Metaverse Stocks to Buy Now - Roblox (RBLX stock) analysis (January 2022 Update)

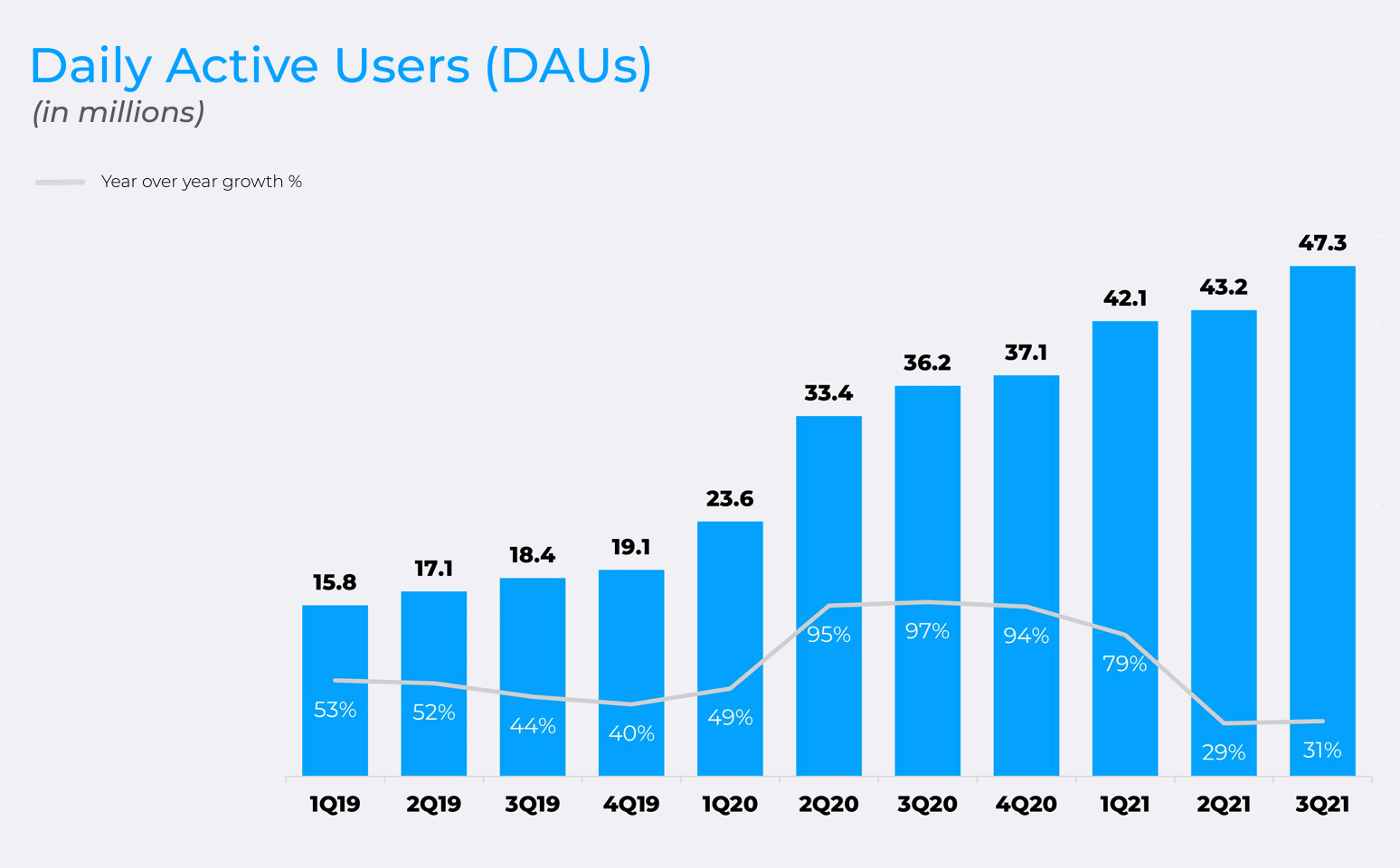

(January 2022 Update) Roblox's daily active users (DAUs) are growing at a declining rate while its bookings per payer is flattish but valuation assumes significant growth.

Roblox's revenue model is basically driven by 1) number of payers and 2) how much they pay.

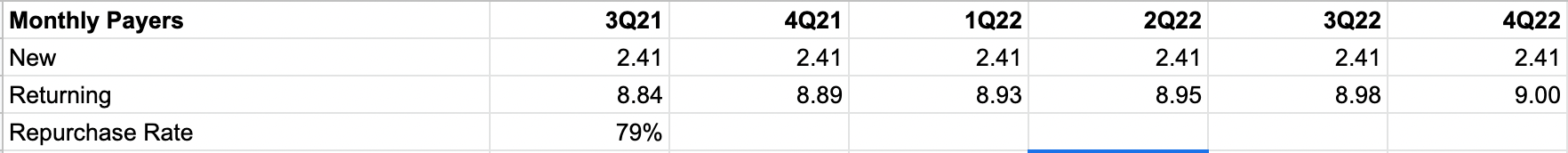

As per Roblox's Q3 2021 Earnings Supplemental Materials, the average monthly new payers has stabilized at around 2.5m. This implies the business is growing at a declining rate.

Projecting this out, returning payers will mature at about 9m by 4Q22.

Average Bookings Per Monthly Unique Payer has been fairly stable.

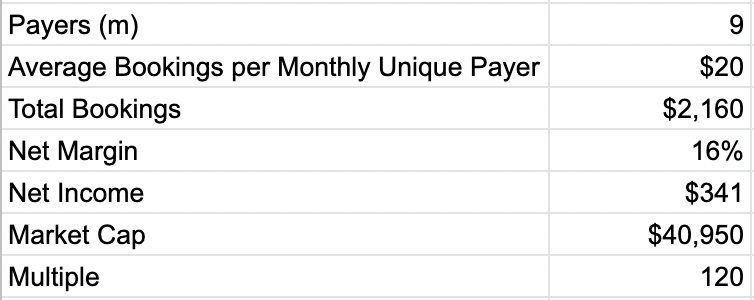

Multiplying the number of payers (9m) and Average Bookings Per Monthly Unique Payer (~$20) by 12, total bookings is around $2.2b.

Assuming a mature scenario where Roblox spends minimal on R&D and Sales & Marketing resulting in a net margin of 16% then Roblox's current Market Cap would imply a 120x multiple.

Therefore, Roblox needs to be growing to justify its current valuation.

Where is the growth coming from?

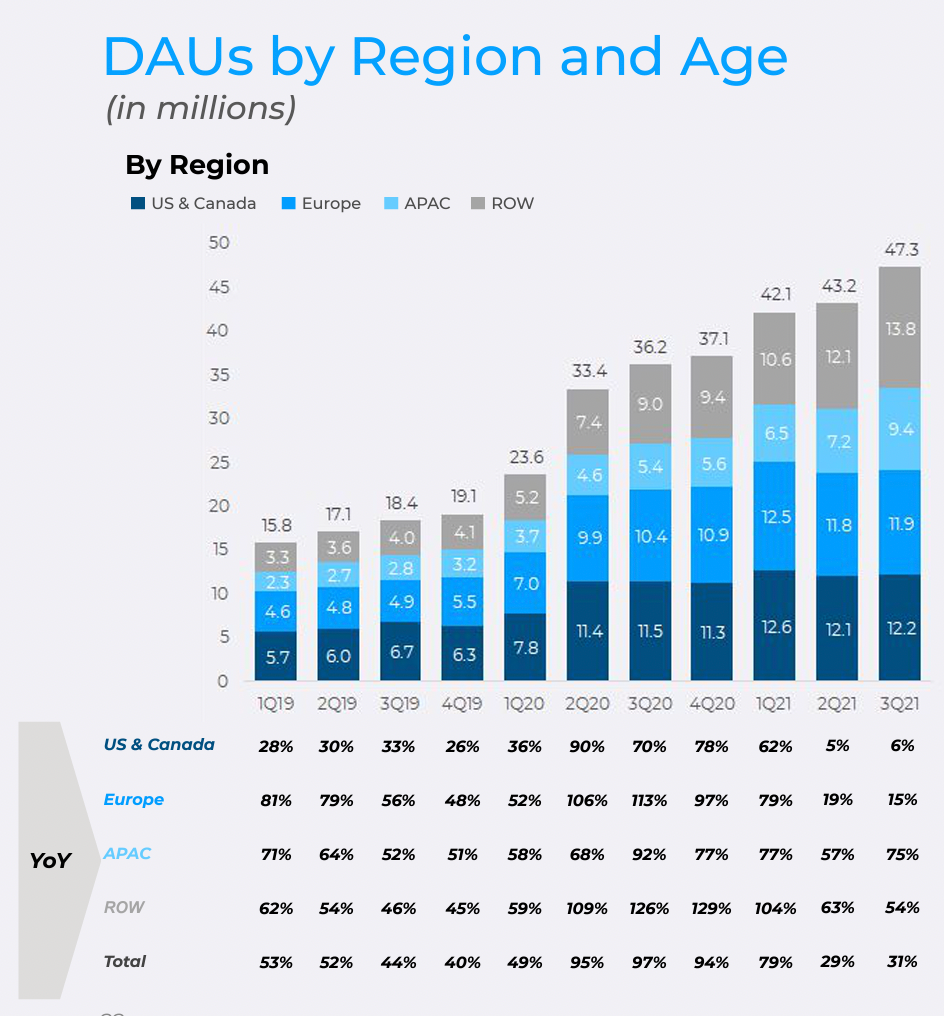

1) Daily Active Users (DAUs)

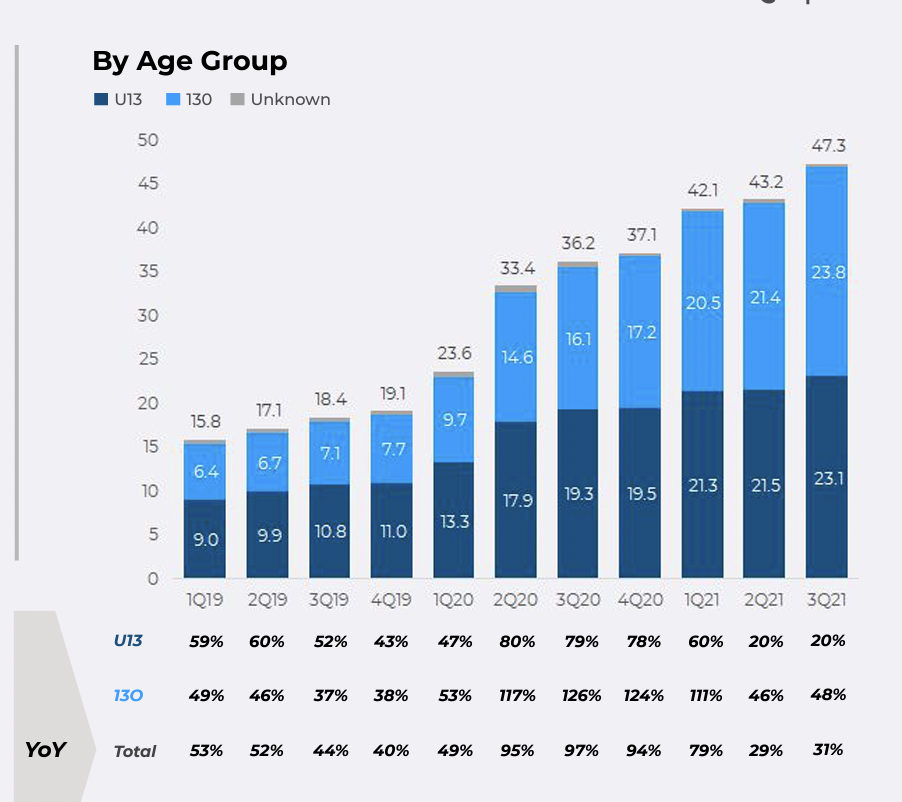

While DAUs have continued to increase, it is also increasing at a decreasing rate. Roblox also needs to convert more DAUs into payers. Payers accounted for 24% of DAUs as at 3Q21 compared to 18% at 1Q19.

By geography, US, Canada and Europe have slowed down fairly significantly in the last couple of quarters. Growth is now mainly driven by APAC and Rest of World.

2) Average Bookings Per Monthly Unique Payer

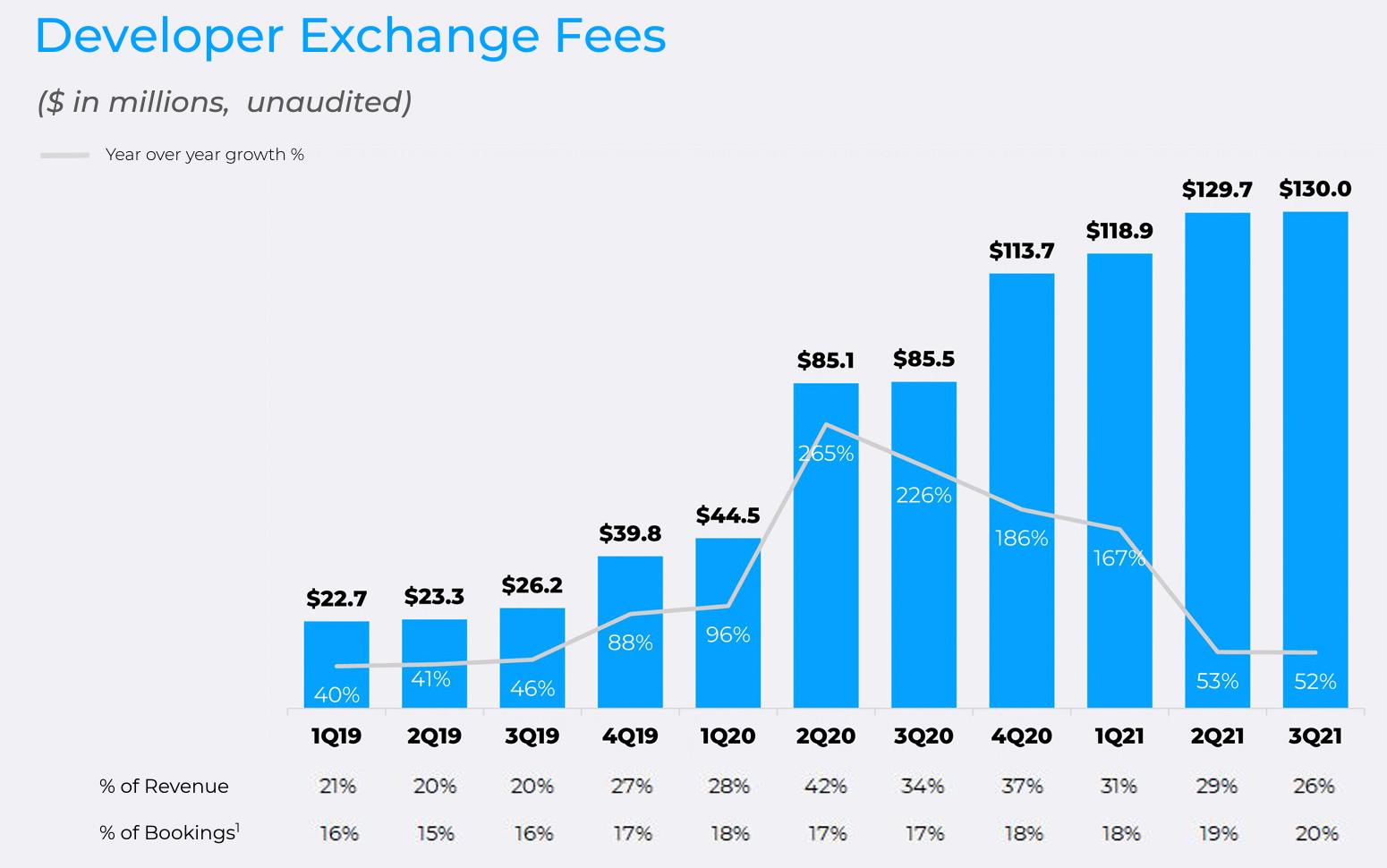

Most of the disclosures are on the demand (users) side. There are limited disclosures on supply (developers) side such as number of games developed, number of developers hours spent and how much they are getting paid or incentivized to continue to create on the platform.

We can only gauge this through Develop Exchange Fees below.

However, it is difficult to understand how this relates to creating games that boost Average Bookings Per Monthly Unique Payer.

As per Roblox's prospectus,

Developer exchange fees represent the amount earned by developers and creators on the platform. Developers and creators are able to exchange their accumulated earned Robux, for real-world currency under certain conditions outlined in our Developer Exchange Program.

Developers and creators can earn Robux through sale of access to their experiences and enhancements in their experiences, sale of content and tools between developers through the Studio Marketplace, and the sale of items to users through the Avatar Marketplace. Additionally, developers can earn Robux through our engagement-based reward program, Premium Payouts that rewards developers based on the number of hours spent in their experiences by Roblox Premium subscribers.

Over the next few years, a major goal is to drive as much money to our developer and creator community as possible while maintaining reasonable margins and free cash flow. We intend to use future cost efficiencies realized in other areas of our business to increase earnings for our developers and creators. As such, we expect that our developer exchange fees will increase in both absolute dollars and as a percentage of bookings over time as our business grows and as we continue to invest in supporting our Roblox developer and creator community.

As demonstrated by Activision Blizzard, Net Revenues by MAU can go as high as $74 for Blizzard with games such as Diablo, Overwatch, Warcraft.

Therefore, with 13 and Over being the predominate age group driver, this may lead to higher Average Bookings Per Monthly Unique Payer.

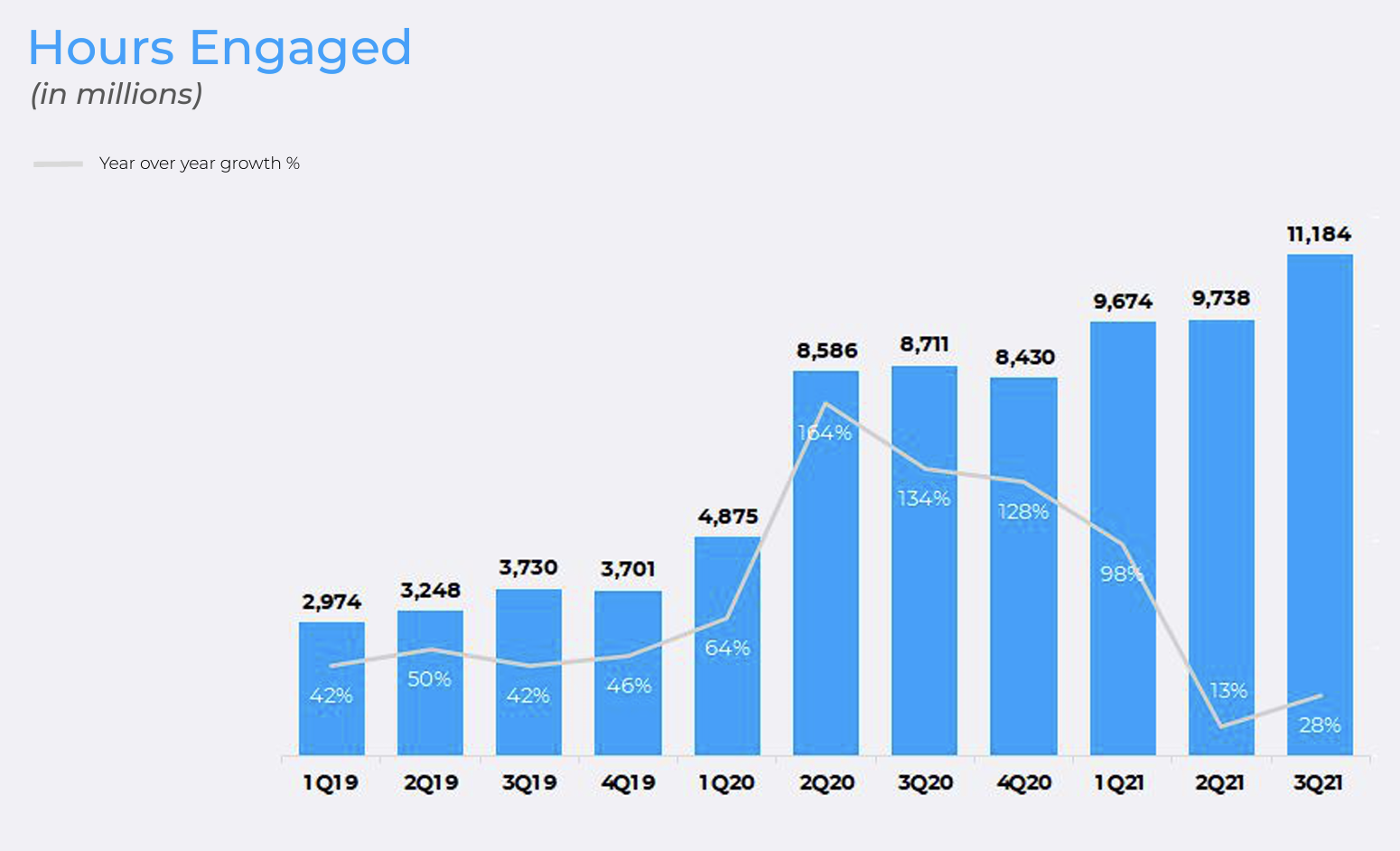

Hours Engaged is also rising but at a declining rate.

Dividing Hours Engaged by DAUs yield 236 hours per DAU as at 3Q21, up from 188 as at 1Q19. This means users are spending more time but still spending similar dollar amounts. Thus, from a bookings/revenue perspective, it probably doesn't matter as much if DAUs are playing longer or more Hours Engaged.

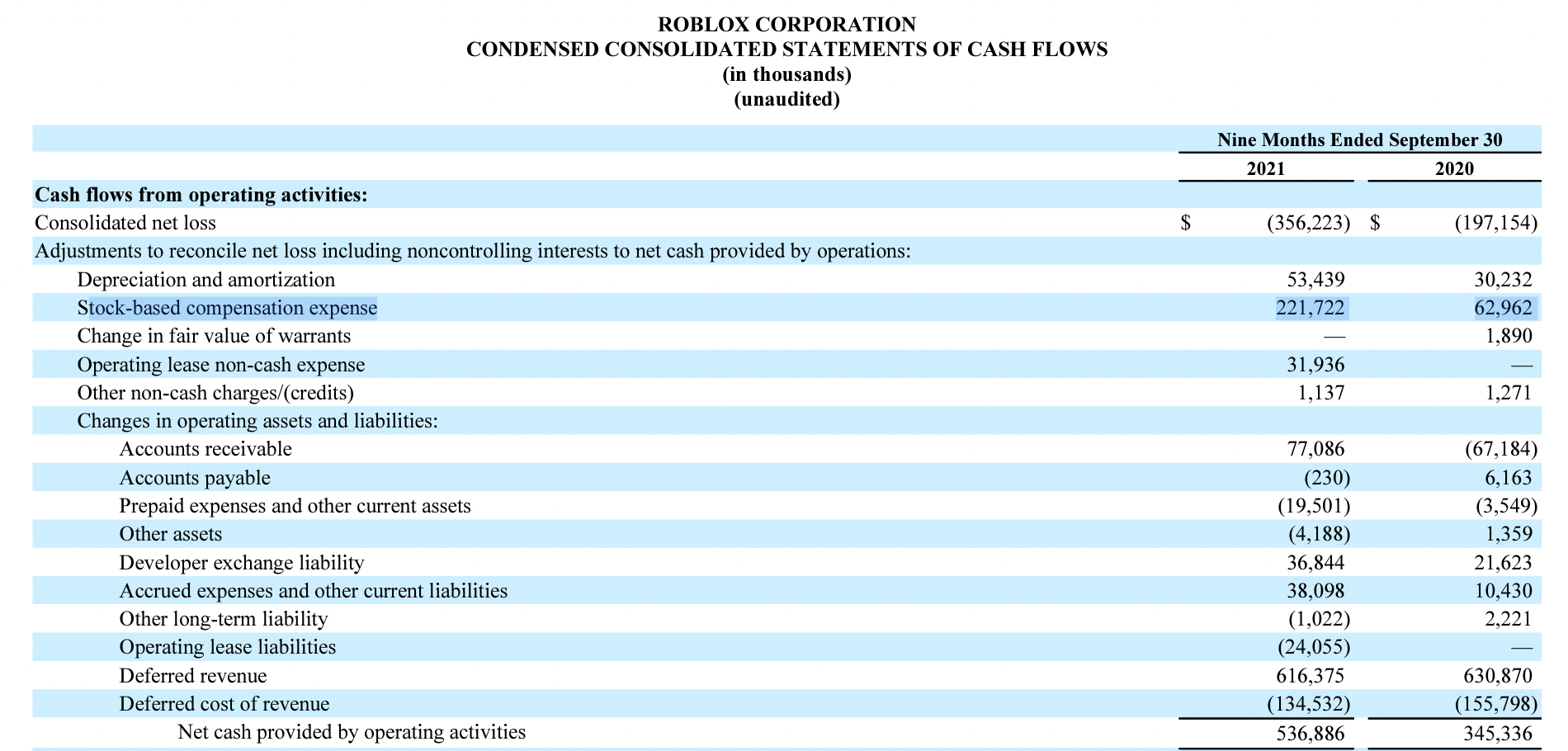

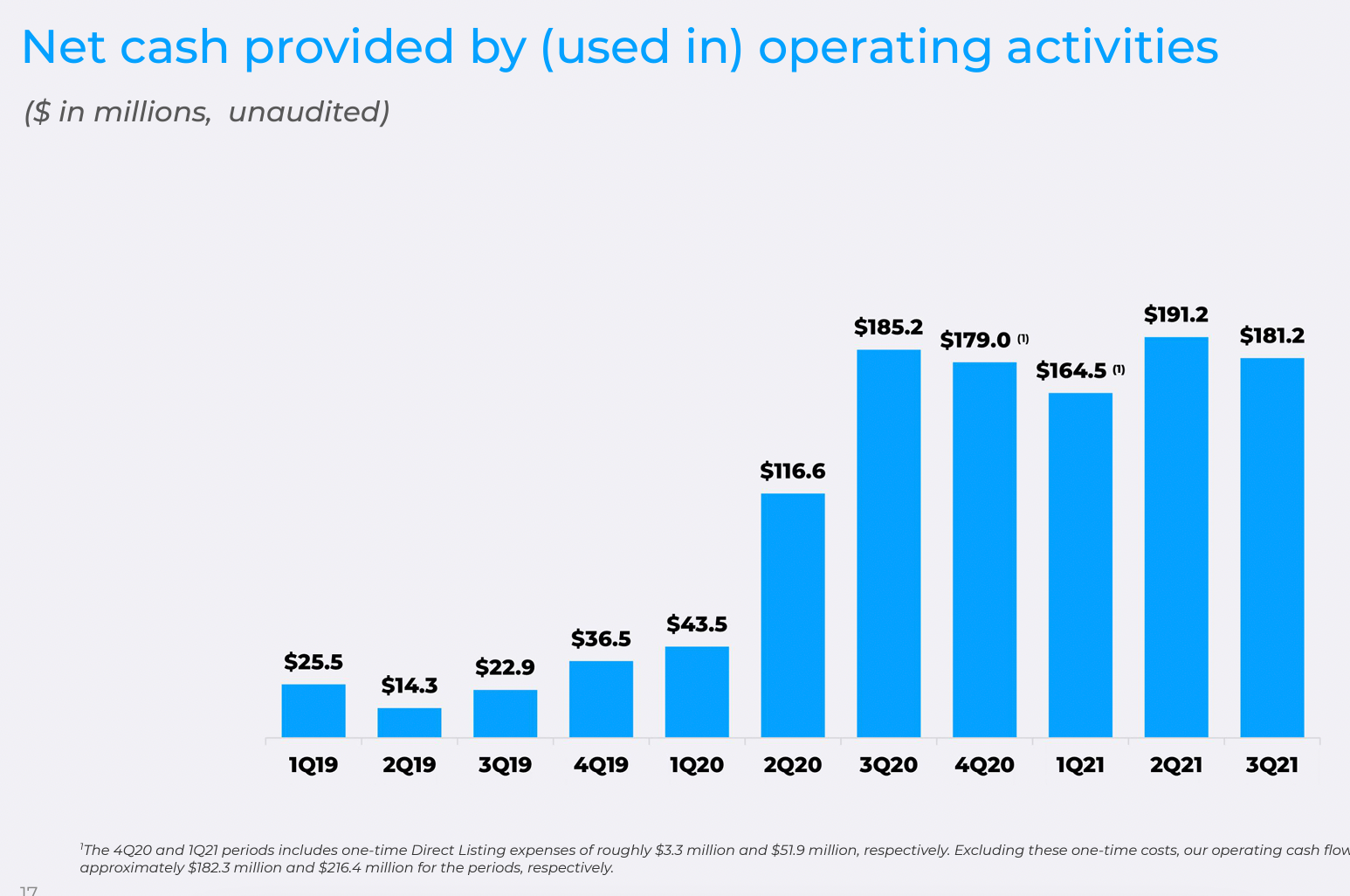

Roblox is a cash generating business because it collects cash upfront from users buying Robux

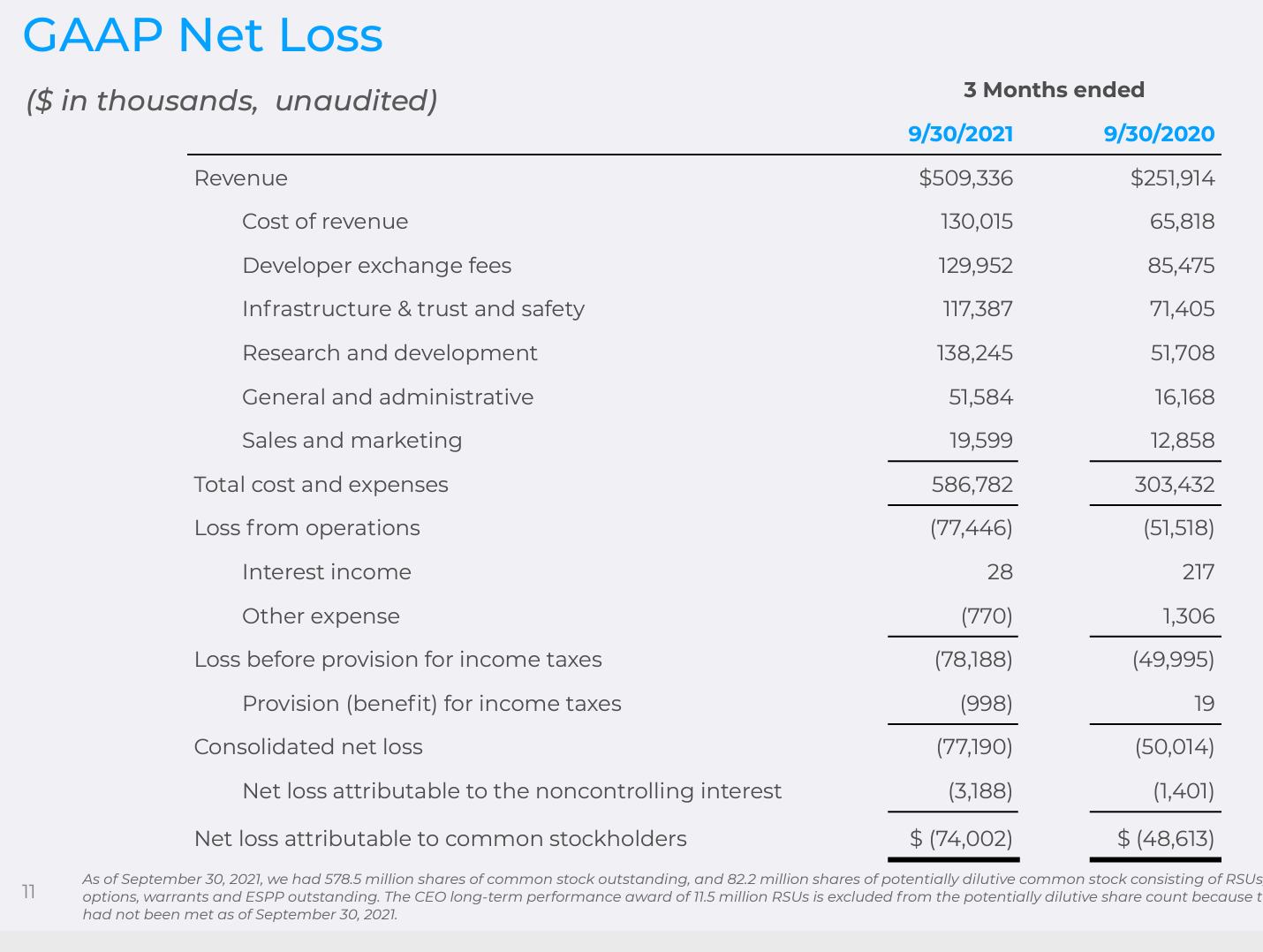

While Roblox reports a Net Loss, after accounting for major non cash items such as stock based compensation and specifically deferred revenue, the business is cash generating.

The business is cash generating because Robux is purchased upfront and recognized as revenue later.

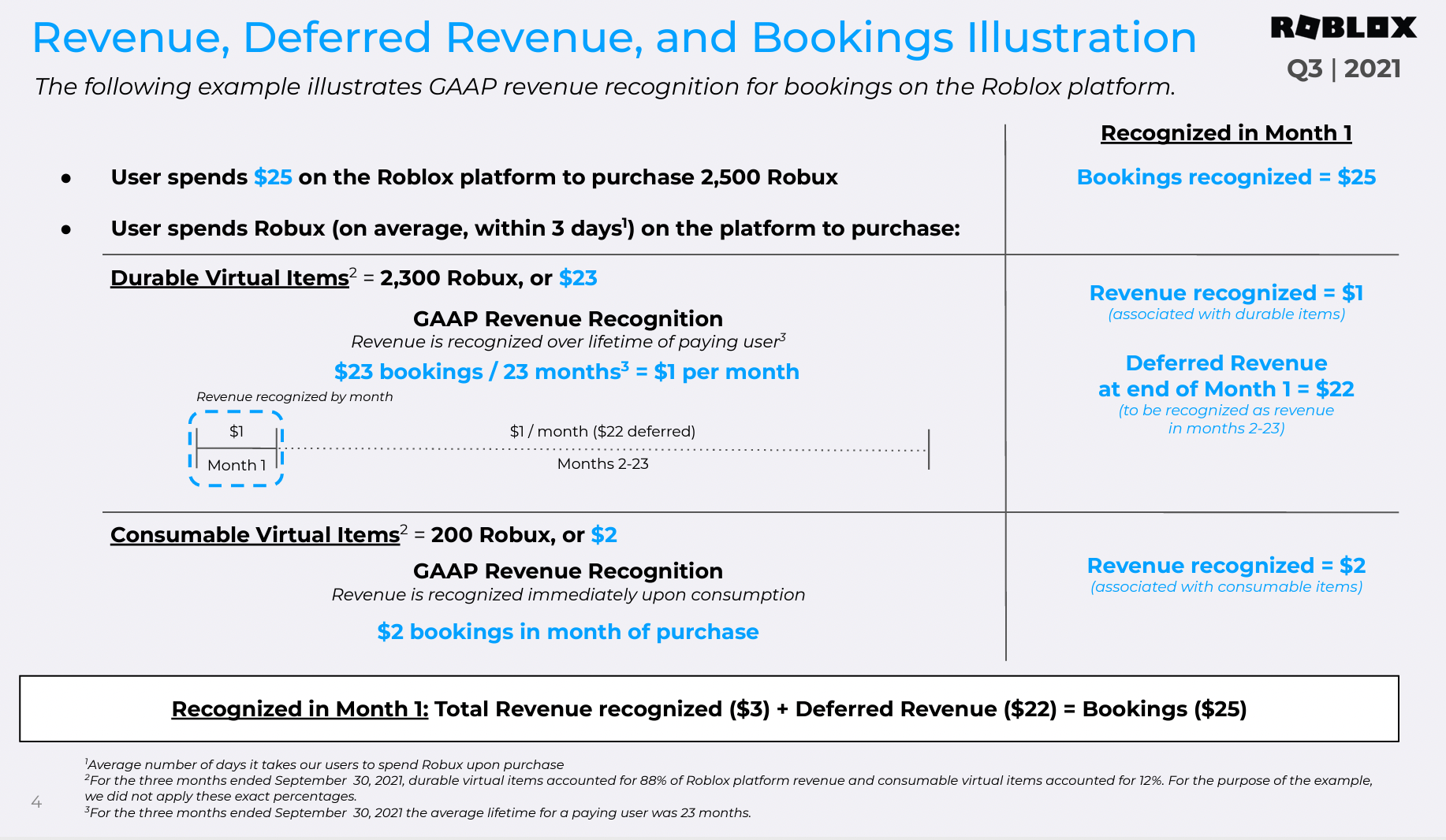

Roblox has a good slide explaining the relationship between bookings and revenue recognition.

The business model also does not require significant investments in Sales and marketing.