Spotify (SPOT stock) analysis - How important is Joe Rogan? (February 2022 Update)

(February 2022 Update) Spotify's key growth area is in Ad-Supported users from the Rest of the World.

The following is an excerpt from Joe Rogan's Wikipedia page,

On May 19, 2020, Rogan announced that from September 2020, The Joe Rogan Experience would be available on Spotify in an exclusive licensing deal worth an estimated $100 million.

In February 2022, Spotify removed over 70 episodes of The Joe Rogan Experience.

If the contract is for 5 years or $20m each year, it would account for ~2% of Spotify's yearly sales and marketing cost.

The Joe Rogan Experience is part of the Podcast business that also counts Armchair Expert with Dax Shephard and Call Her Daddy as exclusive licensees.

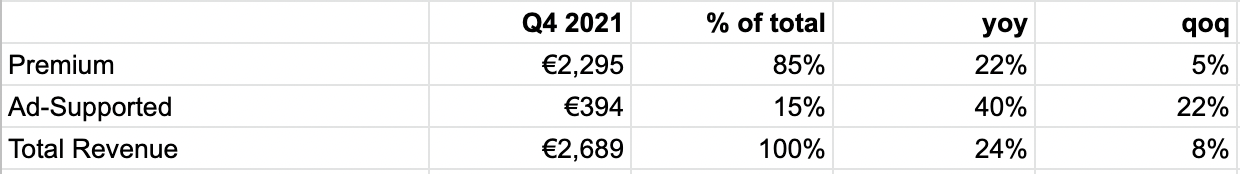

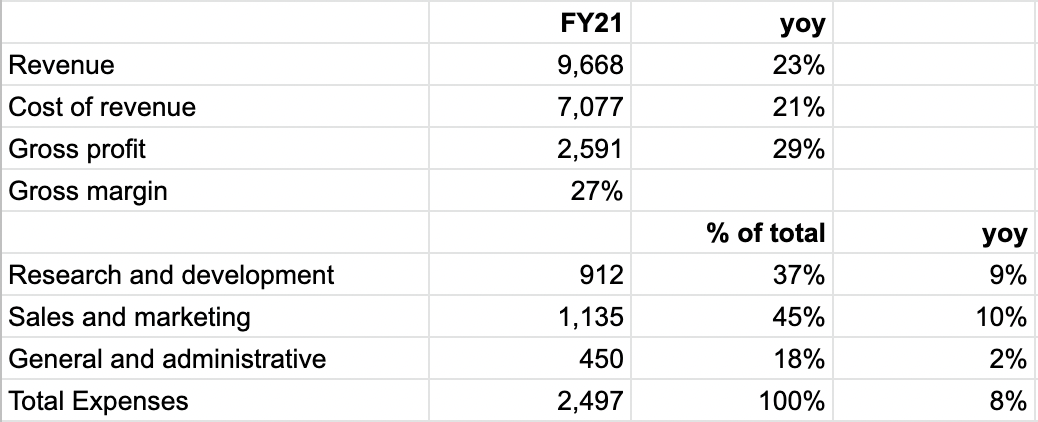

Podcast is part of Ad-Supported Revenue, which accounted for 15% of total revenue as per the below table (calculated using data from Spotify's Q4 2021 Release).

Interesting to point out that while Ad-Supported revenue is small relative to Premium, it is growing faster.

Specifically, this is driven by

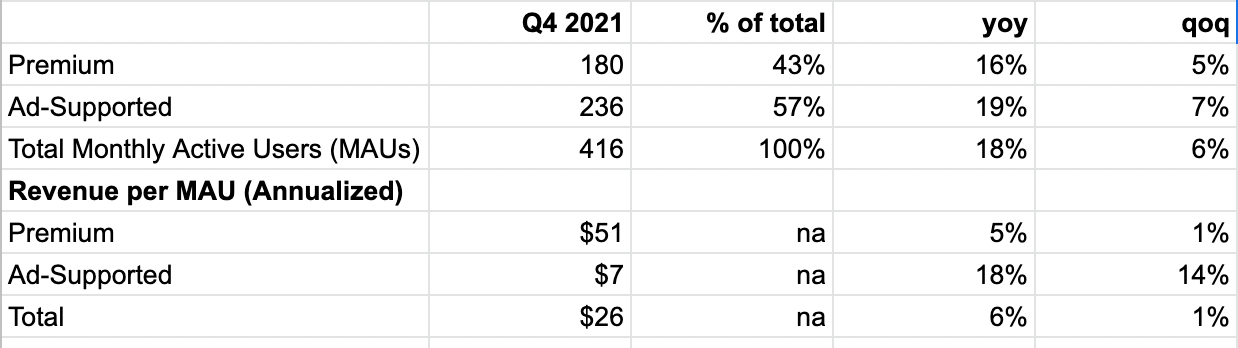

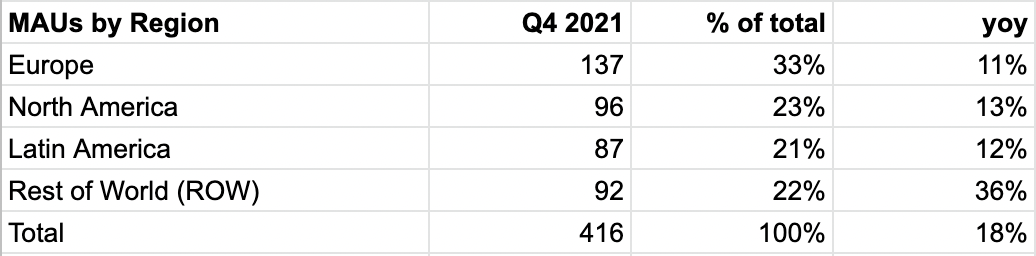

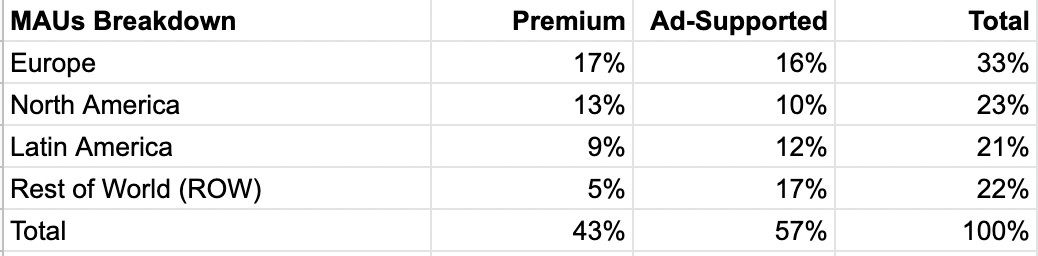

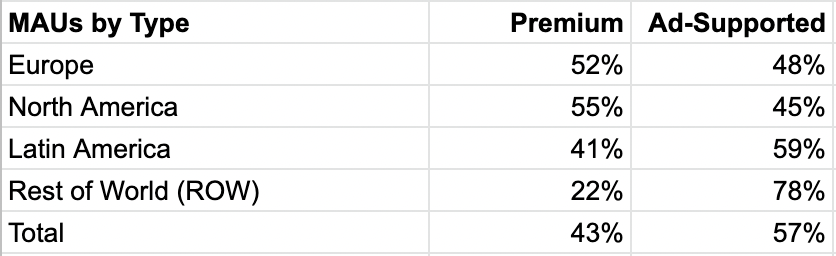

1) Ad-Supported users account for the majority of users at 57% and is growing slightly faster than Premium users.

2) While Ad-Supported revenue per user is €7 or only 13% of Premium, it is growing faster given Premium pricing is pretty much set but Spotify can continue to improve efficiency of their Ads.

From a geography perspective, ROW is a key growth driver.

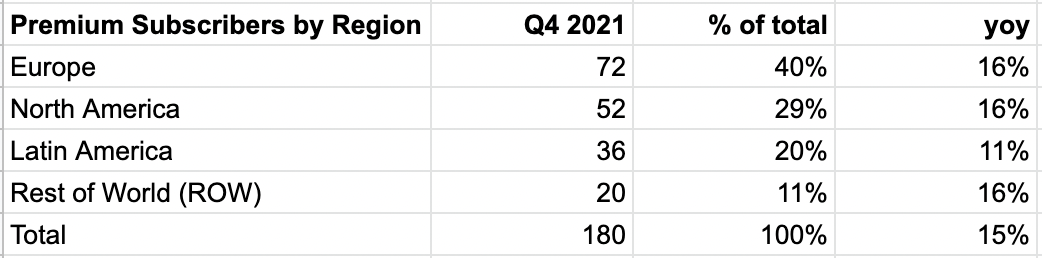

Specifically, Premium Subscribers' growth is fairly even.

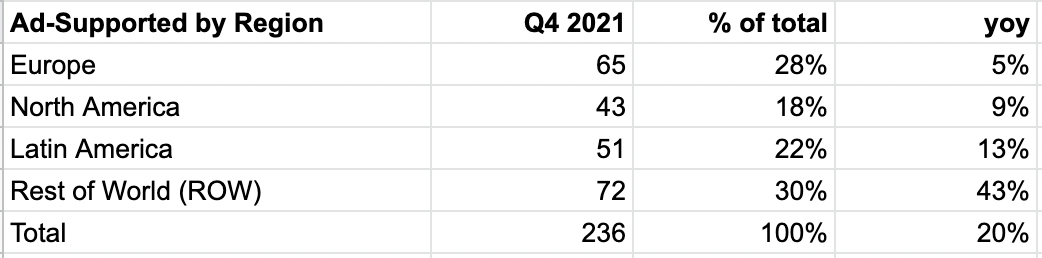

The key growth area is actually Ad-Supported in ROW,...

...which accounts for 17% of total MAUs.

Further breakdown in Ad-Supported Revenue per MAU is not available but assuming this is still relatively low for ROW (compared to the more developed Europe/North America) then this could be the key revenue growth driver for Spotify as most of ROW (78%) is Ad-Supported.

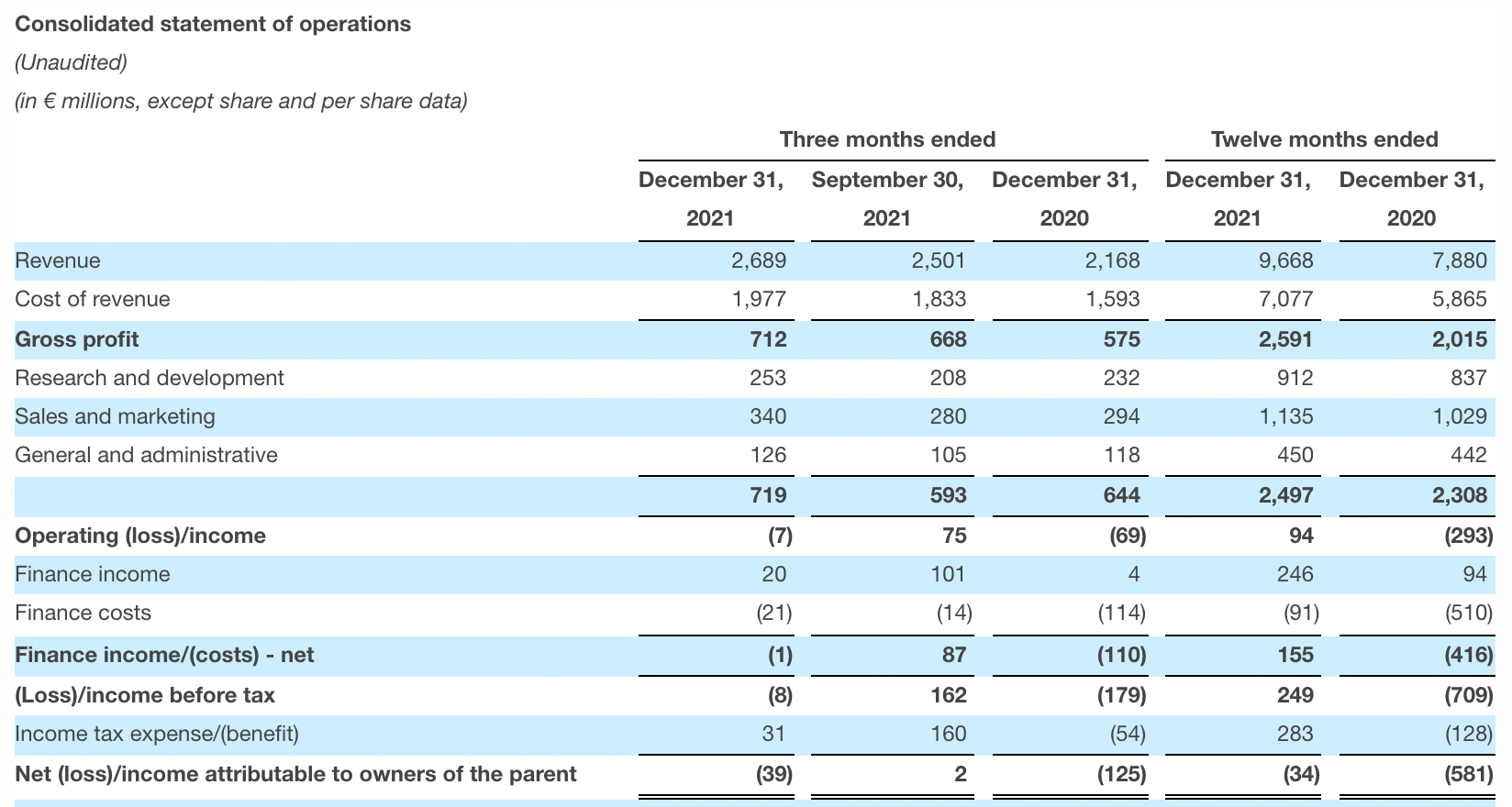

Overall, the operating jaw is expanding as gross profit is growing faster than expenses.

As with our work on Roblox, Spotify as a platform business really has limited disclosures on supply (artists) side economics such as number of new songs, new artists and how much artists are getting paid or incentivized to continue to create on the platform. All of which are currently reflected in one cost of revenue figure in the income statement.

This lack of disclosures means investors are unable to understand further how efficient is Spotify spending their money.

Spotify has a market cap of $33b or 11x its gross profit.

Back in late 2019/early 2020 with the share price at around $140 (before the run up), Spotify was trading at 13x, implying a de-rating in multiple despite similar gross profit growth (29% in FY21 and 27% in FY19).

Warren Buffet's take on big tech growth stocks can perhaps help explain this de-rating in multiple.