Stocks to Buy Now for Stripe IPO - Wise Stock Analysis - (February 2022 Update)

(February 2022 Update) Wise's growth could be mostly driven by its Business segment, which on a Volume per Customer basis, is only 5% that of PayPal.

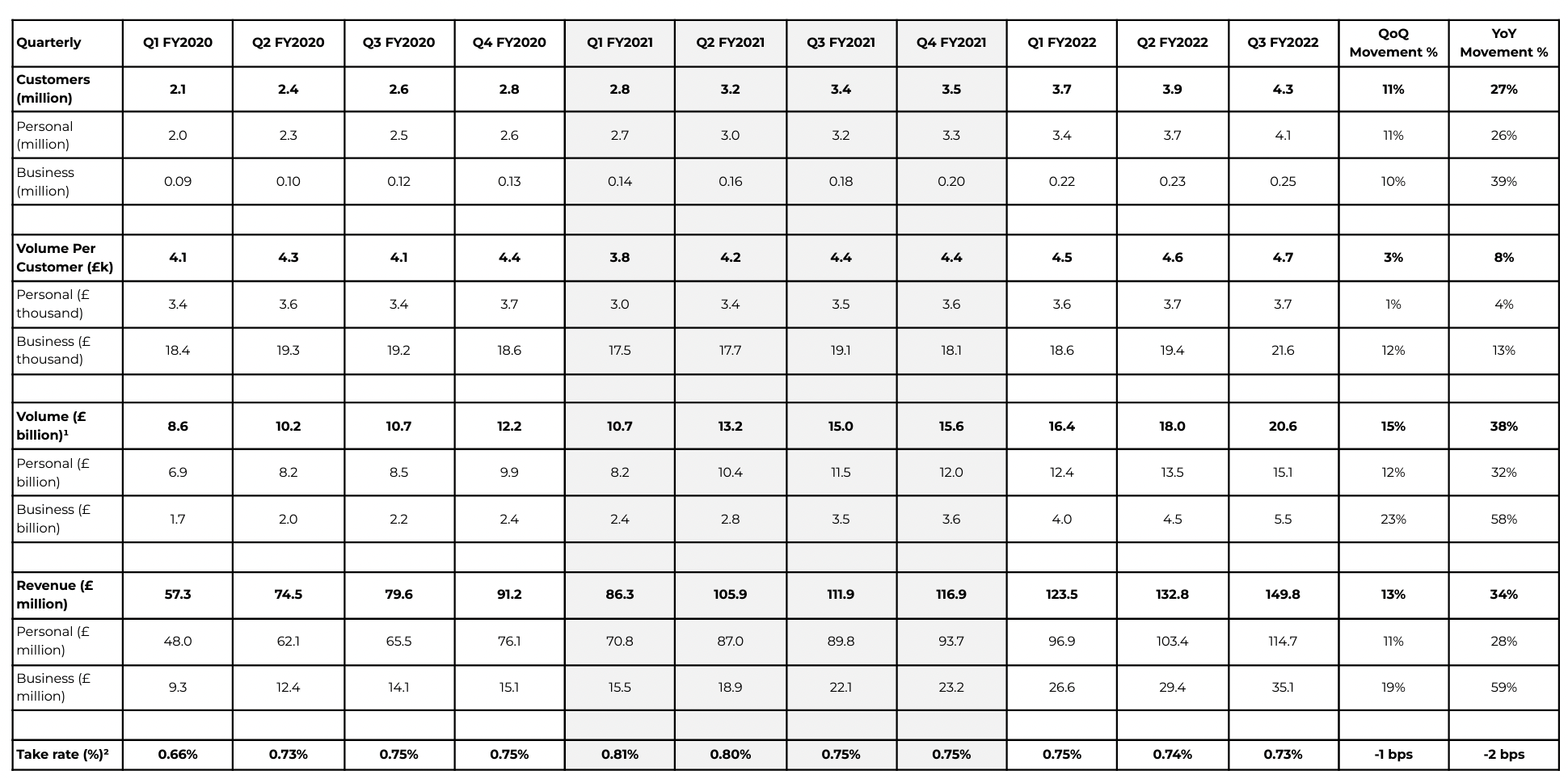

A number of key takeaways from Wise's Q3 FY2022 Trading Update,

Volume per Customer for Personal is stable and rising moderately at £3700 implying most of the Volume growth from the Personal segment is from number of customers.

The Business segment is growing faster than Personal. Business accounts for 27% of total volume as at Q3 FY2022 compared with 20% as at Q1 FY2020. Growth in Business is driven by both Volume Per Customer and number of customers.

Take rate or Revenue by Volume has been rising gradually implying improving profitability.

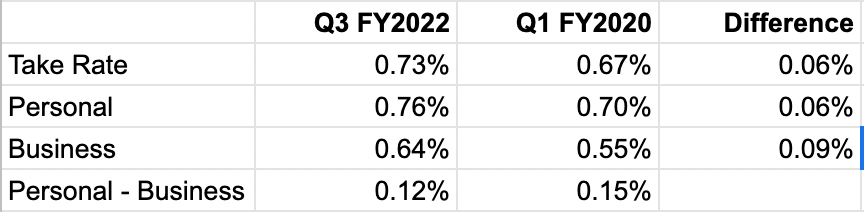

According to our breakdown calculations below, Personal has a higher Take Rate compared with Business and as Business is growing faster than Personal, the overall Take Rate could increasingly be dragged to the lower Business level.

However, Business has also seen a wider Take Rate expansion, partially offsetting this trend.

In this section, we compare Wise with PayPal and Adyen.

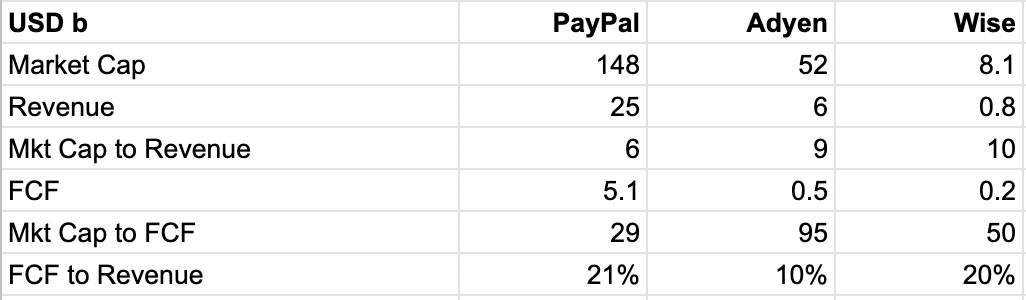

Wise is more expensive than both PayPal and Adyen on a Market Cap to Revenue basis following their recent stock price corrections. On a Market Cap to Free Cash Flow (FCF) basis, Adyen remains most expensive as Wise is more profitable (ie, higher FCF to Revenue).

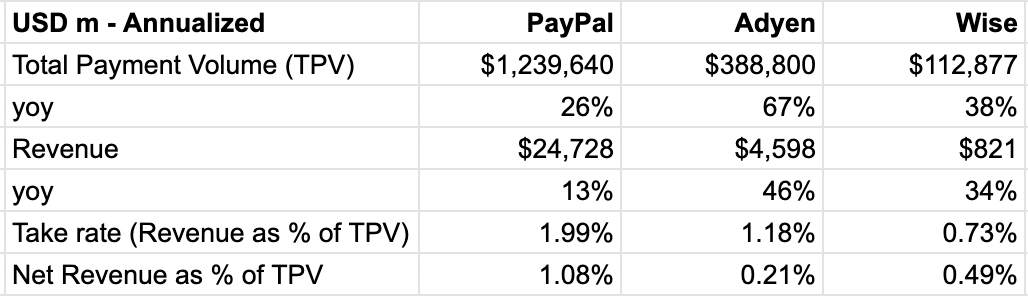

Wise is still relatively small compared to PayPal and Adyen. Wise is growing faster than PayPal though recall excluding eBay, PayPal is growing at 31%.

A pair trade appears to be opening up for PayPal against Adyen/Wise given the relative valuation. It would be interesting to see their historical valuation discounts and the technical indicators.

Wise has the lowest Take Rate though on a Net Revenue as % of TPV basis, Wise is higher than Adyen.

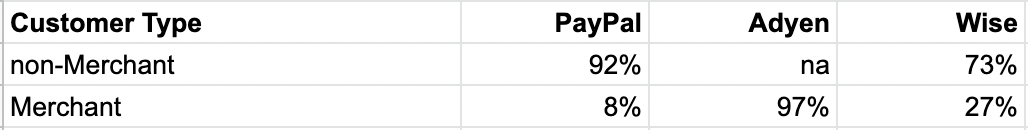

In terms of customer type, both Wise and PayPal are predominately non-merchant (or personal) while Adyen is enterprise.

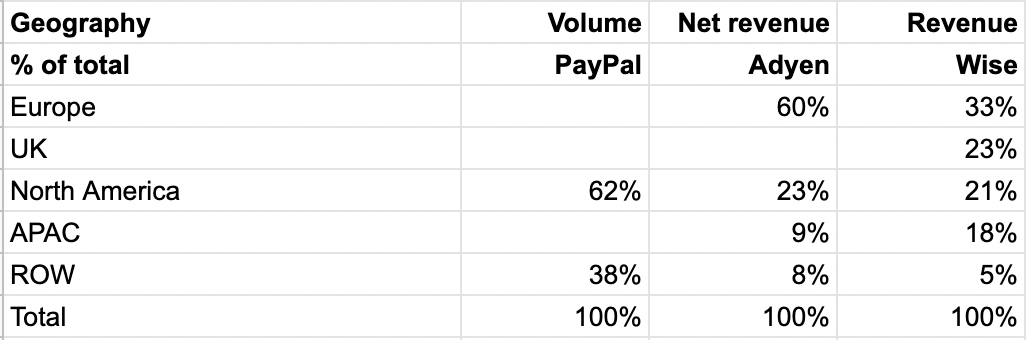

In terms of geography, Wise and Adyen are predominately Europe and PayPal is US.

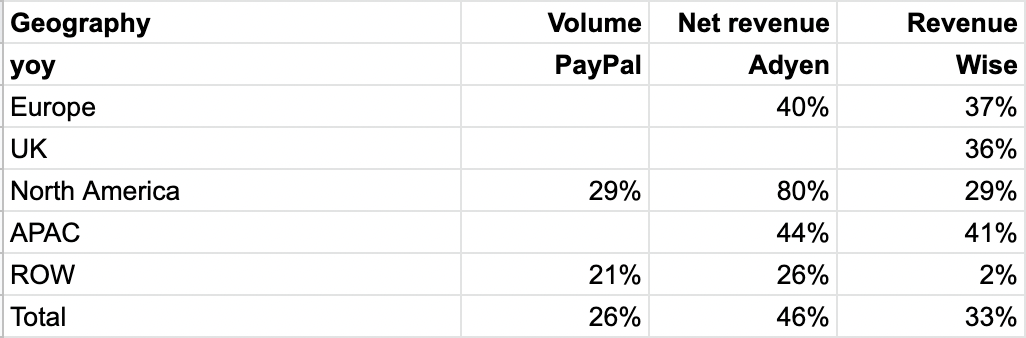

On a year on year (yoy) growth basis, Wise is growing fairly evenly.

Finally, PayPal doesn't disclose volume by merchant and non-merchant. Therefore, we can only divide its volume by total active accounts which is around $3m annualized. This compares with Wise's $0.026m overall. If we take Wise's business segment only, it is equal to $0.151m. Recall Wise's Personal Volume per Customer has been stable, this means most of the growth could be from Wise's Business Volume per Customer, which still has considerable room based on PayPal's figures.

Related Articles

Stripe IPO Competitor - PayPal Stock Analysis vs Adyen (January 2022 Update) - https://www.whichequities.com/stripe-ipo-paypal-pypl-adyen/

Klarna IPO vs Afterpay vs Affirm - Which Stock to Buy? (December 2021 Update) - https://www.whichequities.com/klarna-ipo-afterpay-affirm-afrm-which-stock-to-buy/