EV Stocks to Buy Now - Lucid (LCID stock) analysis vs Tesla (TSLA) (February 2022 Update)

(February 2022 Update) Current market cap is pricing in Lucid selling around 26k cars per year. This compares with the 13k total reservations currently.

According to Lucid's Q3 2021 Earnings Presentation, it has an EV with superior range that has also won the prestigious Motortrend Car of the Year title.

What does this actually mean from an investor perspective?

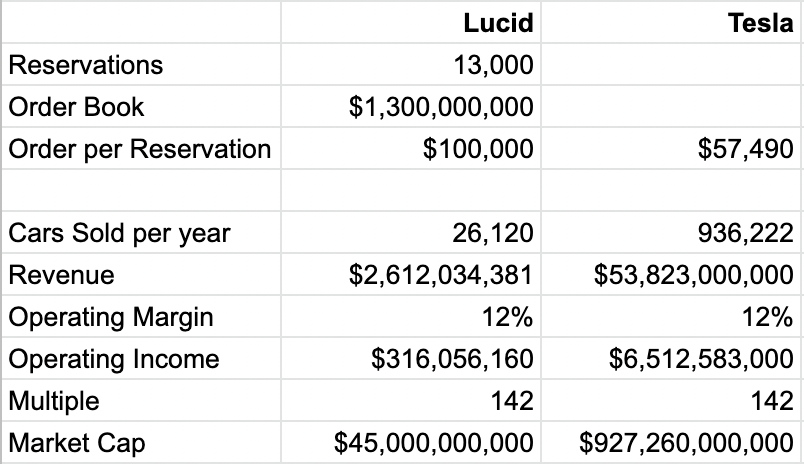

Using Tesla's 2021 Q4 Shareholder Deck, we calculated the below figures:

Based on their respective market caps and assuming Lucid 1) trades at similar multiples and 2) have similar operating magins to Tesla, then the current market is pricing in Lucid selling around 26k cars per year at $100k each. This compares with the 13k total reservations currently.

The questions then are, while Lucid may have a superior car, would it translate to better operating margins and also a higher multiple?

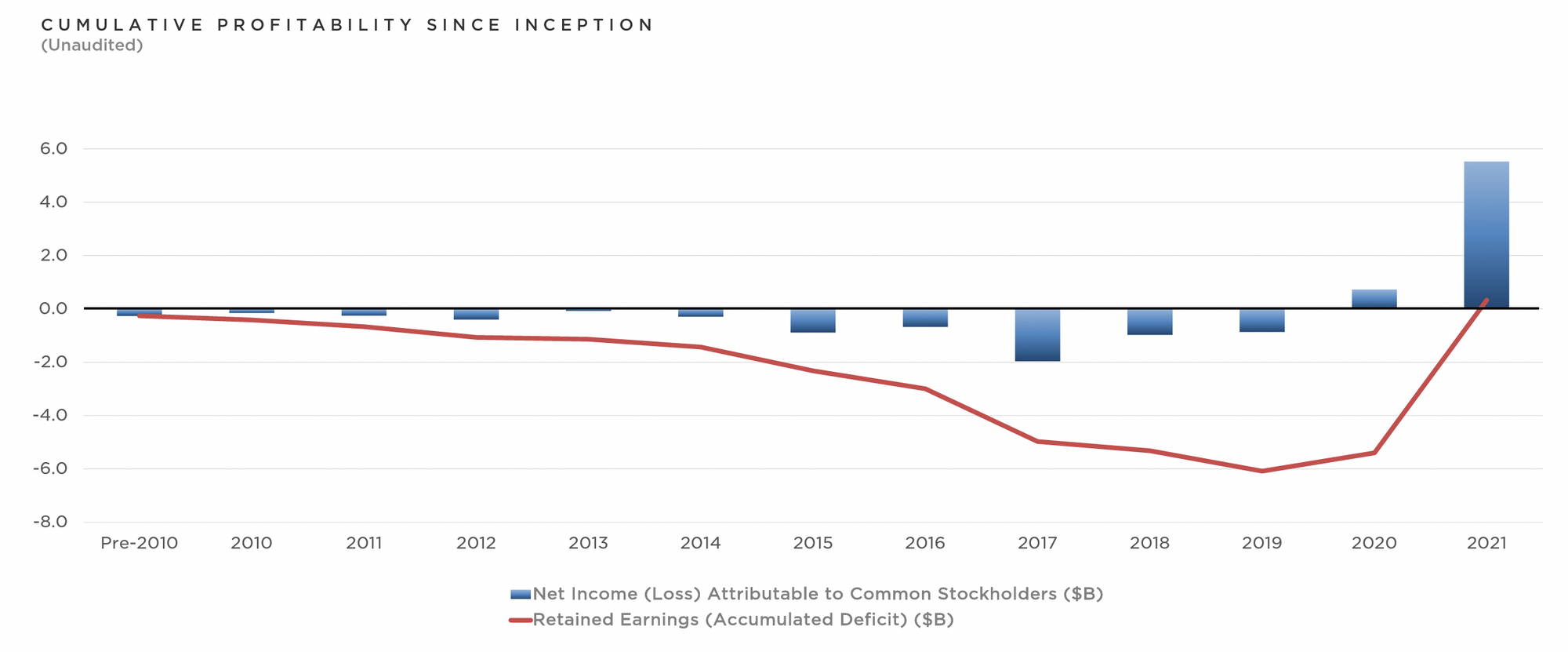

Another question is how long it would take before Lucid becomes profitable? As per the below chart, it took Tesla more than 10 years.

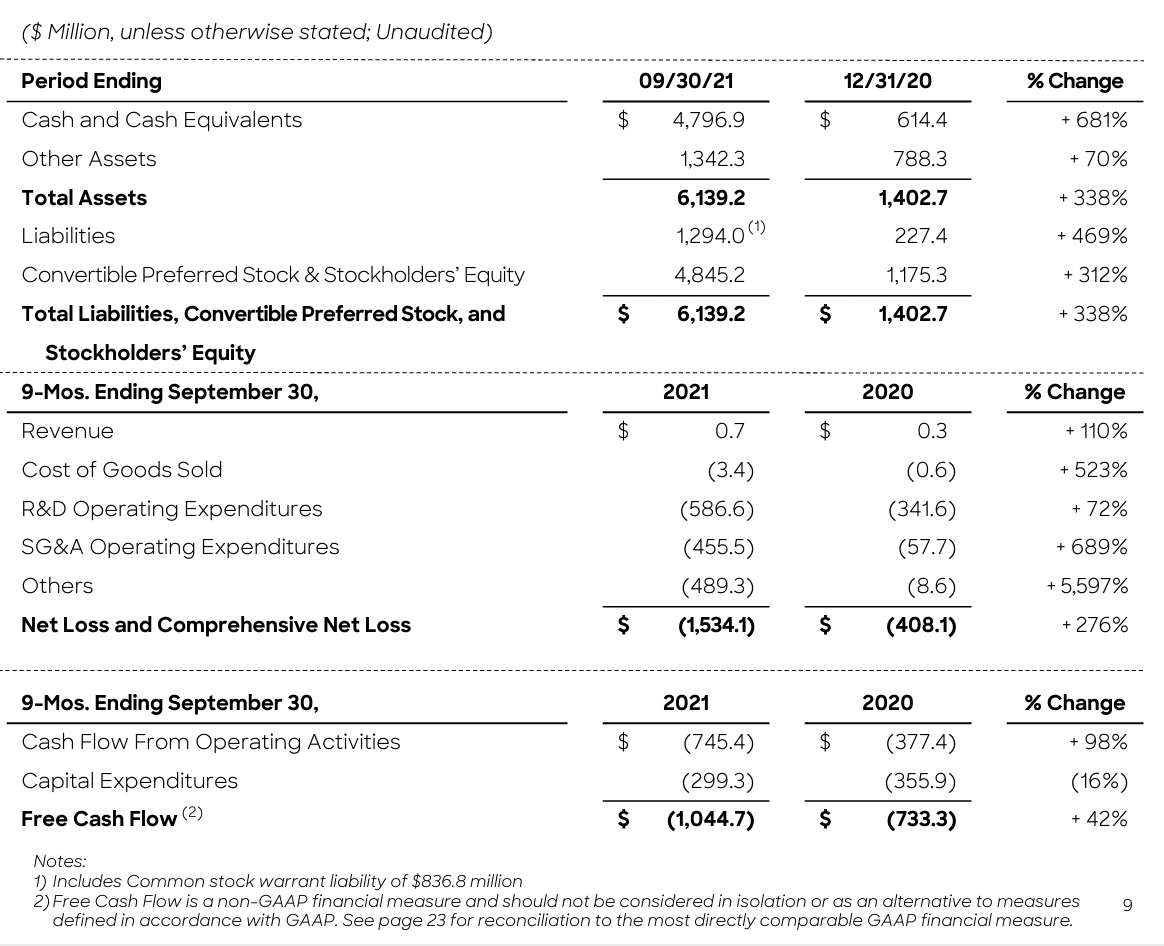

Meanwhile, Lucid has about $4.8b in cash with a cash burn of more than $1b per year, implying about 4 years leeway before any refinancing.

Tesla is one of the largest companies by market cap. Perhaps it is worth listening to Warren Buffet's take on the evolution of the world's largest companies especially towards the end where he discusses the motor industry back 100 years ago in the early 1900s.

You maybe interested in...

EV Stocks to Buy Now - NIO stock vs XPeng (XPEV, 9868), Tesla (TSLA) (February 2022 Update)