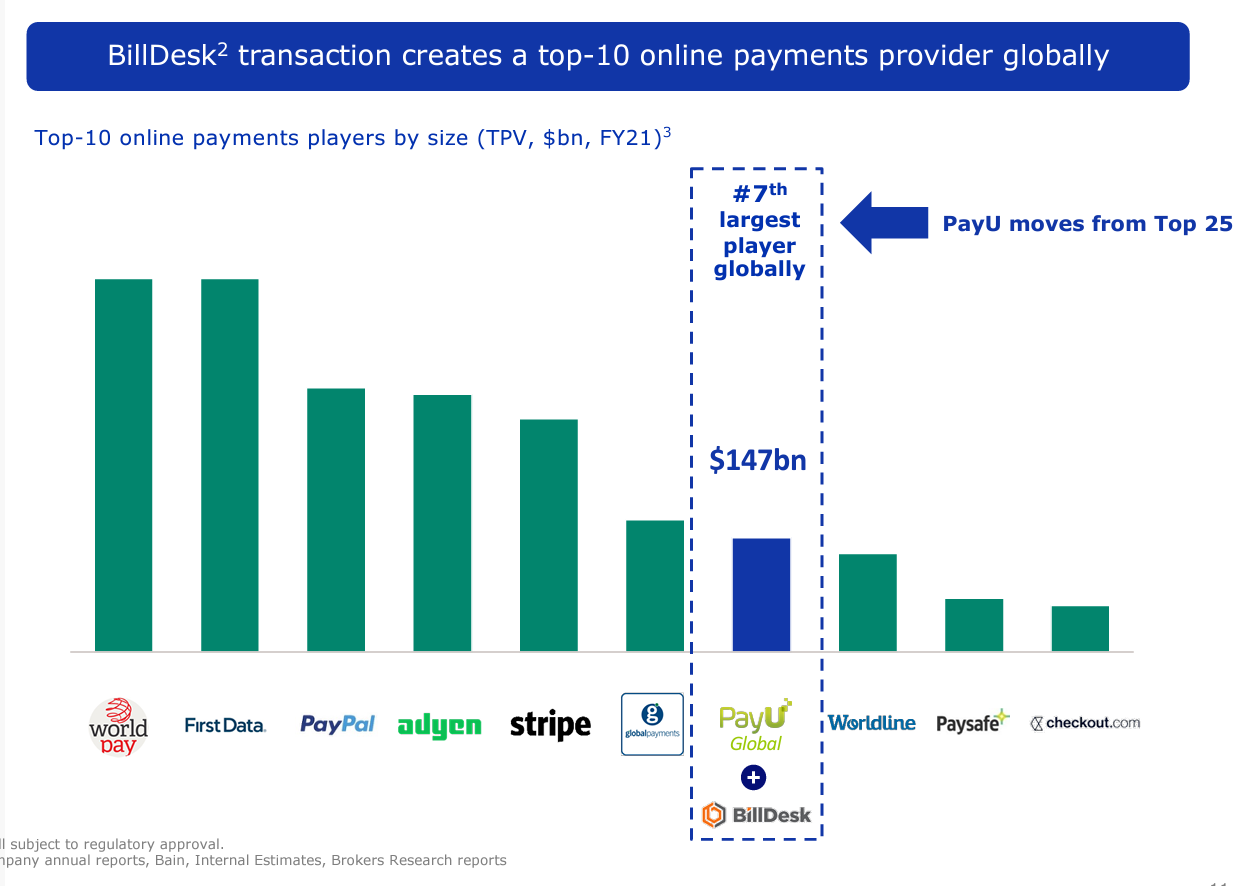

We will publish a series where we look at some of its online payments competitors as per Prosus' HY 2022 results call presentation table below.

In this first article, we will look at a couple of Stripe's (founded in 2010) newer competitors - PayPal (founded in 1998) and Adyen (founded in 2006).

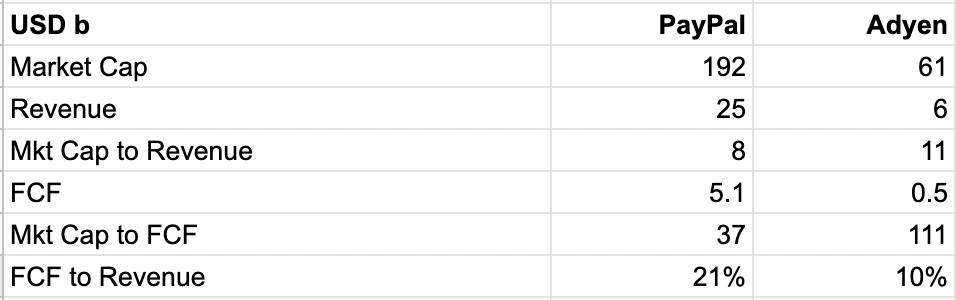

Using PayPal's Q3-21 Investor Update and Adyen's H1 2021 Shareholder Letter, we calculated a number of metrics below:

On both measures of Market Cap to Revenue and Free Cash Flow (FCF), PayPal is trading at a discount to Adyen. However, PayPal has higher FCF to Revenue, implying better profitability.

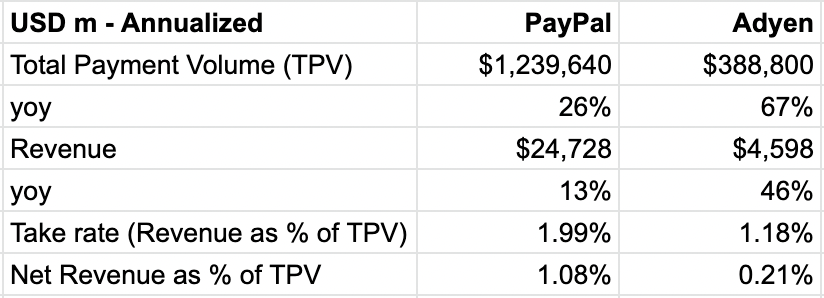

As per the below table, the higher profitability is reflected in 1) a higher Take Rate and 2) more than 5x Net Revenue as % of TPV for PayPal. Specifically, the much higher Net Revenue as % of TPV is attributable to Adyen's much higher costs incurred from financial institutions compared with PayPal. This is perhaps explained by 97% of Adyen's TPV is Enterprise while 8% of PayPal's active accounts are merchant. Another reason could be geography mix, 62% of PayPal is from the US while 60% of Adyen is from Europe and 23% from the US.

That said, Adyen's valuation premium maybe due to it growing faster than PayPal in terms of both TPV and revenue.

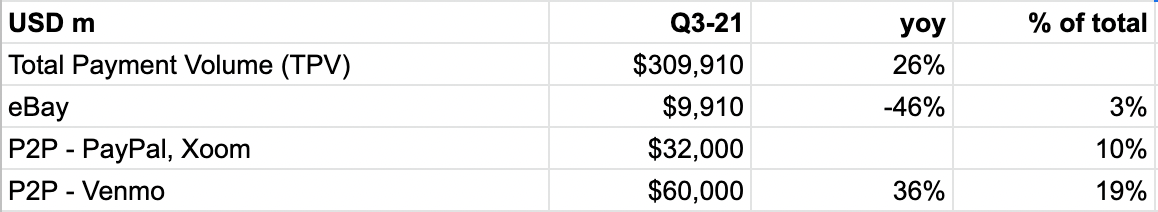

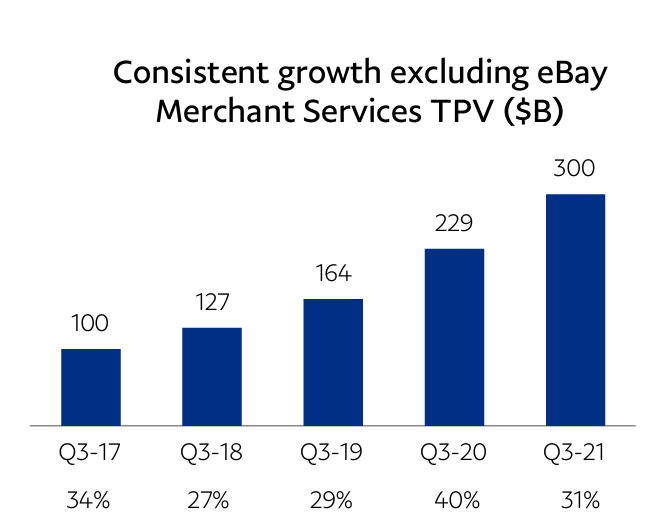

Part of the reason for PayPal's slower growth has been eBay, which now accounts for 3% of the total.

PayPal's TPV growth excluding eBay.

Related Articles

Stripe IPO Competitor - Wise Stock Analysis - (February 2022 Update) - https://www.whichequities.com/stripe-ipo-wise-paypal-pypl-adyen/

Coinbase IPO Stock Analysis (January 2022 Update) - https://www.whichequities.com/coinbase-coin-stock/