Stocks to Buy Now from Warren Buffett's Berkshire Hathaway portfolio - Nubank IPO Stock Analysis (NU) vs Itaú Unibanco (ITUB4) (January 2022 Update)

(January 2022 Update) Nubank's market cap already assumes it will operate beyond its current markets of Brazil, Colombia and Mexico.

According to WhaleWisdom, Warren Buffett's Berkshire Hathaway owns about $1b in Nu Holdings or about 2.5% of the company.

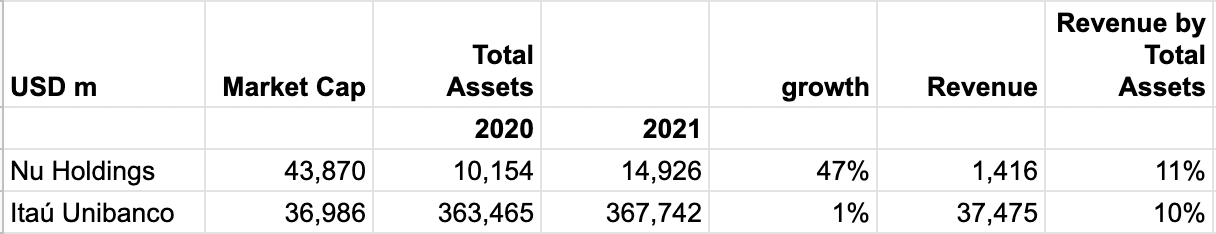

Nu Holdings' market cap is similar to Itaú Unibanco, one of the largest banks in Brazil. Itaú Unibanco's assets and revenue are ~25x that of Nu Holdings. The two have similar profitability in terms of Revenue by Total Assets. Therefore, the market appears to be pricing in significant growth for Nu Holdings playing catchup through technology.

Nu Holdings has grown assets by 47% in 2021 while Itaú Unibanco is flattish. Brazil's GDP growth has slowed in the past decade, implying little economic tailwinds to support growth for both. Nu Holdings is mostly growing through penetration into the unbanked.

Assuming Nu Holdings continue to grow at 47% while Itaú Unibanco remains flattish, Nu Holdings will have more assets than Itaú Unibanco in 9 years or pretty much the end of this decade.

Is this a fair assumption? The memo below explores in more details.

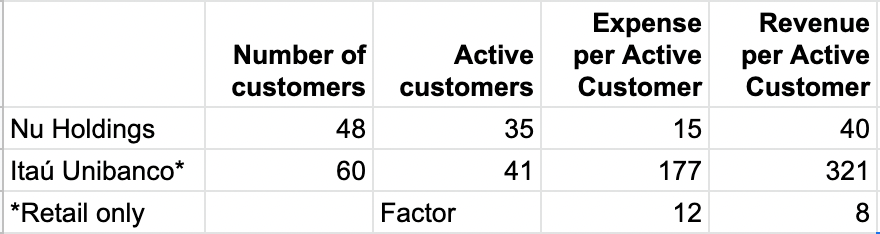

Nu Holdings' revenue can simply be derived from 1) number of customers multiplied by 2) revenue per customer.

These figures are available from its prospectus,

For the three months ended September 30, 2021, our Monthly ARPAC was approximately US$4.9...

...As of September 30, 2021, we had 48.1 million customers...

...Of these 48.1 million customers, approximately 73% were monthly active customers as of September 30, 2021.

ARPAC stands for Monthly Revenue Per Active Customer.

These figures imply Nu Holdings currently have ~$2b in revenue.

Then we make further assumptions and calculations based on the following from its prospectus,

For customers who were active across our core products, which include our credit card, NuAccount and personal loans, we had monthly ARPACs in the US$23 to over US$34 range for the month of September 2021. We estimate that the monthly average revenue per active retail customer for incumbent banks in Brazil was approximately 10x higher than ours in the first six months of 2021. This calculation assumes an estimated average active customer base for certain incumbent financial institutions that do not report this metric. We estimated the number of active customers at each incumbent financial institution using the median active-to-total customers ratio from Nu and one incumbent bank, which was 63% for the six months ended June 30, 2021. Based on this estimate, the incumbents had average Monthly ARPACs of US$38 for the six months ended June 30, 2021.

We estimate that in Brazil, our cost to serve and general and administrative expense per active customer is approximately 85% lower than those of incumbents, based on their publicly available financial statements. Based on this estimate, for the first six months ended June 30, 2021, incumbents had an average monthly cost to serve and general and administrative expense per active customer of approximately US$15.7.

We validated this by calculating the expense and revenue per active customer for both Nu Holdings and Itaú below.

Nu Holdings mentioned,

...we may not reach these levels because the majority of our products have no fees,

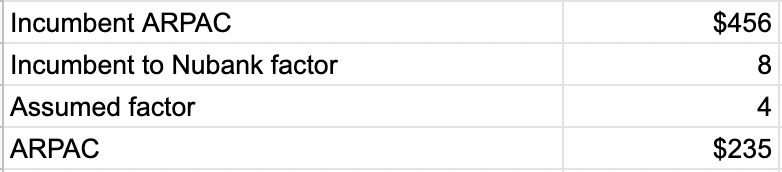

Hence, we make a projection of Nu Holdings' ARPAC assuming it will achieve HALF the level of the incumbent's ARPAC.

According to Nu Holdings,

In the three months ended September 30, 2021, we added an average of over 2 million net new customers per month across Brazil, Mexico and Colombia combined.

Assuming Nu Holdings continue to do this for the next 60 months, the number of active customers will reach ~155m.

Multiplying the ARPAC by the number of active customers give $36b or ~18x of the current revenue of ~$2b. This compares with the ~25x factor comparing current revenue of Itaú and Nu Holdings.

However, are the assumptions on Nu Holdings realistic?

According to Nu Holdings,

In Brazil, 30.0% of the 169 million people aged 15 and above did not have a bank account as of 2017, according to the World Bank. In Colombia and Mexico, the unbanked population in 2017 stood at 55.1% and 64.6% of the 40 million and 96 million people aged 15 and above, respectively, according to the World Bank. Together, these three countries account for 134 million unbanked adults, according to the World Bank.

Recall our projection above already assumes number of active customers will reach ~155m, or more than the unbanked adults in Brazil, Colombia and Mexico combined.

If Nu Holdings is to have similar revenue to Itaú, it may have to operate beyond its current markets.

which is part of Nu Holdings' vision,

...the financial services market in Latin America, the market value of which we estimate will reach approximately US$1 trillion in 2021. This opportunity includes approximately 650 million people in Latin America according to the World Bank, many of whom we believe are underbanked and deeply unsatisfied with their legacy bank relationships, or completely unbanked.

Finally, note that Itaú has institutional business (>60% of total revenue) while Nu Holdings is retail only.

Related Articles

Warren Buffett portfolio - Why did Berkshire Hathaway issue Yen bonds? (January 2022 Update) - https://www.whichequities.com/why-did-berkshire-hathaway-issue-yen-bonds/

Upstart Stock Analysis (November 2021 Update) - https://www.whichequities.com/upstart-upst-stock/